Gone are the days when the term «snack» was limited to potato chips and crackers. Today, the boundaries between meals are blurring, and the range of foods preferred as a snack continues to grow. In recent years, the demand for protein and the desire to eat on the go have opened the door to healthy and convenient meat snacks. Over the past five years, they have become mainstream and loved by a million consumers of healthy snacks. Let’s see what’s happening in the fastest growing subsegment of the snack food industry.

What consumers want

According to a 2019 study by Canadean, 96% of U.S. consumers have snacks between meals regularly or occasionally. This is especially true for people between the ages of 25 and 34, 98% of whom say they eat regularly; in the 55-64 age group, the numbers drop to 93%.

Snacks are more common among younger consumers, with middle-aged men eating more frequently and more regularly than any other group.

Reduced consumption of the three main meals and more informal lunches and breakfasts were the key factors driving the trend towards snacking. Fruits and vegetables are increasingly being used as a healthier alternative to traditional chips, which has given a powerful boost to the fruit and vegetable snack segment. But the meat snack market has become the most noticable response to consumer demands.

Today, meat appetisers are the third largest snack category in the United States and also the fastest growing sub-segment. Sales of jerky, salami sticks, wild boar (Polish pork sausage) and biltong (a spicy South African appetizer made from dried meat) are growing as consumers are constantly looking for foods that are high in protein and low in carbohydrates. With a healthier positioning, snacks filled store shelves in America, Europe, the Middle East, Asia and Japan.

Until five years ago, this category was considered snack food for convenience stores or bars, and jerky could not be found in regular grocery stores, let alone meat sticks. Today, meat snacks can be bought not only in c-stores (they account for up to 65% of the category’s sales), but also in various formats of supermarkets and even pharmacies, not to mention the Internet.

Mintel researchers in their February 2020 US Snack Flavor and Ingredient Trends report found out that meat appetizer sales grew 29% from 2018 to 2019 to $ 3.83 billion, a 23.2% increase sales of muesli were 19.9% higher than popcorn sales, 15.7% corn snacks, 8.9% nuts, 8.4% potato chips and 1.2% higher crackers sales. Since 2016, sales of meat appetizers have significantly outpaced the growth in sales of potato chips, previously the benchmark for the snack market.

A research company from Chicago Information Resources Inc. (IRI) reports that US jerky sales were $ 3.7 billion in the 52 weeks ended November 1, 2020, up 8.5% from a year earlier. Dried meat (jerky) accounts for almost half of the sales of meat snacks. This subcategory is growing at an average annual rate of 5.6%.

IRI and Mintel data also indicate that in addition to growth in the US sub-segment, sales of meat appetizers were also growing in the UK (up 11%), making meat appetizers one of the fastest growing sub-segments of the UK snack market, second only to popcorn. In Germany, the market for cold cuts grew from 8% in 2011 to almost 27% in 2019.

The global market for meat appetizers is driven by the growing interest in protein. Consumers are looking for snacks that satisfy their unassuming, rational and emotional needs, with meat and poultry choices becoming the most popular part of the range.

It seems that the trend towards meat appetizer is becoming long-lasting, which is attracting investors. Our review is about the most interesting M&A deals of recent years.

Complicated category

The meat appetizer category is quite complex. One of the important drivers in FMCG is the assortment, which is quite narrow in this sub-segment. Sales of biltong and meat sticks together account for the lion’s share of the category (almost 85%).

Manufacturers are trying to find new innovative formats (we will refer to some of them later), but players have a rather narrow gap left for experiments in order to be unique and not alienate the mass audience.

They prefer to expand the product matrix due to the less risky driver — taste. Industry experts agree that fragrances will remain the most powerful catalyst in this market for a long time to come.

Taste is a key factor that attracts and retains loyal consumers choosing meat snacks. In 2018, Mintel surveyed 1,899 internet users aged 18 and over, and 79% of respondents agreed that taste is more important than brand when choosing a snack, and 52% said taste is more important than a product’s health benefits.

Although the attention to healthy snacks is also observed in the segment of meat snacks, to which manufacturers are trying to respond, in the meantime, brands are racing to create the most original combinations of sweet, savory, spicy, and sweet-salty combinations to convey to consumers the idea of taste of pleasure and new experience.

In the United States, Latin American and Asian flavors are most popular in meats, while North African and Jamaican flavors such as dried chicken are preferred in Europe.

This approach brings unexpected and interesting hits to the industry. For example, the spicy-sweet biltong Honey Harissa Beef Jerky from the Private Selection brand, which has successfully taken its place in the hearts, and most importantly, in the wallets of consumers.

Another incredible taste is Spicy Peri Peri Beef Biltong. According to the manufacturer Stryve, «hot African red devil pepper blasts your taste buds.» Along with its ‘hot peppery flavor’, Spicy Peri Peri is the perfect dietary product — 16g protein, no sugar, gluten, artificial flavors, and 0% carbohydrates.

Duke’s Hatch smoked pork sausages without added nitrates or artificial preservatives with 7 g of protein also deserve attention. The most popular flavors are green chili and smoked on «devilish» mesquite wood. The latter are peach-flavored, smoked on the natural and most valuable hickory nut tree.

Snack makers have shown the most interest in herbal, vegetable and spice combinations of avocado, basil, chili, Worcester sauce, brown sugar, wasabi, and other gourmet spices.

Consumers prefer the classic flavors of barbecue, garlic and salt, ranch and jalapenos. The third largest brand in the snacks category with $ 1.3 billion in revenue and a market share of 4.5%, Oberto Brands, based in Seattle, USA, claims that about 75% of its jerky sales today come from just 3 flavors, which the company calls the most popular ones: original, teriyaki and pepper.

Younger brands are looking to a wider range of flavors. It is believed that the fresher perceptions a new taste brings, the more shoppers will seek new consumer experiences. According to Mintel, any slightest taste innovation allows new players to enter the segment.

Debutants often rely on extreme flavors. This sub-segment is characterized by the maximum influence of the most exotic taste trends in the entire food industry.

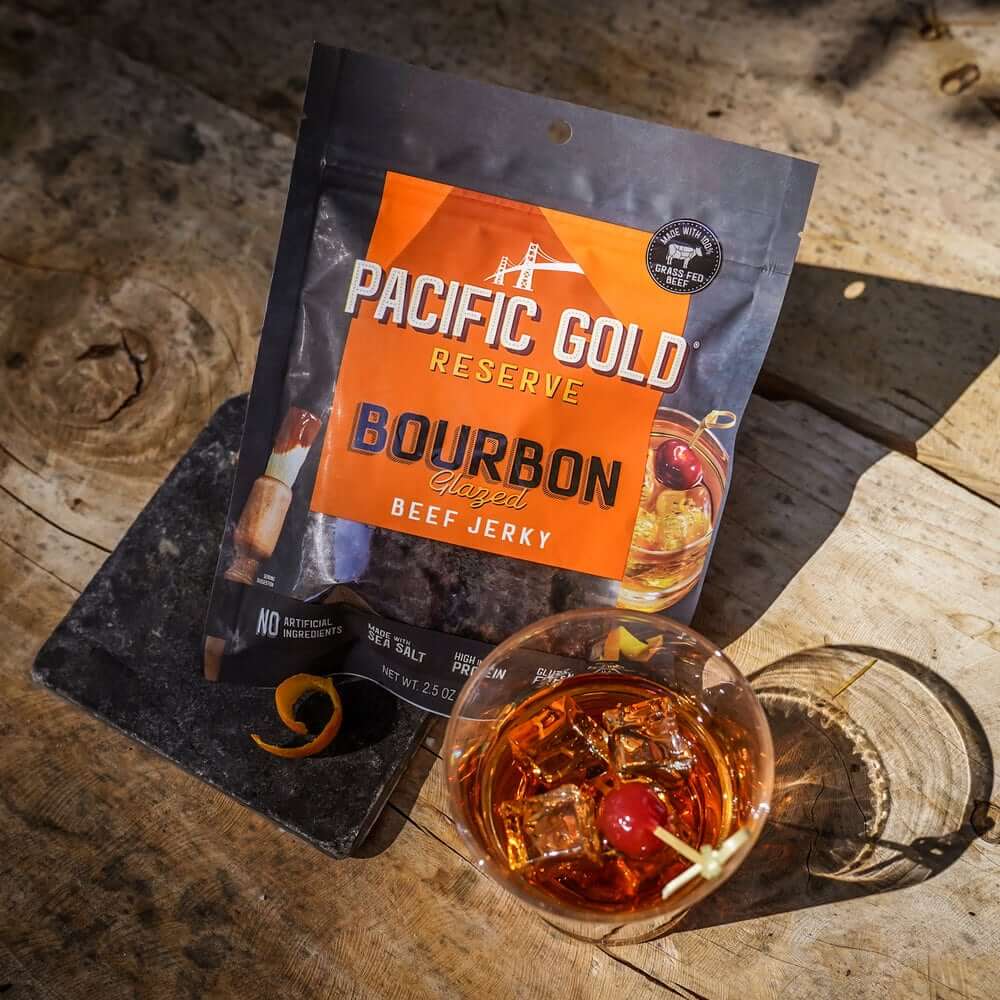

To narrow the horizon for new entrants, Oberto Brands has launched a new brand, Pacific Gold Reserve, featuring unusual flavors such as carne asada, Japanese-style teriyaki, Korean BBQ and bourbon icing.

The manufacturer defines the Pacific Gold Reserve concept as «a safe adventure for those who want to go beyond the usual tastes.» Since Oberto Brands’ growth is outpacing that of the category as a whole, this strategy is paying off well.

Merchandising is the next important driver. 80% of purchases in the category occur in retail stores, which have an incredible number of brands on the shelves. This imposes on retailers the need to make snack shelves more visible to shoppers and place them in different areas of the store to stimulate impulse buying.

Checkout areas that attract brands as much as possible cannot accommodate everyone, which encourages manufacturers to look for innovative solutions for effective merchandising.

Original displays, racks and other POS equipment can make sales to even little-known brands in a rather competitive segment.

Finally, another factor driving the segment is distribution. Similar to all products of impulsive demand, the widest choice of sales channels, ranging from minimarkets at gas stations to large chain retail stores, as well as non-standard channels such as, for example, vending or subscription products, solve the issue both with a good representation of brands, and with their accessibility for meat lovers around the world.

Delicious, because it’s meat

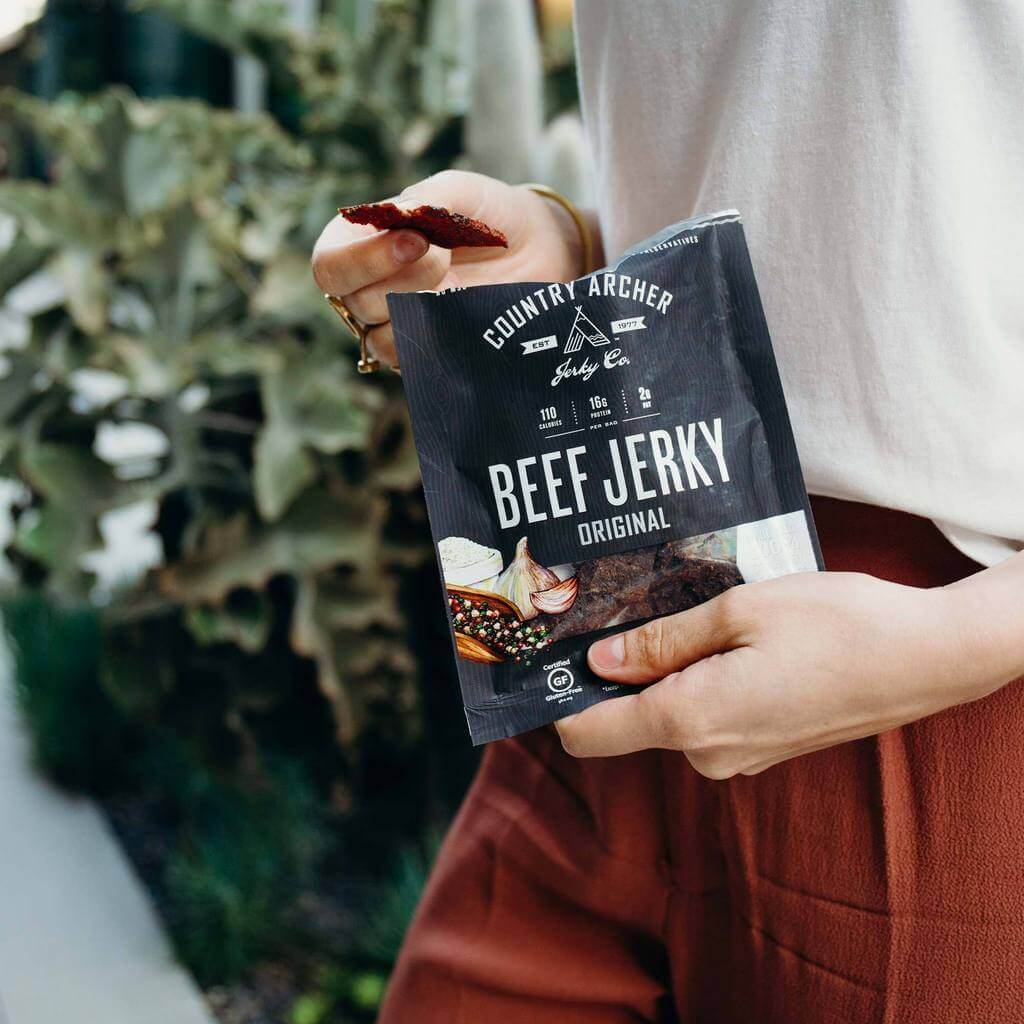

One of the top-selling jerky brands in the US is Country Archer. The company began its triumphant march across the country in 1977 from a roadside cafe, initially simply packing its products in plastic bags.

Country Archer’s premium beef, pork and turkey jerky meat sticks, introduced to the market in the summer of 2019, are currently the #1 brand in America, according to the SPINS analytical company.

The current CEO, Eugene Kang, bought the company from its founder in 2011, and in 10 years has turned it into a leader in the American meat snack market.

Country Archer’s formula for success is simple — natural meat without additives and popular flavors. The manufacturer uses grass-fed beef, pork and turkey free of antibiotics for its products. According to the company, all brand products are free of nitrates, monosodium glutamate, gluten and hormones.

In addition to its own production facility located in San Bernardino, California, Country Archer has the largest presence in various retail channels, which has made the company one of the leaders. Walmart, Kroger, Target, Walgreens, Costco and 7-Eleven have literally jumped at the brand’s products.

In addition, Country Archer products are sold in special grocery chains Whole Foods and Sprouts, as well as in Starbucks. The company’s products are also actively sold on the Internet, especially on Amazon, which certainly contributed to the popularity of the entire sub-segment of jerky snacks.

Chicago-based startup Think Jerky used a clever marketing ploy with flavors to navigate the market.

The brand has launched four SKUs with original flavors developed by renowned chefs. Taste the creations of culinary masters, including: Michelin-starred Food Network columnist Gail Gand (turkey jerky with sriracha and orange and ginger jerky), three Michelin-starred culinary innovator and publicist Lauren Gras (thanksgiving style turkey jerky) and Matt Trust, an expert in the delivery of organic, locally sourced products from farm to table (sweet jerky with chipotle flavor), quite a few fans and neophytes dared.

So far, Think Jerky products are available on the Fortune Fish chain in the Midwest for $4.99 per pack. But thanks to aggressive «taste marketing», the company’s distribution is growing rapidly across the country.

The ambitious Australian brand Tiger Buck is aimed at old-school premium consumers. Its classic-flavored beef jerky, packaged in cardboard bags with the design of playing cards from the saloons of the historical series Frontier, is exclusively supplied by the manufacturer to liquor stores and bars.

The emphasis in marketing is wine and beer lists, with recommendations: which snacks of the brand enhance the impression when consuming drinks. The strategy is working — the company is in the TOP rankings of snacks brands in Australia, which ranks 26th in the world in terms of market size, according to Euromonitor International.

But this segment provides the most extensive opportunities for ethnic meat snacks producers.

A three-year-old discovery is the Bakkwa brand by Little Red Dot in Hayward, California. The company introduced consumers to the popular fried street snacks in Malaysia and Singapore. Juicy and tender beef, pork and turkey snacks with unusual flavor combinations of chipotle, brown sugar, fish sauce, gluten-free soy sauce, rice wine, cayenne pepper, onion powder, strawberry compote and ethnic spices from Southeast Asia, to the taste of consumers.

The novelty quickly expanded into 50 stores of natural and specialty foods in California and delighted fans of meat snacks in the United States until 2019. However, the bet on flavor and exotic flavor was not enough for the brand to be firmly entrenched among competing sharks.

Outside North America, the interest in alternative meat snacks is high. The largest jerky and biltong producer in Europe, the Meatsnacks Group, has launched the Speyside Smokehouse brand, a gluten-free jerky salmon snack that is high in omega-3, protein and low in calories. 3 SKUs of sea salt and black pepper, chili and teriyaki are available for Scotland residents at £2.50 per 30g package.

The manufacturer believes that the use of seafood helps to attract new consumers to the meat appetizer market. It can also help allay concerns about the health benefits of meat snacks, as they are mainly made from red meat.

Meat merges and acquisitions

In response to consumer demand in the segment, food giant Kraft Heinz invested in cured meat producer Ayoba-Yo. Not wanting to be at the rear of a burgeoning industry, the market leader founded his own research division, Springboard, with the primary goal of «nurturing, scaling, and accelerating the growth of disruptive American food and beverage brands.»

Ayoba-Yo is the first acquisition of Springboard, demonstrating what this segment represents for Kraft Heinz future snacks.

Founded by South African brothers Vian and Emil van Blommestein, the company uses a family recipe from 400 years ago. Ayoba-Yo’s fancy products are an alternative to traditional beef jerky and meat sticks. 3 SKUs are available at US retailers and Whole Foods for $7.99.

The ketchup maker was relatively late in setting up its own incubator, following in the footsteps of PepsiCo, General Mills, Kellogg and Campbell Soup, which have already created their own innovative divisions to respond to changing consumer behavior [and traces of which can be found in the snacks segment].

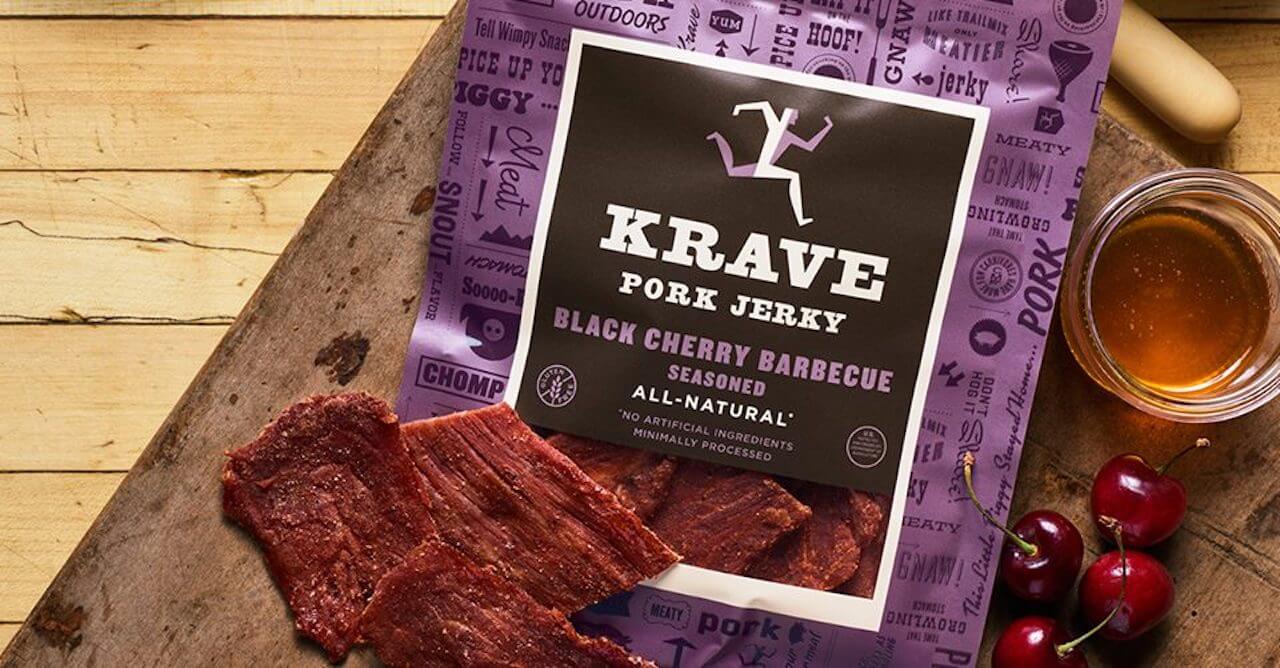

When talking about this market, it is unacceptable to omit the KRAVE success story. In 2015, the startup was acquired by food giant Hershey for a record $300 million. This deserves a separate story.

One of America’s fastest growing companies emerged in 2011. KRAVE founder John Sebastiani ran a premium family wine business in Sonoma, California, before applying his entrepreneurial talent to the charcuterie. He formulated the situation in the segment of meat snacks as follows: “On the one hand, all consumers know what jerky is, and this is good. But, on the other hand, everyone also knows how to make jerky, and therefore have a negative attitude towards it. This is a problem and we must overcome it,” Sebastiani said.

The young company initially chose a different approach to the production of its products. KRAVE is made from whole muscle meat, not meat trimmings, as all companies in the industry have done before. Therefore, its products have an unusually delicate taste and remain juicy and soft for a long time even after opening the package.

Due to the technological approach, the shelf life of KRAVE Jerky is less than a year compared to the standard shelf life of almost two years from other manufacturers.

All this together created KRAVE. Having broken the established rules of the game, in return the new brand received the support of a huge number of fans from the army of healthy food lovers, which allowed it to grow by 400% per year from the moment it entered the market.

At the time of the acquisition of Hershey, the annual sales of KRAVE were about $ 35 million. Therefore, it was not experts who were more surprised at the estimate of $ 300 million, but other market participants.

The Hershey KRAVE Pure Foods portfolio feels pretty cozy. Sebastiani continues to lead the company as President of KRAVE, operating as a stand-alone business within Hershey North America and taking advantage of the food leader’s almost limitless marketing, technology and distribution opportunities.

Today, the company’s products are sold in updated packaging in more than 20,000 retail outlets throughout the United States, and the company has grown to 45 employees.

In 2016, the market was buzzed by the news of General Mills’ purchase of the Texas-based meat snack manufacturer Epic Provisions.

Epic makes high-protein snacks in the form of bison, beef, pork and chicken in sesame sprinkles. The company’s products have repeatedly reached top positions with retailers such as Whole Foods, Sprouts and Natural Grocers, as well as specialty sporting goods stores such as REI.

Epic is an innovator in many ways. For example, the manufacturer was one of the first in the United States to launch a gluten-free protein bar made from dried salmon with a high amount of 43 g Omega-3 per serving.

Another hit from the already revamped EPIC Provisions is its line of gluten-free chicken chips. Oven baked with chicken breast, coconut flour, pepper, Himalayan rose sauce, sea salt and spices, they are ideal for a snack or to complement various sauces and spreads for those consumers on a low-carb diet or seeking High Protein Crispy Snacks — 22g Protein & Only 2g Carbohydrates Per 42g Serving

The intrigue with the Epic Provisions deal continues to this day also because, despite the fact that the amount of the deal remained unknown, the company was acquired by General Mills less than three years after its foundation.

The young brand CHOMPS, known for its colorful packaging of meat sticks and miniature CHOMPLINGS jerky snacks, made it to this section in advance. The manufacturer truly expects to soon become the next KRAVE or EPIC.

The startup’s intentions to compete for a significant market share in the meat appetizer category are based on business metrics that are different from those of the market. The main metrics by which CHOMPS evaluates the success of its strategy are the share of repeat purchases and the percentage of household penetration, not the number of points of sale or new customer acquisition, as many of its competitors do.

CHOMPS has achieved tremendous success in distribution in a short time. Today, consumers can find the company’s products at 6,000 US retailers such as Walmart, Kroger, Meyer and other major retail players. In August last year, the brand’s products began to be sold in Sprouts, and in October — in all regions of Whole Foods presence.

But most of all, the company relies on e-commerce and the creation of an online brand, which in 4 years should make it one of the leaders in the sub-segment.

Unlike giants such as Slim Jim or Jack Link’s that control more than half of the meat-based snack market, CHOMPS has so far covered about 2% of households in the United States with its sales, which is approximately 6 million apartment buildings.

A recent study by a retailer showed that 53% of all CHOMPS shoppers have never bought a charcuterie before. In addition, the number of repeat purchases from the brand is much higher than from competitors.

Optimistic metrics allow the brand to be convinced of the effectiveness of its business strategy. Amid the pandemic, the company further widened its lead in technological innovation, introduced new flavors and really increases the category, rather than cannibalize consumers of other brands.