Since 2000, milk consumption per capita has been declining in many markets. According to the Economic Research Service of the USDA, dairy consumption per capita in North America was down 22% by 2019.

Consumers are choosing plant-based alternatives, considering them to be a healthier replacement for classic milk. And right up until the start of the pandemic, the rise of plant-based alternatives was a key factor that was changing the balance of power in the dairy sector.

We talked about this global trend, which opens up special opportunities for players in the article «Dairy-free milk innovations» (link). This is a profound shift in consumer behavior that has had a profound impact on the industry. But it’s not the only one.

In addition to switching to plant-based milk replacements, consumers stopped drinking milk due to lactose intolerance. Some consumers, who are particularly concerned about their health, have completely stopped consuming dairy products due to the presence of hormones and antibiotics used in milk production. High fat content in milk may also be one of the reasons.

The pandemic has changed this trend. Against the background of quarantine restrictions, the level of consumption of dairy products in the world increased by 5.5 million tons compared to 2019, which allowed the dairy industry as a whole to end 2020 on a positive note.

The «second life» of milk began thanks to the invaluable ability of whole milk to strengthen the immune system. Since the beginning of the epidemic, this has been the main demand of consumers focused on their own health. Turned out that there is enough room for innovations in the segment [which, in a rather conservative industry, did not «reach» their hands in the pre-pandemic time].

Take the revolutionary patented ingredient IDP (Immune Defense Proteins) of the New Zealand company Quantec alone. Derived from fresh pasteurized New Zealand milk, the component contains over 50 natural bioactive milk proteins that are effective against influenza virus. Independent research has confirmed IDP’s ability to protect cells from COVID-19, reducing the severity of symptoms in people carrying the virus.

IDP isolate has excellent anti-inflammatory, antioxidant and antimicrobial properties. It has proven to be particularly effective as an active ingredient in functional skin care products and nutritional supplements due to its ability to act on the skin, mouth and intestinal surface.

With this conclusion, Quantec’s lines of immune-boosting supplements Milkamune, and Epiology’s skincare brand, which uses IDP to prevent the spread of acne-causing bacteria, are becoming famous.

Laitap’s most popular food products are in powder sachets, protein drinks and chewable tablets, one of the main dairy markets in China.

Laitap’s most popular food products are in powder sachets, protein drinks and chewable tablets, one of the main dairy markets in China.

Milk reappears in a new consumer basket. Since the early calls for social distancing began and despite the disruptions in supply chains in some regions at the time of a hard lockdown, the volume of consumption and production of dairy products in all categories has been growing throughout 2020, analysts from the research company GIRA noted. Since the beginning of the coronavirus epidemic in the United States, milk sales have increased by 47.5%, yogurt — by 21.5%, cream — by 43%.

While this increased demand was not enough to compensate for the loss of milk sales in the foodservice segment, according to the American Federation of Farmers’ Bureaux, lockdown affected the industry in a rather positive way.

Aggregate demand for dairy products across all categories has grown in many other global markets, including Italy, France and the UK. By subcategory, sales of chilled skim/low-fat milk and whole milk increased by 46.7% and 47.2%, respectively.

We tell you about trends and new trends that market participants should follow, which we have noticed in the dairy segment. Teaser: dairy products are returning to consumer baskets, but the categories in the segment are blurring.

Yogurts Saving the Market

One of the drivers in the segment is the yoghurt category. Many consumers associate yoghurts with an immune-boosting product. They began to buy more of them precisely during the pandemic. That, on the one hand, supported the dairy sector, and on the other hand, gave producers a lot of opportunities for differentiation.

According to forecasts of GIRA analysts, yoghurt production will be increasing by 2.1% annually in the next five years. For comparison, milk production will grow by 0.6%, cheese — by 1.3%.

In turn, the increase in consumption and production of cheese means that the amount of whey, which is a by-product of cheese-making enterprises, will also increase, which will provide a huge increase in production in the sports nutrition segment. So in 2020, more than 70% of products in this sector were produced on the basis of whey concentrate and isolate. GIRA estimates that this category will grow by over 2% annually.

We opted for brands that relied on innovative packaging. Modern competition takes place at the level of functional convenience for the consumer, combined with a wow effect. This opens up excellent opportunities for companies to break through the segment.

Produced by Erenstråhle & Wågnert in Sweden, the Yollibox brand packaging resembles a cardboard box of food from a Chinese take-out restaurant. An unconventional move allowed the manufacturer to make his product not only tasty, but also as mobile as take-away coffee. In the line of frozen yoghurt dessert made with 70% natural ingredients, 4SKU: natural tart, chocolate, mango, and strawberry.

The packaging is a bit more than a year old, but it has become so popular in the Swedish market that in 2018 the manufacturer decided to repeat its success by launching a new line of Hey CoCo ice cream! absolutely in the same boxes.

Austrian dairy company SalzburgMilch paid their attention to disposable yogurt and sour cream lids, which are a major source of plastic waste, and came up with an environmentally friendly and hassle-free alternative. The plastic lids on the 500-gram cans of SalzburgMilch yogurt have been replaced with reusable ones that can be washed in the dishwasher and then reused to preserve fresh dairy products.

When, ultimately, injection molded and IML labeled new lids made from polypropylene (PP) have to be disposed of, they are completely recyclable.

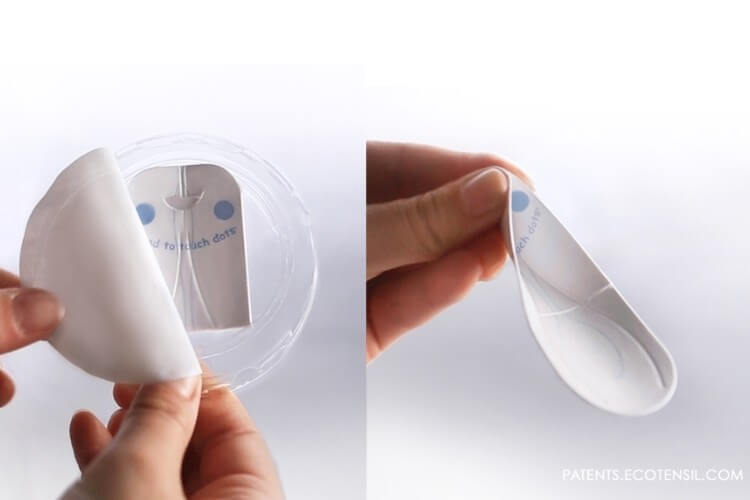

EcoTensil, a California-based eco-friendly paperboard manufacturer, has launched its innovative GreenDot line of foldable multi-purpose paper tableware for the European market to replace the plastic spoons found in yogurt lids or trays of many other products. The eco-friendly novelty is made from a material similar to that from which coffee glasses are made. The material is plastic-free, completely recyclable, and apart from yoghurt or desserts, it is also suitable for foods that need to be taken out and sliced, like cakes, salads and more. Unlike wooden spoons, GreenDot has no aftertaste.

The decision came exactly on the eve of the adoption of European legislation banning the use of disposable plastic items, such as cutlery, plates and straws – in July 2021.

Each cup of Tillamook Creamery Collection yogurt contains two flavors in one jar, which can be eaten separately or mixed for full flavor. The product got into our review not because of the 13 g of protein and only 9-10 g of sugar per serving, but because of its reusable glass jar with a lid — the dream of every thrifty housewife. The company effectively beat the eco trend by completely abandoning plastic.

And the eco-theme works. Companies that rely on sustainability in their sustainability programs get more benefits. GIRA research shows that 55% of consumers are willing to pay more for the products of companies that respect the environment. Moreover, 41% of respondents indicated that concerns about the environment and safety of goods have increased during the pandemic.

For the dairy industry, this trend means increased consumer interest in companies that keep cows free to graze, produce organic goods and maintain high standards of animal care.

Stop the Decrease

How should the dairy industry react to prevent a pre-pandemic decrease in sales after the end of the epidemic?

Some manufacturers are trying to develop premium products such as milk fortified with calcium, omega-3, reduce calories, or fortify their products with protein. For example, the Fairlife brand. Dairy products were viewed by Coca-Cola (the Fairlife brand owned by the beverage giant) as one of the most profitable categories for high value-added beverages.

Other companies are betting on zero allergens and benefits by producing lactose-free dairy products or more digestive A2 milk.

Dairy companies should also take a closer look and follow the lead of Dean Foods and Danone by investing in plant-based companies (Good Karma Foods, Whitewave).

PART II