The market for cheese alternatives has been showing enviable growth rates in recent years. Sales of plant-based milk in the United States grew over the past year by 21.9% to $2.542 billion, measured by SPINS channels until January 24, 2021, while sales of plant-based cheese and yogurt (much smaller categories) grew by 43.6 % ($233.9 million) and 16.4% ($346.2 million) over the same period, respectively. Analysts are inspired and expect this segment in North America to grow by 21% annually through 2026-2027.

According to the ResearchAndMarkets.com report, the global vegan cheese market, which was $2.7 billion in 2019, will grow to $4.6 billion by 2027 (+70%). The experts expect an average annual growth rate of at least 7%. The players of the segment can only rejoice at such prospects, and we are happy to observe the success of companies that are developing a promising niche.

Solving a Problem

Manufacturers began to face serious challenges from the middle of the 20th century. It turned out that finding enough raw milk is not the main problem of the dairy industry. Changes in consumer preferences and «black swans» cause serious risks. The latter include the impact of COVID-19 on the dairy industry.

The drop in cheese consumption in 2020 is solely due to the pandemic. Lockdown led to a 28% decrease in the consumption of cheese products in public catering, which led to a 6% decrease in the volume of the entire segment based on the results of the 2020 Covid year.

However, last year’s figures were rather an exception — before that, the cheese market had been growing vigorously for the last five years, showing an annual 2% growth. The global market accounts for 26% of the retail dairy market, second only to drinkable dairy products.

Cancellation of pandemic restrictions could compensate for the last year’s fall at the end of the year. But the oversaturation of consumers in the largest markets in North America (the United States accounts for 24% of the global volume) and Western Europe (Germany, France and Italy occupy the second, third and fourth places in world cheese consumption), the growth of flexitarian sentiment, causing a decrease in meat consumption and dairy products, replacing them with plant-based products, have become a decisive driver in the market.

In addition, the influence of social media and animal rights organizations highlighting the impact of dairy and meat industries on climate, animals and consumer health is essential to boost demand for plant-based alternatives.

These are the main factors that have led to a tectonic shift in the cheese market, in which well-established classic dairy players are actively entering, wanting to meet the growing consumer demand (in our article we talked about the latest acquisitions of several food giants).

A few years ago, this has given new strength and resources to unknown young industries to complete their innovative breakthroughs.

Cheese Innovations

Innovations in the segment were noticeable back in the last century. For the time being, cheesemakers were saved by a relatively conservative consumption and an unusually long life cycle of the category. Indeed, since the dawn of production, the «cheese classics» in consumer baskets have not changed.

However, bold sprouts of R&D have also penetrated here, which can be explained by the desire of brands to diversify the gustatory palette of the consumer.

It is now a «Belp truffle» or a hard cheese invented in Switzerland in 1993 with a unique and unforgettable taste, Belper Knolle, in the form of a ball sprinkled with peppers of various varieties and thickly seasoned with Himalayan salt, seems to be an absolutely ordinary variety. Until 2007, when it received the prize for the best innovation in Swiss agriculture, it was considered exotic and prized exclusively by culinary aesthetes.

Inspired by the Swiss “cheesy achievements”, the industry’s most daring players rushed to experiment with different additives. The segment began to swell from unusual combinations of flavors, which were scary to think about just a decade ago.

Since last fall, the Beemster brand has been treating customers with a new product — pumpkin-flavored cheese. Pumpkin Spice Gouda with pumpkin spice combines the classic buttery and caramel flavor of semi-soft Gouda cheese with aromatic autumnal spices like cloves, nutmeg, cinnamon, ginger and cardamom.

Perfectly paired with ham, turkey, cranberry sauce, chutney, raisin bread or even malbec, chardonnay, beer or cider, the extraordinarily spicy taste of the pumpkin Beemster has made it a popular seasonal specialty for those seeking an extraordinary experience.

Beemster’s pumpkin initiatives have also been supported by other cheese makers with their fall versions. Pumpkin has become a popular flavor for a long time, although pumpkin cheese has remained an exclusively limited edition holiday product.

These seasonal varieties include Belle Chevre‘s Pumpkin Spice Cream Cheese, launched last year.

The autumn table novelty with a sweet taste of cream cheese is created on the basis of natural goat cheese and with the addition of completely natural pumpkin puree. This creates a delicious combination of the rich creamy, pungent and soothing aromas of autumn. In addition to using Pumpkin Spice Cream Cheese with crackers and canapes, the manufacturer recommends mixing it with whipped cream to use it as a light and fluffy filling for cakes, reducing their calorie content.

On the Thanksgiving eve, the popular brand Boursin that loves to please its fans with “cheese exotic” (the company’s line includes such unusual varieties as maple cheese Bourbon Gournay Boursin and Boursin Maple Bourbon Gournay Cheese with bourbon), launched a limited edition of apple cheese with cinnamon. The manufacturer promises that the novelty will be the perfect addition to a range of different dishes, including crostini, turkey sandwiches and vegetable sauces.

Still, such products are more like an experiment. The quirkiness of the conservative cheese segment only partially supports the category’s growth [however, it does a good job of advertising on social media].

The brand Aldi, known for a range of alcohol-added products — from pasta sauces with wine to fruity salsas with alcoholic beverages and even British prosecco chicken. The company recently introduced a new line of alcohol-flavored cheese products, offering a new perspective on alcohol and cheese pairings.

Cheese has always been an integral part of the festive table, but new Emporium Selection additions include Whiskey Business (whiskey-flavored cheddar), Boozeberry Vodka Cheddar, which combines blueberry and vodka flavors, and Gaelic Glory (Irish cream liqueur cheddar) offered a new way to delight guests with a fresh take on classic cheddar.

Another scenario for the development of the cheese market could easily be the sub-segment of cheese snacks. But here, too, not everything is so simple. For total innovation, consumers are in no hurry to vote with their wallets, and rare successes, which are not perceived by the majority, remain niche requests, satisfying the needs of gastro-freaks.

For example, Sonoma Creamery offered dairy lovers an ingenious way to eat on the go. With crispy bars made from real baked cheese, the manufacturer wanted to captivate large categories of customers by offering a wide palette of flavors. 5 low carb zero sugar parmesan & cheddar with spicy seeds, bell peppers & bacon SKUs — what could be better?

Protein-rich bars could be an alternative to sweet bars as well as chips with low nutritional value. But so far they have remained an extraordinary product for adults.

In the meat snacks article, we mentioned cheese as one of the ingredients in the popular meat snack sub-segment. Immediately, we dare to assume that authentic mono cheese snacks will remain a micronishe segment that can only dream of the popularity of their meat counterparts.

Indeed, there are many cheese snacks that use cheese ingredients to add texture or flavor, but Moon Cheeseproducts are completely made with 100% different types of cheese, no added sugar and low in carbohydrates. Each pack ($14.99) Garlickin ‘Parmesan, Get Pepper Jacked and Cheddar Bacon Me Crazy contain over 10 grams of protein. A real treat for cheese lovers!

While Moon Cheese is actually made with natural cheese, they don’t require refrigeration, making them ideal for on-the-go snacks. Consumers can not only enjoy savory low-carb and high-protein snacks on their own, but they can also add them to salads, soups and other dishes that will benefit from it.

Fresh Express went even further. Their new line of savory snacks, Chiquita Bites, includes a blend of protein snacks such as cheese, fresh fruit and nuts, as well as crackers and pretzels. It contains a minimum of 7 grams of protein per serving, and is suitable for both individual raw foodies and families on the go.

We’ll tell you in secret that the most delicious option is SKU with semi-hard Monterey Jack cheese, cranberries and cashews, giving at the same time sweet, salty and piquant taste, with a rich array of textures for an unusually strong cheese snack experience. Find it on Amazon.

The company could not decide on positioning for a long time. As tasty and original as Chiquita Bites’ products are for the general public, the emphasis has been on making life easier for parents who buy this product as a “school lunch” for their children. The manufacturer put aside plans to make an «adult» version, ceasing to struggle with the attitude to the product as to something «for an excursions in the fresh air with a chance of getting hungry.»

But the family farm of former Russian immigrants Crystal Farms Dairy Co from the Midwest of the United States, honestly turns its brand of cheese snacks Nibblers to children. Small pieces of mozzarella, marbled cheese or nuggets in blocks can be playfully stacked together to create the shape of a fun character.

The fans of the brand are parents who care about their children health. The main thing for them is to buy portable, convenient and, most importantly, not harmful snacks for their offsprings. And if they are fun too, they are more likely to become a pleasure for schoolchildren. Nibblers really compare favorably with many other snacks on the market as they are sugar free and low in calories.

Kyubu fruit and cheese cubes are called «Japanese-style cheese snacks». They come in unexpected flavors such as strawberry, orange yogurt, and chocolate with almonds and nacho. This unusual innovation is sold in supermarkets in Thailand and Singapore.

Fruit and cheese are the very companions that often sit side by side on decadent cheese platters. Kyubu has brought these two ingredients together so much that it is deliciously original.

Although the product looks rather unusual for a European consumer, Asian fans have appreciated it. Consumers in this part of the world currently consume less than 10% of the world’s cheese, but the consumption of cheese products is increasing throughout Asia, where cheese consumption was expected to reach 1.65 million tonnes by 2021, but these Napoleonic plans were heavily influenced by the coronavirus.

Beyond the Borders

Such innovations have completely blurred the boundaries of the cheese category. Currently, plant-based cheeses have maximum growth opportunities. This stable trend is supported by distribution networks apart from consumers.

For example, Starbucks, one of the leaders in the global catering, has included vegan cream cheese from the California manufacturer Miyoko in its assortment since the fall of 2020.

Testing of the novelty began near the Starbucks headquarters in Seattle. It can be assumed that everything will go well. Looking at the «non-dairy history» of the coffee chain, it is clear that it began offering soy milk in its establishments back in 1997. In 2015, coconut milk was added to the assortment, and so was almond milk in 2016. Oat milk has become a constant supply for coffee in several regions, thanks to the partnership with the global market leader in oat alternatives, Oatly, concluded in 2020.

Then in January, Starbucks announced its commitment to sustainability, which includes expanding its plant-based product range. The company has highlighted expanding vegan alternatives as a fundamental strategy. The food service giant claims 15%-20% of consumers in its North American establishments already choose plant-based foods.

The company plans to include two exclusive Miyoko vegan cashew milk flavors, Everything and Cinnamon Raisin Cream Cheese, on a long-term basis by the end of 2021.

In the context of a “plant-based strategy,” Starbucks President and CEO Kevin Johnson said in an interview, “Alternative dairy products will become an important part of our portfolio.”

The consumer demand curve has finally shifted to the non-dairy side.

Plant-Based Opportunities

Experts have been talking about the huge potential of herbal products in the dairy industry for a long time. But it was in the cheese category that they expected special growth opportunities — from alternatives to soft cheeses to plant-based fermentation that could completely replace classic cheeses.

Although cheese is the most technically challenging place among alternative dairy products, key players in the food and beverage market have chosen to go into production to capitalize on the growing popularity of veganism around the world.

Plant-based cheese has become big business by now. Globally, the sector is expected to be worth $3.9 billion by 2024, up $1.8 billion from 2016, according to forecasts by research firm Variant Market Research.

For now the figures show that the market for plant-based cheese has not yet reached the peak of its ripeness, and there is still a lot of space in which to develop.

There are two main types of plant-based cheese alternatives on the market today. One based on legumes, oil and starch is best for hard cheese counterparts.

For example, the German brand Veganz uses this method to produce their Gourmet Pieces, which mimics the popular Gouda cheese. The company, which began as the “first” vegan supermarket chain in Europe, now boasts a portfolio of 165 products, which are produced with its own plant-based raw materials and successfully sells in 26 countries.

The total volume of the market for soft cheeses made from cow’s milk is estimated by the company at 1.2 billion euros. Veganz assumes that if plant-based soft cheese alternatives achieve only 5% of the market share, this will translate into annual sales of just one product in the amount of 60 million euros. This is «truly amazing and opens up huge potential for many market players,» the company says.

Vegan cheese brands such as Miyoko’s Farmhouse Cheddar also contain a dark blue bean and chickpea paste, water, oil and starch as the first three ingredients. Cheese brands such as бренды Violife, Daiya, Follow Your Heart, Good Planet and So Delicious have followed a similar path, sometimes adding pea or potato protein to their cheese products.

One area particularly ripe for innovation is the segment of alternative soft cheeses. Here, the filling with new products of product offers is as active as possible.

California-based Kite Hill brand specializes in non-dairy products such as yoghurts, pastes, sauces and spreads, expanding its line of soft vegan gluten and soy free almond milk cheeses with garlic, jalapenos and strawberries.

The company regularly pleases its fans with noveltie, expanding its presence on the shelves.

Last season’s hits are the Everything Spread-branded sesame seed, poppy and onion spreads, available from Whole Foods Market in the US from April. The recent novelty, the alternative to ricotta, can be expected to be a success as well.

Investors love Kite Hill’s strategy. Last year, the company closed a $40 million investment round led by General Mills’ venture capital unit 301 Inc. The funds raised by management have already planned to invest in expanding the plant’s production capacity to meet the «insatiable consumer demand for delicious vegan products prepared according to the recipes of our chefs,» the company said in a press release.

The Follow Your Heart brand strategy aims to create a wide range of products for vegans and lactose intolerant people. Their cheese is made from coconut oil, various types of starch, and plant-based flavors. The line also includes grated parmesan and vegan cheddar and mozzarella delicacies made with organic soybean oil.

Consumers note that these dairy-free cheeses are as eclectic as their traditional varieties. Produced SKUs range from sliced cheese and slices to grated cheese — for any type of consumption.

We have already mentioned Miyoko. The company is known for its plant-based craft cheese substitutes, which it produces in the form of wheels. In the spring, it introduced the game-changing slices of cheddar cheese to the market.

All-new alternatives to cheddar and bell peppers, present not only the first nut-free vegan Miyoko cheese, but also an innovative recipe made with cultured legumes and oats. Perfect for both regular and baked hamburgers.

Nuttin Ordinary is different in that it makes its cultured cheese only from selected cashews. The company’s vegetable cheese is dairy, GMO and gluten free. Also, all products are made without oils, soy, gum and sugar.

Each of the four flavors Cracked Pepper, Italian Herb, Spicy Cashew Cheese and Plain are made of no more than six natural ingredients.

These cream cheese substitutes are easy to eat with sandwiches, crackers, or added to vegetable salads. In addition, they can be used in ravioli recipes (the company’s website also offers to buy them ready-made) and even in sweet recipes such as strawberry «cream cheese» as suggested by the Nuttin Ordinary website.

Swedish plant-based milk leader Oatly launched the first line of vegan cream cheeses. Creamy Oat Spreads hit shelves in the UK this year. The new product contains saturated vegetable fats, which are similar in characteristics and taste to dairy counterparts, but do not contain trans fats.

Oatly Creamy Oatmeal Spreads with Tomato Basil, Garlic Cucumber and Classic Creamy are available for $2.40 at Tesco and some of Sainsbury’s stores.

San Francisco-based Forager Project, another major food and beverage company, has entered the fast-growing plant-based cheese category. Its new brand of organic soft cheese, based on cashews, starch, coconut cream and butter, is said by the company to provide «the cheesiest vegan cheese with the best melting and stretching.»

The company previously specialized in juices, but has now completely abandoned them, focusing exclusively on cheese alternatives.

The new dairy-free lump cheese under the CHEESEWORKS brand includes 4 SKUs: Jack, Queso Fresco, Mozzarella and Parmesan. The $5.99 package is available in retail at the San Francisco Central Market and Stop&Shop.

Vegan Aging

Another method of making herbal cheese alternatives is closely related to traditional cheese making methods based on fermentation, maturation and aging.

The already mentioned German brand Veganz responded to the gap in the category with a plant-based alternative to camumber: keshubert. Made with just five ingredients, including cashews and macadamia nuts, the product is fermented and matured at their own production.

Factory with an area of 200 sq. m. can produce up to 2000 kg of keshubert per day. “We could produce more, but we are limited by the areas used for maturation,” explains CEO Jan Breda. The alternative Veganz cheese matures within 10 days. Once packaged, it continues to ripen and has a typical shelf life of about 40 days.

Press releases of the company assure that “… due to high demand, the company believes that the market will continue to develop exponentially, and currently the manufacturer plans to open a second production with a total area of 4000 sq. m. in Berlin. »

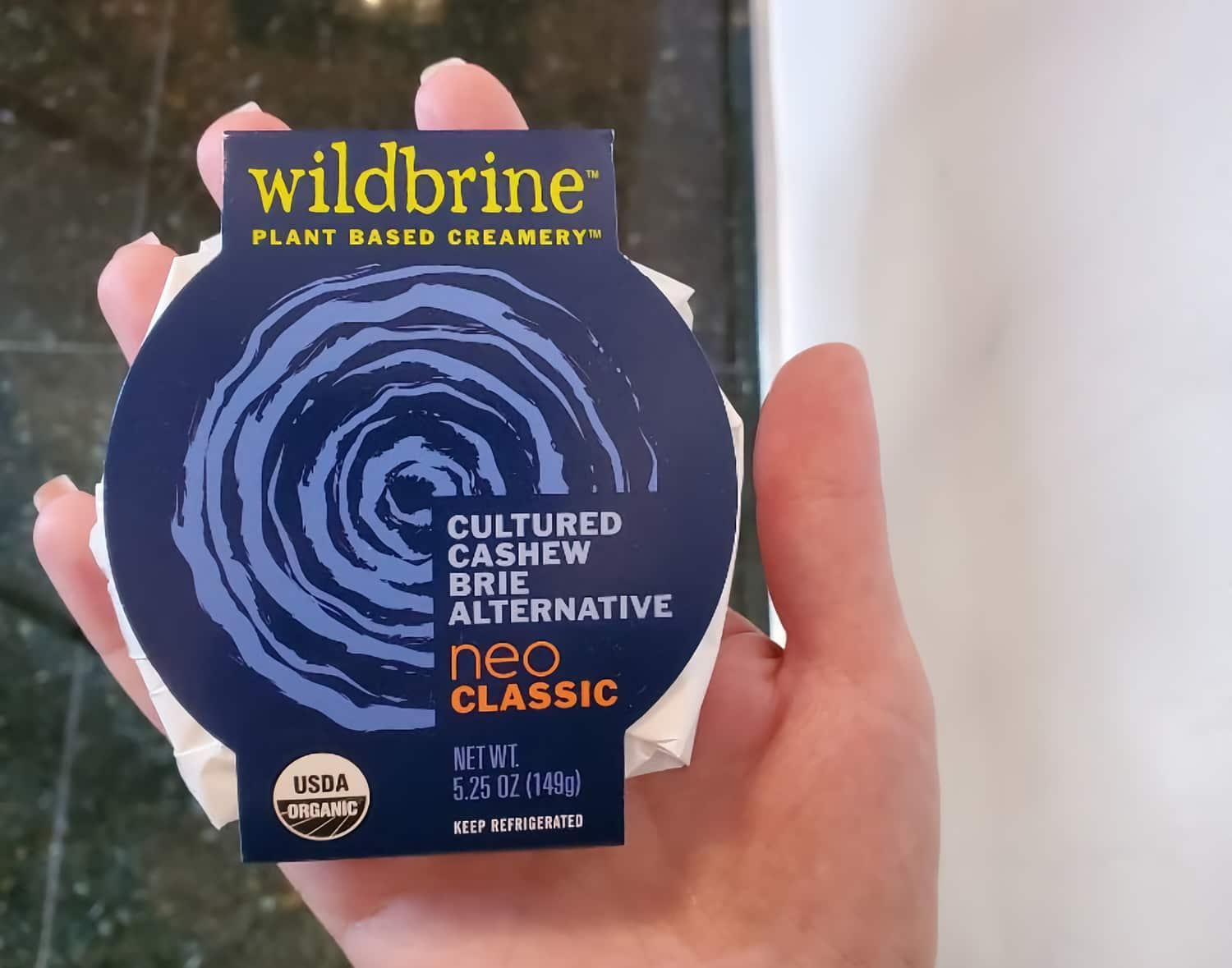

Wildbrine‘s Neo Classic Brie Alternative is a vegan cheese also made with cashews. According to Wildbrine, the plant-based brie alternative has «a rich, creamy flavor and the distinctive crust of classic milk brie thanks to its long aging process.»

In addition to organic cashews as the first ingredient, the product contains simple and recognizable organic additives: coconut water, coconut cream, nutritional yeast, kale, oats and sea salt.

The Swedish startup Stockeld Dreamery also sees fermentation as “free space”. According to Anja Leissner, founder and head of research and development at the company, it is this method that allows you to get the «full flavor» of the classic cheese.

Stockeld Dreamery has completely ditched the typically high price of nuts, opting for legumes and protein combinations. It took the company three years to find a plant-based alternative to casein, milk protein that helps provide meltness, flavor and fat binding in regular cheese.

Selected vegetable proteins are not disclosed in the company, only saying that in a matrix with vegetable fat, which acts as a «flavor carrier», they add the necessary creaminess and «correct» cheese feeling, saving the manufacturer from adding a large amount of flavors or other additives.

Stockeld Dreamery’s feta substitute is the first to appear in Stockholm restaurants as an alternative to pizza cheese. Leisner says: «Consumers should feel full after eating legume-based cheese.» Just like they feel from regular protein.

Violife, another leader in vegetable cheese production, with products available in 65 countries, also believes that protein in cheese alternatives is becoming «more and more important.»

“Currently, our products, made with coconut oil and starch, are relatively low in protein,” the company agrees. But now Violife’s portfolio includes a truly protein-rich cheese.

The company’s technologists argue that fermentation is one of the ways to increase the protein content in the company’s products, although it is admitted that this approach currently has problems, especially when it comes to scaling the production process.

Rather than fermenting at the “end product level,” Violife is exploring the use of fermented ingredients, which may ultimately provide functional benefits to their products. A similar approach is already being used by other manufacturers, and it has proven itself to be excellent.

Cheese makers approach the production of plant-based cheese from different angles. This approach opens up ample opportunities for creative experimentation, leading to the emergence of unusual products.

Violife Cocospread is a new vegan cheese product offered by the brand to vegetarians in the UK. Compared to similar sweet spreads, it contains only a quarter of sugar and also half the fat and calories. In addition, it is completely free of palm oil and other allergens, which consumers should appreciate.

Violife strives to push boundaries by innovating and opening up new categories — sweet alternative spreads. Thus, the brand further contributes to the development of the segment of cheese plant alternatives.

Founded by former economist Veronica Phil and chef and restaurateur Sean Quaid, Australia-based Grounded Foods Co introduces its own alternative cheese made from fermented cauliflower and hemp seeds.

Management says their products (starting at $5.99 / pack) are nut, soy and gluten free, rich in OMEGA-3, and have been formulated “non-vegan for flexitarians”, as well as anyone looking to cut down on dairy. The manufacturer defined its goal as «to create such an insanely delicious product that ordinary people do not hesitate to choose it over ordinary cheddar».

Bel Brands USA, a cheese maker with brands such as The Laughing Cow and Babybel, has launched the new Nurishh brand of plant-based alternative cheeses.

Certified vegan lactose-free Nurishh is made using french Bel Brands cheese making methods. Vegan 6 SKU: Cheddar style slices and slices, mozzarella, provolone and cheddar and mozzarella style slices, are dairy-free and are a good source of calcium and vitamin B12.

Nurishh products have been available in select retail stores and through Amazon Fresh since April. The company plans to increase availability in stores nationwide during 2021.

Opportunities for Investors

One of the reasons for the significant growth in the global plant-based cheese market is the popularity of vegan hamburgers and other plant-based products in leading fast food chains. This interest has spurred huge demand for other plant-based supplements, including eggs and mayonnaise. But most of all, it influenced the cheese market, significantly redrawing the structure of this segment over the past couple of years.

And it is only natural that such changes have caught the attention of major industry players, opening the door for mergers and acquisitions.

The recent acquisition of one of the first dairy-free cheese brands, Follow Your Heart, by food holding Danone, clearly demonstrated the category’s potential to investors. Danone already produces its own plant-based cheeses under the So Delicious brand, but is trying to strengthen its position in a growing segment by leaps and bounds.

Buying Follow Your Heart is a good sign for the entire market. As consumers seek more plant-based alternatives to traditional food, more local brands are launching their plant-based cheese alternatives, and food giants are pumping more and more money into the market.

For example, the world leader in the production of vegetable-based oils and spreads Upfield Group BV, which owns such iconic brands as Flora, Rama, Country Crock, Blue Band and PROACTIV, recently announced that one of its group companies, Upfield Europe BV, has completed the purchase of a Greek company ARIVIA SA, a leading manufacturer of cheese alternatives, with regulatory approval.

As a result of this strategic acquisition, which was first announced in October 2019, Violife moved into the Upfield Group BV portfolio, showing how the global food leaders are passionately caring for this segment. The spread holding made a profitable acquisition — ARIVIA SA has 27 years of experience in the production of non-dairy products, mainly based on coconut oil, exporting its products to 45 countries of the world.

Another one of the largest producers and distributors of cheese, the global giant Kraft Heinz, recently invested $3.5 million in New Zealand biotech startup New Culture. New Zealanders use fermentation to produce plant-based cheeses. Their vegan-safe, non-dairy product is made with microbes and yeast to replicate the traditional flavor and texture of mozzarella.

New Culture has previously received funding from other investors including IndieBio, Boost VC, SOSV, Bee Partners, CPT Captial and Bee Partners, but Kraft Heinz’s recent investment is one of the largest contributors. This suggests that non-vegan food manufacturers are expanding their portfolio to meet consumer needs with plant-based options.

Commenting on such closings, the combined expertise of the companies will further drive impressive growth in plant-based food innovation