Anti-energy Drinks

Since the start of the pandemic, stress levels have skyrocketed, and people are more likely to prefer drinks and foods that offer psychological well-being. Consumers are aware of the importance of mental health and seek to self-optimize. If in 2019 more than 52 million users all over the world downloaded meditation apps, then in 2020 there were almost 4 times more of them. In the US alone, the market for meditation and peace of mind products is worth more than $2 billion.

Beverage makers have responded to requests with a new subcategory of mind-chills designed to calm the mind and find balance. Almost all of the new products that we will discuss later are the antithesis of stress, known as «eustress», or a positive form of stress.

These functional products should not only give consumers focus and peace of mind, but allow them to remain energetic and efficient so that they can tackle everyday challenges.

Perhaps such a USP seems a little confusing, so let’s figure it out with examples.

Created in Canada, The Mind Cooler by Slow Cow is referred to as «peace of mind in the bank”. The novelty is «an icy infusion of botanical extracts flavored with dragon fruit (pitahaya) and citrus fruits to create the perfect drink for relaxation and tranquility, while maintaining a clear and focused mind.»

The anti-energy drink has been a huge success in Canada and Scandinavia and is now available in the UK, “helping Britons stay calm and withstand the stresses of everyday life,” the brand says. The product helps to lead a stress-free life and even improves mood — this is necessary at any time, especially now, which opens up great opportunities for alternative energy drinks.

Slow Cow’s Mind Cooler is free of calories and caffeine, preservatives, sugar and taurine, allowing anyone to enjoy it as part of a healthy and balanced lifestyle. The product contains six key plant-based ingredients: L-theanine, chamomile, valerian, passionflower, linden and hops.

Available in the corporate online store.

Noa Relaxation is a brand of relaxing RTD drinks from Sweden. Created to reduce stress using all-natural ingredients blended with tea, one of the most relaxing and healthy drinks in the world.

The first includes unusual combinations such as Elderberry and Rhubarb, Apple and Gooseberry, and Blueberry and Birch Sap. Each of the drinks can be easily distinguished by their color, as well as botanical illustrations of the ingredients on the bottle caps, which can be used as glasses if desired.

The British company OHMG Brands has released a contender for the leadership in the category of «drinks for relaxation». Each 330 ml can of OHMG Magnesium Water provides 15% of the RDA for magnesium — about the same as in an avocado.

The range of zero-calorie still and carbonated drinks, with bioavailable magnesium that regulates more than 300 functions in the human body, without sugar and sweeteners, includes three flavor combinations: raspberry and lemon balm + L-theanine, peach and rosemary + ashwagandha and black currant and echinacea + vitamin C. Functional novelties help relieve fatigue and fatigue and regulate the nervous system, improving cognitive and psychological balance, the manufacturer promises.

In the trio of Moment botanical drinks (Tulsi Lemon, Rooibos Blood Orange and Hibiscus Dragon Fruit), adaptogens and nootropics play a central role in the calming and functional benefits. However, in marketing, they faded into the background.

The company’s proprietary blend of ingredients includes ashwagandha, L-theanine and other botanicals that have been used in many cultures for millennia. However, Chottany continues, many Americans are not familiar with these ingredients or their historical uses. Therefore, education is a key component of Moment Marketing.

Customer relations are primarily focused on the overall experience of the product. Starting with the incredibly pleasant tactile sensitivity of the packaging and the Moment consumer club, with the SMS urging consumers to “find time to recharge with a drink before rushing into battle again”. The Moment philosophy is to create a gateway to the opening of awareness and detachment from noise, and the consumption of the product is a ritual «held in the afternoon.»

For consumers looking to delve deeper, the brand’s website explains that L-theanine comes from green tea and boosts alpha brain waves to reduce stress and improve mental clarity, «the same as meditation.» As part of ashwagandha, it supports cognitive functions in the brain, reduces cortisol levels and helps fight stress.

The idea of meditation and botanicals to support mental and physical well-being has gone into collaboration with Victoria Secret to launch Moment Pink, the proceeds of which will go to support non-profit organizations that help Americans maintain mental well-being.

An interesting case from GT Living Foods, a kombucha manufacturer and # 1 selling brand in the United States — ALIVE Ancient Mushroom Elixir line of adaptogenic teas, inspired by Ayurvedic medicine.

An infusion of reishi, chaga and tinder fungus, combined with invigorating leaf teas and a little raw apple cider vinegar, infused with live probiotics and plant extracts. The result is a light, refreshing drink that helps support the body’s ability to deal with stress.

The new product is available for sale at Whole Foods, Wallmart, specialized natural food stores, and Amazon.

Driftwell — this is what PepsiCo’s product looks like in the “relaxing segment” of functional drinks. With its sugar-free product containing 200 mg of L-theanine, 10% of the daily value of magnesium and zero calories, the global leader not only claims to be 55% of Americans who experience regular stress during the day, but is swung at 45% of consumers who cannot falling asleep due to constant stress.

This is where the beverage giant has great opportunities. Because anything that helps consumers sleep better could be the next blue ocean that all manufacturers dream of. In the context of the expected economic recession, the innovation sub-segment may become perhaps the most promising in the next one and a half to two years.

This does not mean that the era of classic functional drinks has come to an end. Although they also change.

Hard Kombucha

Kombucha is the main product of the Australian company Bucha of Byron. However, the kombucha maker RTD has gone beyond its traditional clientele to target consumers looking for a more comfortable low-alcohol drink.

The company once produced the Dirty Bucha kombucha brand of spirits. The manufacturer has now brought the Sneaky Bucha Kombucha line to the RTD market.

According to co-founder and general manager of sales and marketing Paul Tansley, the company started out with authentic kombucha to build consumer confidence in Byron Bay, Australia, but creating alcoholic options has always been part of the roadmap. “We wanted to be the first to take the lead in the alcoholic kombucha niche,” admits Tansley. “First of all, we look at our products as a quality cocktail, we mix our kombucha with premium spirits for the second stage of fermentation.”

With beer Sneaky Bucha, the company is still researching the market, this is the company’s first such product in the hard kombucha category, in which the manufacturer pioneered in Australia. The production uses a mix of the original Kombucha with different beer styles (Summer, XPA and Lager).

According to technological regulations, the strength of classic kombucha must remain below 0.5% in order to adhere to state standards for alcoholic beverages. However, the company decided to move to the category of alcoholic beverages in compliance with traditional restrictions and regulations, meeting labeling requirements and adhering to advertising standards, with a mandatory statement of harm to health and other restrictions on promotion.

This was the reason for the price difference. Back in the day, their 4x 330ml Dirty Bucha glass bottles could be purchased for a retail price of $ 17.08 (AU $ 22). Sneaky Bucha has a retail price of $ 13.97 (AU $ 18) for a 4-pack of 4 330 ml cans as spirits are taxed higher in Australia than beer. The brand’s products are available at BWS and Dan Murphy stores across the country.

The company was contemplating bringing Sneaky Bucha to the Singapore market, where it now displays its classic kombucha in food service outlets, and was also testing sales in Thailand and Hong Kong when COVID-19 erupted and international expansion was halted.

Pinned hopes on the North American market AB InBev. With his Kombrewcha brand, the beer industry leader hoped to take his place on the “healthy spirits” shelf.

While cooking kombucha usually involves minimizing the amount of naturally occurring alcohol in the beverage after fermentation, Kombrewcha has instead sought to increase the alcohol content. Until 2019, the strength was 3.2%, but then the brand, which is part of the AB InBev ZX Ventures accelerator portfolio, announced an increase in alcohol content to 4.4%.

This put Kombrewcha on a par with beer, pushing it into the alcoholic beverage field. At the same time, a 330 ml can contained 120 calories, 7 g of sugar and was gluten-free (for comparison, Bud Light with a strength of 4.2% contains 151 calories, and of 5% vol. — 145 calories).

Kombrewcha is based in Brooklyn, NY and has billed itself as «the world’s first hard kombucha». The drinks are made with organic ingredients that comply with fair trade principles.

In New York, key partners are Whole Foods and Trader Joes. In addition, Kombrewcha is available in Portland and Seattle at Whole Foods, Total Wine, Safeway, Albertsons, QFC and Fred Meyer, as well as specialty natural food retailers. After undergoing rebranding, the 6-can pack retailed for $11.99.

Let’s wrap up our review of Kombucha 2.0 with new additions from local brand Bambucha from San Diego, California. The company was included in our review for a reason. This year, she brought new flavors to market with her line of organic kombucha with spirits, which hit the market in 2017, making the Californian brand the parent of the category.

3 new SKUs — with the aroma of tropical guava, blueberry with vanilla and Hawaiian hibiscus, added to the line, which also contains exotic tastes of Thai ginger (classic lemon-ginger aroma, only lemongrass and lime leaves are used instead of lemon, which gives a more sophisticated taste), punch from guava with tropical notes of guava and pineapple, languid aroma of rose with hibiscus sourness, mango masala, which combines mango, lime, ginger and cayenne pepper to create something sweet and spicy with a pungent kombucha aftertaste. And one more SKU with blueberry pie flavor.

Each can of vegan and gluten-free is 6% ABV and contains only 140 calories and 6 grams of sugar. USDA Organic Certified.

The segment players expect that the aura of health around the kombucha will help it appeal to consumers who prefer alcoholic beverages, but at the same time take care of their health. Typically, the marketing of these manufacturers does not focus on teetotalers. Not obsessed with healthy lifestyle, fans of the brand from 20 to 30 years old are themselves looking for alternative options for low-alcohol drinks on the shelves. And the fact that they are also useful gives them more weight.

Interest in hard kombucha is growing gradually, but it perfectly reflects the changing trends in the consumption of alcohol and functional drinks — in fact, «blurring the boundaries» between them. The dynamics of the industry are indeed changing.

Second Breath of Juices

2020 has shown that consumers are returning to juice. The growth of the category of juice-containing products has been observed for the first time in a five-year period, if not longer. And the explanation is simple — people have reoriented to drinks that are better at preventing disease and maintaining health and performance during quarantine. Among such beverages were juices that have learned to benefit from consumers’ desire for health.

It would seem that you can tell about a category that has not changed for centuries? However, bold discoveries are taking place here. Today any juice is a miracle. A useful category, like a sponge, absorbs ideas from related segments, and becomes even more functional for consumers who are fixated on their own health.

Most people associate the word «probiotic» with yogurt or kombucha. But the oldest juice brand, Tropicana, took it a step further and introduced a delicious, nutritious and healthy probiotic juice to the market. The Tropicana Essentials line promises a billion active cultures in every serving. New in three flavors (peach passionfruit, pineapple, mango and strawberry-banana), fortified with plenty of vitamin C and free of any traces of sugar, artificial preservatives or flavors.

“We are delighted to be the first to bring probiotics to the juice category,” said Bjorn Bernemann, vice president and general manager of Tropicana North America. “As a brand driven by innovation, Tropicana is committed to driving significant innovation in the rapidly evolving health and wellness beverage industry.”

More importantly, the brand has diversified its use of ingredients to create a truly unique product line. Having once opened up orange juice to Americans, 70 years later, probiotic novelty Tropicana has become a delicious and convenient new way for consumers to include more probiotics in their daily diet, greatly expanding the prospects for orange juice, the market for which is waiting for strong turmoil.

Despite the fact that according to the US Department of Agriculture (USDA), the production of orange juice in the world in the season 2020/21 will increase by 13% and reach 1.6 million tons, in the USA production will decrease by 18%. In addition, orange juice futures predict a rise in prices, which will certainly affect retail prices. This happens as a result of a decrease in crop volumes in the country, as well as a disruption in supply chains — the direct impact of the pandemic on the industry.

The agency predicts that in Brazil, orange juice production in 2020/2021 will increase by 12% to 1 million tons (Brazil is the world’s main producer of orange juice), as well as an increase in the export of juice products from Mexico (TOP-3 producers) offset the decline in the United States.

Orange juice production in the EU will increase by 24% due to the increase in the volume of fruit for processing in Italy and Spain. For the EU, Brazil will also remain the main exporting country. But the growth in consumption, first of all, will increase in connection with the interest of consumers in products containing vitamin C. This trend has given manufacturers a powerful impetus for development.

New Zealand functional drinks brand ’73 citrus has launched its first product — carbonated orange juice with liposomal vitamin C to boost immunity.

This healthy product is not made from concentrated orange juice — the main form of raw material for the production of many ready-to-drink juices from oranges (RTDs), but from liposomal vitamin C, which is longer than the usual vitamin C found in the digestive system and therefore is absorbed twice as much.

The idea for this product came about two years ago when the owners of the Woodlands farm in Gisborne, New Zealand wanted to expand their orange business. The family-owned farm has been growing oranges since 1973 and supplying them to wholesalers, who then sell them to supermarkets and restaurants, and in small quantities for export.

Even though oranges are constantly growing in New Zealand, people only drink orange juice for breakfast a couple of times a week. Music festivals made life easier for producers (at popular music festivals like Rhythm&Vines or Splore, you can sell up to 5,000 liters of orange juice in three days), but the ban on public events required the introduction of technological innovations.

The farm turned to innovating technologist James Crowe (now Crowe co-founder and managing director of ’73 Citrus) to help grow the business. And he came up with carbonated orange juice with liposomal vitamin C, used for decades by New Zealanders to support immunity.

Actually, the technology itself is not new; it has been used in the food industry around the world for a long time. “It’s just that no one has ever used it in a drink,” says Crowe. “We were looking for different ways to turn oranges into a product that was interesting and different from others.” And the company succeeded.

Each can of ’73 citrus (330 ml) contains 1165 mg of Vitamin C, of which 1000 mg is Liposomal Vitamin C and the rest comes naturally from orange juice. The company uses non-GMO soy lecithin, which encapsulates vitamin C into carbonated juice and pasteurized to provide a 12-month shelf life.

“Traditional vitamin C passes through the body too quickly to be absorbed. But if it is inside the oil, your body treats it like food, so it is digested more slowly,” Crow states the USP of his product.

Sparkling ’73 citrus is currently on sale in the company’s online store. In retail, the product can be purchased at several cafes and restaurants in New Zealand, as well as health food stores such as Farro, Four Candles and others. The company is also in talks with supermarket chains in Australia and Singapore, other potential markets for functional juice.

The history of this innovative Pacha de Cacao juice from cocoa pulp began in 2017. In the Ecuadorian province of Esmeraldas, Marica van Santvoort became familiar with the process of making chocolate, noticing the enormous waste of cocoa pulp that usually goes to waste.

Cocoa juice is the biggest secret among farmers in Ecuador. The sweet pulp of pachamama cocoa beans — «Mother Earth» in Inca mythology, is extremely rich in vitamins and nutrients. In appearance, it resembles a white lychee-type pulp. Local farmers eat small amounts of it, providing themselves with a natural boost of energy.

After 3 years of development, van Santvoort introduced an innovative novelty to the world market in 2020 — a 100% natural and nutritious juice-containing product made from a hitherto neglected part of the cocoa fruit, in the best traditions of the circular economy and the upcycled foods trend, which we talked about in our special report.

“Through Pacha de Cacao, we bring to the fore the ancient farming traditions of cocoa processing, creating a product full of limitless energy,” says van Santworth. “We pride ourselves on being one of the first in this market and our product has a unique value proposition that attracts a growing group of health conscious consumers.”

The company wants to present cocoa in a positive light, celebrating its South American origins, its role in nature and its health benefits, bringing a fresh perspective to a very traditional industry, and fighting challenges such as deforestation, slavery and child labor.

By 2030, Pacha plans to become a global brand known for its innovative and high quality products that generate higher incomes for cocoa farmers.

Hemp Bursts of Curiosity

Functional drinks today most clearly embody the concept of 21st century products: tasty and convenient products for health and wellness. Since the release of the first energy drink Lipovitan (known in some countries as Livita or Libogen) in accordance with this concept in 1962 by the Japanese company Taisho Pharmaceutical, functional drinks are now targeted at the widest range of consumers and are in demand all over the world.

Although the leaders are still Japan, North America and Western Europe, manufacturers around the world are actively expanding their competencies in this direction. More than 8.3 thousand new beverages are launched on the market annually — this is one of the most knowledge-intensive segments in the entire food industry. The share of functional drinks in the segment of non-alcoholic drinks has exceeded 11%, and the volume of the world market for fortified and functional drinks is estimated at $43 billion.

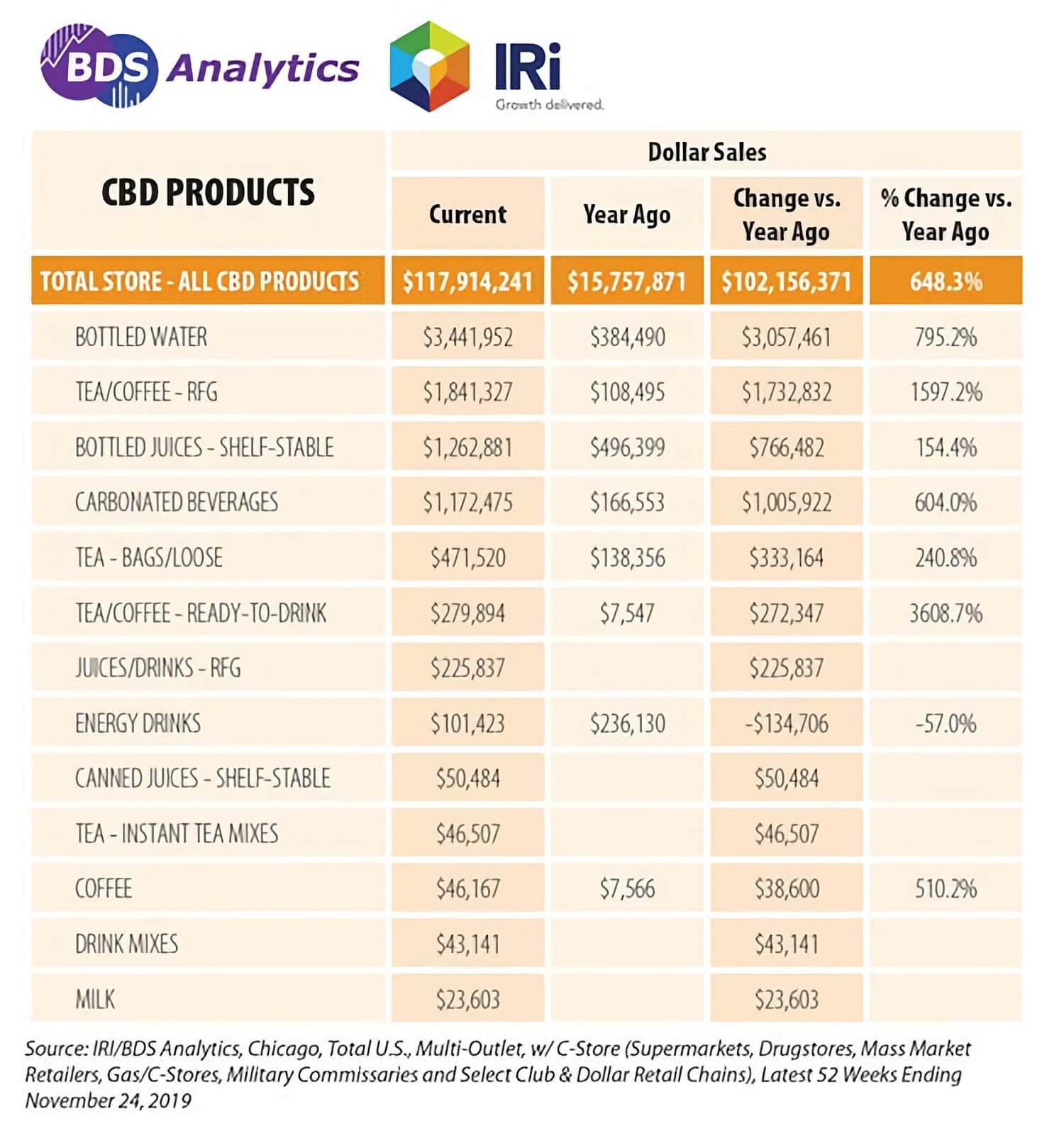

If until recently it seemed that everything had already been invented, the 2018 Agriculture Act in the United States opened the door for a unique innovative segment — drinks with cannabidiol (CBD), the non-narcotic component of cannabis. The global market for cannabidiol products is expected to reach $ 47 billion by the end of 2025, according to BDS Analytics forecasts ($ 20 billion in 2020).

The optimistic outlook is fueling investor interest. The market is saturated with money, which makes it one of the most promising investment areas for a long time.

The avalanche growth in the CBD product market in North America is forcing players to adjust their product strategies. The priority for industry giants and young startups today is to meet the rapidly evolving needs of cannabis consumers.

Truss Beverage Co introduced six new CBD drinks in the 2020/2021 season. Having sold more than two million units of its functional drinks by the beginning of 2021, the manufacturer has taken a leading position in the category with a market share of 43%. The brand believes that there are no signs of slowing down in this category and expects it to continue to grow until the end of 2021 and looks positively into the next year.

Molson launched their brands (in partnership with Truss launched a line of CBD-based drinks in Canada in 2020), Constellation Brands (manufacturer of the Quatreau brand, with 20 mg of CBD, which is prized for its soothing and healing properties) and others.

Shankman & Associates Inc., a major online shopping broker in partnership with non-alcoholic beverage company Centr Brands Corp., recently launched its first product, a carbonated low-calorie CBD beverage.

C-store chains, which account for 60% to 80% of the US retail market, are launching their brands. For example, C Yesway, a chain of stores owned by BW Gas & Convenience LLC in Fort Worth, Texas, announced in November that it is adding four CBD brands to its stores: Kill Cliff, Defy, Weller and CBD Living Sparkling Water. And retailer United Pacific, Long Beach, California, has included RTD CBD drinks in 350 of its c-stores in partnership with KushCo Holdings Inc.

Eat Beyond Global Holdings, which acquired many alternative protein brands last year (portfolio includes protein brands such as Eat Just Inc., Above Food, Nabati Foods and more), has invested in a Canadian soda brand infused with hemp and adaptogens Daydream Drinks.

Since its launch in late 2019, Daydream has seen a 550% increase in 2020. Encouraging forecasts show that the brand will again show three-digit growth by the end of 2021. By the end of this year, Daydream will be available in 1,000 retail stores, which means a 2,300% increase in sales. On the website, consumers can purchase 8 or 12 pack samples of the brand’s three flavors for $ 33.99 and $ 62.99, respectively.

The shift in consumer behavior has led to the emergence of a new sub-segment of decaffeinated functional drinks, which have soothing and stress-relieving effects from herbal ingredients.