Do consumers prefer a new extension of the brand they know to a totally new brand? Yes, they do, says the latest “Global Survey of New Product Purchase Sentiment” survey conducted by Nielsen. The research, which polled over 29,000 Internet respondents in 58 countries, shows that consumers are more likely to buy new products by familiar brand rather than choosing a new label.“Innovating on established brands that are already trusted by consumers can be a powerful strategy. Companies spend millions of dollars on new product innovation, yet two out of every three new products will not be on the market within three years,” comments Rob Wengel, senior vice president, Nielsen Innovation Analytics.

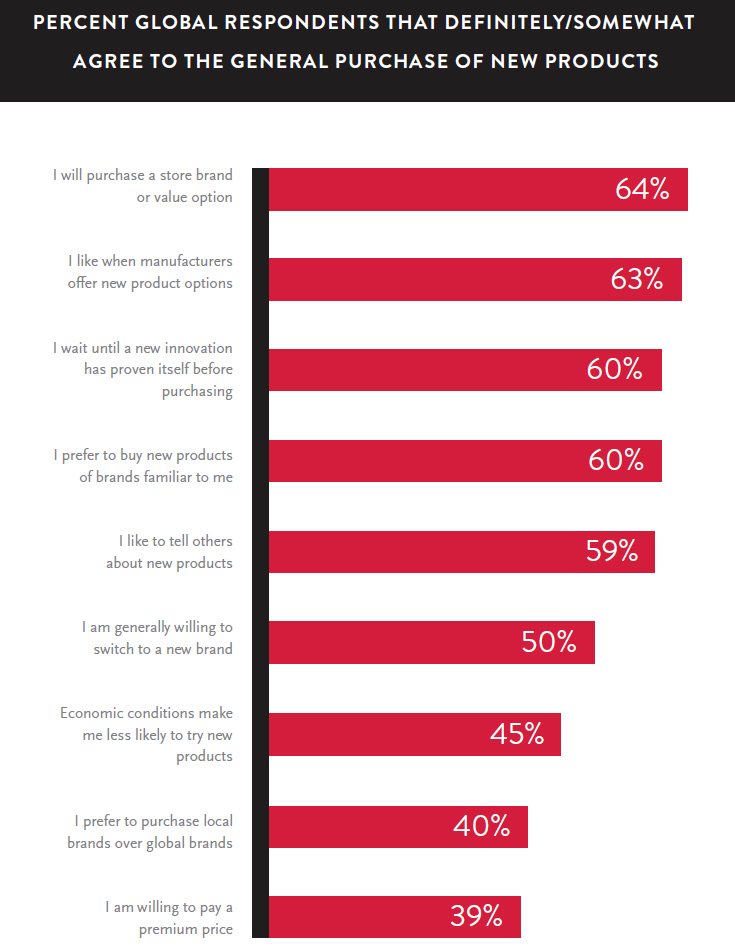

Pic.: Percent global respondents that definitely/somewhat agree to the general purchase of new products, from Nielsen’s survey (click to enlarge)

According to the survey, 50% of global respondents (57% in North America and the Middle East/Africa, 56% in Europe and 47% in Latin America) are in fact ready to switch to a new product. With this, two-thirds (60%) don’t want to purchase the product until “a new innovation has proven itself.” 64% of contributors confess “they would consider value or store-brand options.” The economic issue is also a big factor here—45% of respondents say that they are likely not to try a new brand’s products, explaining their choice by economic turbulence. Still, 39% of surveyed consumers confess they would consider “paying a premium price” for a totally new product on the shelf.

Forty percent of global respondents tend to buy local products. In North America, 47% of contributors say they prefer local options, while 26% of Asia-Pacific respondents (more than in other regions) marked their willingness to buy global brands products over local alternatives. As to the source of the new information, 77% of respondents say that feedback on the new product from family and friends influences their purchasing decisions most. The word-of-mouth advices are followed by Internet searching (67%) and traditional television advertising (59%). Internet helps make purchasing decisions in most consumer product fields—for food and beverages (62%), personal hygiene categories (62%), personal health/over-the-counter medicines (61%), and hair care categories (60%).

“There is no one-size-fits-all approach to successfully developing and marketing a compelling new product,” said Wengel. “By focusing on unmet needs, creating a distinct solution, and developing a market-ready offer, marketers and manufacturers will create the best opportunity to ensure their product delivers on core demand insight and is ultimately adopted by consumers. However, ensuring consumers are aware of the product and can find it on store shelves is just as critical as coming up with that winning new product idea.”

See more infographics in the PDF-version of the report (download it here).