![]()

You are welcome to share your thoughts on this article written by Max Spiegelberg, Brand Director at Bloom

You may have spotted Ella Valentine’s Baking Eggs on the shelves, currently being rolled out across the UK supermarkets nationwide. At £1.29 for half a dozen, they are cheaper than most branded equivalents but these are not value eggs. The brand is specifically targeting the growing trend in home baking. Tapping into the popularity of programs like The Great British Bake-Off, Stonegate, the brand owner, is hoping to encourage consumers to buy multiple eggs for different purposes. Naysayers may doubt that the idea will take off, but this is only one of a number of interesting innovations to come out of the seemingly unglamorous egg market.

Eggs have always been difficult to market because on the surface there’s not much difference between them. However in a way egg branding, quite literally, has been some of the most successful of all time, with the Red Lion mark enjoying consumer awareness levels of over 80%. This marque, launched in the 1930s as a quality stamp to encourage consumers to buy British, was removed in the 1970s and reintroduced in the early 1990s to reinvigorate egg consumption.

Alongside this marque, eggs have benefitted from a range of successful advertising campaigns. Classics like ‘Go to work on an Egg’ or the more recent and perhaps questionable, ‘Fast food. And good for you’ have fought hard for the egg against the cereal conglomerates and their seemingly unlimited advertising budgets.

Despite cereal’s dominance, egg consumption is once again on the rise. But suppliers are suffering from an increase in feed prices and an oversupply of eggs, therefore there is still a lot of pressure on the industry to jump-start consumption. In fact, when you compare the UK to other western countries, it seems there’s room for the category to grow. Britons eat on average 147 shell eggs per person, per year, whereas Americans eat 169, the French 172 and Australians a whopping 196.

Yet the industry still faces considerable challenges. Eggs aren’t particularly convenient and they have been subject to concerns over salmonella and cholesterol. They differ from other branded products because they have high market saturation. Most people eat eggs and those that don’t refuse to because they’re allergic or simply don’t like them. So it’s not really a case of bringing new consumers into the fold. Instead brand owners have focused on promoting formats and usage occasions to drive volume and adding value by creating compelling new brand propositions. As a result a rather humble staple has become a hub for some significant innovations.

Tactic 1: Increase Volume

Eggs can be found lurking in most kitchens, but their position as a staple makes them recessive, they are a supporting act rather than the main event. Brand owners therefore have to work hard to convince consumers of egg’s versatility in order to increase the volume of sales.

One of the most obvious ways to create new occasions for egg eating is to increase convenience. Consumers recognise that boiled eggs are a naturally nutritious snack, but it’s easier to pick up a synthetically souped-up cereal bar. In an attempt to overcome these barriers Noble Foods, who dominate the UK egg market, have launched ready boiled eggs, under the Happy Egg brand, perfect for a picnic lunch.

Entrepreneurs are also getting in on the action. Noticing a gap in the market Anna & Alla launched ‘Two Chicks’, a liquid egg white product that’s handier and healthier. Unlike its precursor, Eggnation, which is aimed at sports buffs and nutrition nerds, they have created an appealing mass-market brand, which has secured them listings in Sainsbury’s stores nationwide.

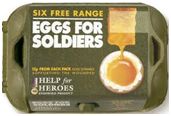

The egg category has also successfully leveraged charitable trusts to entice consumers. They may seem like strange bedfellows but they actually work well together. Eggs have long been associated with giving, thanks to the Easter connection and they have a purity that allows them to be adapted to various causes. Consumers know they’ve got to buy eggs anyway— why not support a good cause at the same time? Noble Foods have helped a number of charities get up and running including the brilliantly named Eggs for Soldiers, One Eggs (part of the One Foundation) and Sainsbury’s mid-range Own Label eggs Woodlands, with funds going to the Woodlands Trust.

Tactic 2: Increase Margins

On the continent Own Label tends to get pride of place on the supermarket shelves. However, in Britain retailers have a more flexible attitude towards high-value brands, giving suppliers leeway to create new and compelling propositions that add value and grow the category.

Free Range is no longer a differentiating factor. Barn, Free Range and Organic eggs represent nearly half of Noble’s stocks and once new EU laws come into effect in January 2012, battery farming will be a thing of the past. So brands have had to go above and beyond ‘free range’ to really create a strong point of difference.

Noble and Stonegate have done this using their extensive network of producers to create regionalized egg brands. Likewise Clover is an independent example of a brand that has taken advantage of consumer interest in locally grown produce. These brands tap into many consumer’s desire to shop at neighborhood farm stores whilst enjoying the convenience of the supermarket.

Others have put a face to their brand in order to give it a more human quality. Glenrath, one of the largest free range egg producers in the country, has done just that. By creating Kitty Campbell’s eggs they have given the brand a more interesting niche while still leveraging the Campbell family’s decades of experience running Glenrath farms.

Noble Foods, one of the most experienced suppliers and marketers in the industry, have gone even further. Ecowise focuses on the environment and Happy Eggs on the hens, but both brands are essentially selling a world in which eggs contribute to the wellbeing of mankind.

Another way to differentiate is to concentrate your energies at the more premium end of the spectrum, with an emphasis on rarity and quality. Church & Manor describes in detail the quality of life their hens enjoy, while Clarence Court works in collaboration with Mark Hix to entice foodies to try their extensive range of exotic eggs.

Most of these examples are about adding value through branding, however farmers have added value to the product itself by feeding the birds flaxseed to produce Omega-3 enriched eggs. This tactic counteracts consumer’s concerns about the high-cholesterol by bolstering egg’s already strong health credentials.

By creating carefully considered brands these diverse strategies are likely to boost sales further and for longer than a catchy strapline could on its own. Overall, eggs are a great example of how to take a fairly unexciting staple and creatively brand it building what is now a really dynamic category.

In fact, milk could learn something from egg branding. Aside from a few clever ads, little of interest is going on in the world of milk branding. Yes, brands have attempted to set themselves apart through purity, lactose fee and organic claims, but the category remains confused. However, the egg category has shown that by being more authentic and adventurous in the way that you market farm staples, you can really capture the consumer’s imagination.

About the Author

Max Spiegelberg has over 15 years expertise in branding as a consultant on brand development and innovation programs. He has worked for brands across the globe spanning a broad range of industries including FMCG, technology, pharma, agriculture and professional services.

Max is the Brand Director at Bloom, which is a brand agency dedicated to building brighter brands. Clients include Diageo, Nestlé, Pepsico, P&G and GlaxoSmithKline.