Media, the power which has an indisputable influence on people’s minds, purchasing habits, lifestyle and political choices, hardly can do without ‘financial partnering’ with companies and organizations that need to get into the spotlight. The volume of advertising in media depends both on the economical factors and number of events, which will attract audience’s attention over the year.

Naturally, the ad spend figures mean a lot to both consumer brands and media channels, as well as advertising agencies since it shows how much work they will have on their plate in the coming months. With two much-anticipated sports events this year, London 2012 and the European Football Championship, which are going to be in the spotlight this summer, and Presidential elections in the USA and the Russian Federation (so-called ‘quadrennial’ effect), the ad spend is boosting in 2012 despite the eurozone debt crisis and the tough economic situation in the world.

This review provides an insight into which countries will have the biggest ad expenditures and which of them will have to tighten their ‘ad belts.’ It will also make a prediction on which media channels will rule in the future (the forecasts is based on figures unveiled by leading agencies the in measurement and information fields).

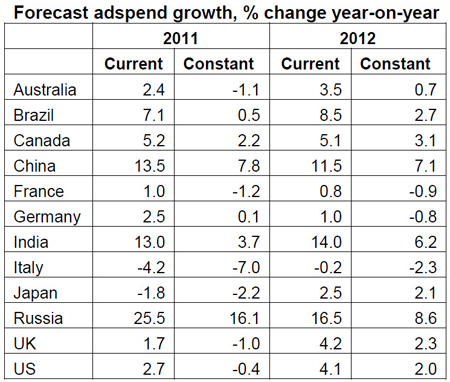

Warc reports that BRIC countries “to record the strongest ad spend growth in 2012, according to its latest International Ad Forecast. Russia is predicted to increase expenditure by 16.5%, followed by India (14.0%), China (11.5%) and Brazil (8.5%)” (see the table below). The UK and the USA will also see a moderate advertising boost this year—4.2% and 4.1% correspondingly,—primarily thanks to the Olympics and the President Elections (for the second), which will be heavily covered by mass media. For Germany (1%), France (0.8%) and Italy (-0.2%), this year will be the worst year-on-year ad spend performance as now the countries and trying to survive the current economic turmoil and so marketers are reluctant to spend extra money on advertising. «With continuing debt worries affecting mature markets and knocking business and consumer sentiment, it is no surprise that 2012 ad spend growth will come from emerging markets. Without the support from the presidential election and major sports tournaments, the outlook would have been even worse. But there are some bright spots in the data, with TV’s performance looking particularly encouraging,» commented Suzy Young, Data Editor, Warc.

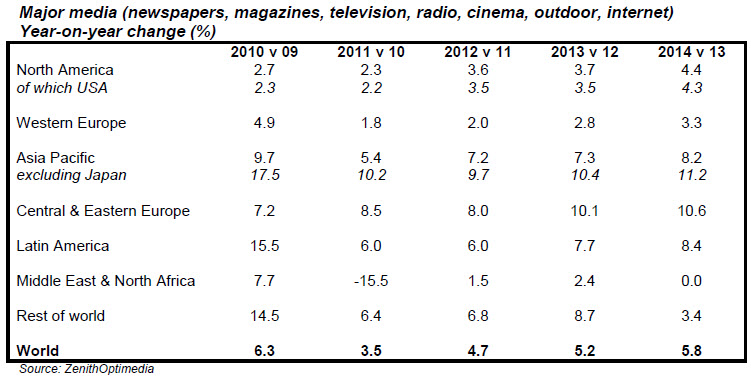

Though, in its last year’s report, ZenithOptimedia predicted that for European countries there’ll be 2.8% ad spend growth in 2013 and 3.3% in 2014, assuming that the economy will get better by the end of 2012. “Our forecast assumes that GDP continues to slow in the eurozone (and the rest of Western Europe) towards…the beginning 2012. However, the economic situation is extremely uncertain and could get even worse, so we have considered the potential effects of a further deterioration of the debt crisis in Europe. This would clearly depress advertising in the eurozone and its main trading partners, but its impact on global growth should be limited,” writes the source. They also forecast 3.6% growth in North American ad expenditure in 2012 as compared to 2011, strengthening to 3.7% in 2013 and 4.4% in 2014 and say the major ad spend will be related to developing markets, Asia Pacific, Central & Eastern Europe and Latin America (see the table below).

Photo: Click to enlarge

As to the media channels, across all 12 markets in the Warc review, TV will be doing quite well since the ad spend in this platform will grow by 5.3% compared to the overall media total of 4.5%. Online advertising, which is now frantically developing (Facebook is elaborating new options for advertisers and Apple is pushing its iAd platform, trying to win more companies by compromising), are predicted to slow to 12.6% this year (as compared to the forecasted 16.6% in 2011), so the rates of expansion will be not as great as thought before. According to Warc, “the digital advertising spend is expected to account for 20% of all media spend by the end of 2012.” ZenithOptimedia writes that the online platform will soon become the major medium for advertising, since between 2011 and 2014 internet advertising is expected “to account for 52.9% of the growth in total expenditure” and will increase its share of the ad market from 15.9% in 2011 to 17.6% in 2012. Television will continue to be the prime platform for showing ads with its 40.4% share this year, followed by newspapers (18.7%) and magazines (8.9%), driving $193,735 million (currency conversion at 2010 average rates).

The industries, which will be on the list of the biggest ad spenders, vary from country to country, but in general, the FMCG giants will probably take the lead—in 2010, the list of top 5 ad spenders around the globe included P&G, Unilever, L’Oreal, General Motors and Nestlé, as reported by Ad Age in the end of 2011, and it doesn’t seem that this year the situation will change dramatically (see the infographics showcasing top 100 global ad spenders in 2010 here).

Two major global sport competitions, the most long-awaited events this year, are slated for summer, so the biggest advertising wave is still coming. Still we can analyze ad spend related to two recent events, which are also among the biggest advertising bombs in the USA. These are Super Bowl and the Academy Awards, which usually set enormous prices for advertising. For instance, a 30-second ad spot in this year’s Super Bowl rose to $3.5 million on average, and this is 84% more than just 10 years ago, but at the same time the audience of the game doubled for the past decade as well. “Between 2002 and 2011, companies spent $2.5 billion on Super Bowl advertising, based on 24/7 Wall St.’s estimate. The top 10 spenders were responsible for more than one-third of that. And one company, Budweiser maker Anheuser-Busch, spent almost $250 million over the past 10 years on Super Bowl ads, or a whopping one-tenth of all Super Bowl ad spending,” writes www.247wallst.com. This year’s top five advertisers at the event were Anheuser-Busch, PepsiCo, GM, Yum! Brands, and Coca-Cola. As to the one of the biggest cinematic events, the Academy awards, the pricing was expected for the 2012 show, in the range of $1.70 million per :30 unit, while “ads in the 2011 telecast fetched an average rate of $1.55 million per 30 seconds and total revenue was $74.4 million,” writes Kantar Media.

All the forecasts related to the ad spend in the coming months are based on thorough researches and investigations, but still any prediction is just a prediction, and things can change under a range of unforeseeable circumstances. Anyway, the overall increase of ad spend on a global scale is sure to happen, still by far neither companies nor advertising agencies or media companies publicize the data of the volume of ad spent—most likely, this along with new forecasts will be disclosed in the end of the year.