New Products Overview

Fairlife launches the Good Moo’d line of ultrafiltered lactose-free milk, which contains very little sugar and less protein than the regular Fairlife line. The manufacturer confidently declares that it has presented the most «affordable option on the market, which tastes as good as ordinary milk.»

The Coca-Cola-backed Fairlife premium brand uses patented filtration technology to separate milk into water, fat, protein, vitamins and minerals, and lactose (milk sugar). The manufacturer then recombines them in varying proportions to produce lactose-free milk, which has 50% more protein, 30% more calcium and 50% less sugar than regular milk.

Since its global launch in the US in December 2014, the Fairlife brand has grown faster than the manufacturer’s other products. At the same time, the fact that the price of Fairlife is almost twice as expensive as regular milk is not an obstacle to development in the category. The company’s products are presented in 76,000 retail outlets throughout the country.

The Fairlife brand has gone through a couple of packaging iterations. The first version is on the left, the last is on the far right

According to the brand’s rebranding history, one can also observe trends in packaging design in the US milk market.

With the growth of consumer’s demand for milk, the segment of specialized dairy products received a new impetus for development.

For example, GoodSport line of low-fat dairy products now includes isotonic milk made from lactose-free ultrafiltered deproteinized milk with a natural monk fruit flavor.

Since spring, the new product is available on Amazon.com and the online store ($32 per pack of 12), as well as from select retailers in Chicago. More widespread retail distribution is slated for later this year.

Milk is a natural source of electrolytes and carbohydrates and can be an attractive sports drink in itself, but its texture and protein content, which is slowly digested, is a deterrent for athletes before and during training.

The GoodSport formula provides three times more electrolytes containing sodium, potassium, calcium, chloride, magnesium and phosphorus than all existing sports isotonic drugs. In addition, the product contains 33% less sugar than traditional sports drinks and contains carbohydrates from natural milk sugar (lactose), which is broken down by the lactase enzyme into glucose and galactose, creating a lactose-free drink that well replenishes fluid loss during sports.

The manufacturer has already applied for a patent and will soon see the appearance of a new subcategory of sports drinks with natural milk, which will be easily sold.

Coca-Cola have also indicated their interest in the growing segment of specialized milk drinks for sports. In collaboration with the American company Select Milk Producers, the beverage market leader invests in the Core Power brand of high-protein milkshakes.

The giant’s involvement in Core Power began back in 2012. As part of its nationwide strategy, the company partnered with Fair Oak Farm Brands to «add a shake-up to its distribution network.» Today, such investments are carried out by a specialized division of Coke Venturing & Emerging Brands (VEB). VEB’s primary goal is to find brands with high growth potential in the North American beverage market. And the dairy segment is one of the priorities.

Core Power is marketed as a post-workout revitalizing shake. Manufactured using the patented Fairlife filtration process to remove lactose. Each bottle of Core Power (340 ml) contains a record 26 g of whey protein and casein sourced from natural milk rather than added as a powder as do many other manufacturers in the segment.

After test markets in stores in Arizona, Illinois and Indiana, the brand is sold throughout the United States, competing successfully with PepsiCo’s Gatorade brand (which, incidentally, also ranks the dairy industry as a “key component of its global development strategy”).

Fairlife continues the high protein trend with a line of flavored ultrafiltered milk aimed at the teen market. Brand YUP! boasts 25% less sugar than regular flavored milk.

Initial sales in the East Coast market showed high potential. And now 5 SKUs of naturally flavored skim milk are available throughout the United States.

“Friendly Milk”

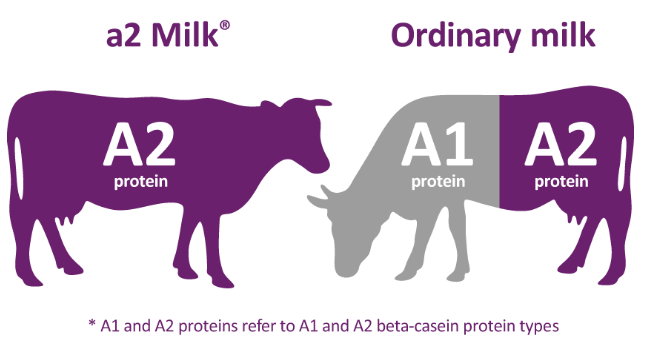

New Zealand’s a2 Milk brand (which holds 10% of the Australian milk market) entered the US West Coast market in 2015 as a dairy product without the A1 beta-casein found in regular milk and causing milk intolerance symptoms in some consumers.

Since 2017, the brand has expanded across the country, initially entering 1,100 Publix stores in the southeast of the country. National distribution was then expanded through retail chains Ahold, Shoprite, Safeway, Fairway Foods and Whole Foods Market, bringing the number of locations to 5,000 stores by the end of 2018.

a2 Milk Chocolate (design from 2018)

In 2018, the brand invested $25 million in a national advertising campaign to raise awareness of its brand in the United States and launched a new product with a chocolate flavor. In the beginning of 2019, the products were presented in more than 6,000 stores in the United States, including Walmart.

That said, the reaction from the dairy industry was «cool at best.» America’s milk players reacted rather negatively to any actions of the first representative of the A2 milk sub-segment in the USA due to the irrational fear that his actions would somehow tarnish ordinary milk.

The history of the A2 sub-segment of milk is worthy of a separate article. Over the past four years, three clinical trials of A2 milk have been published in specialized journals in humans who believed they were lactose (milk sugar) intolerant, while their digestive system was upset due to the presence of beta-casein protein α1 in milk.

The difficulty with the development of the sub-segment is determined by the fact that only 30% of cows give A2 milk. In conventional dairy farms, all milk yield goes to one pool and «regular milk» contains both types of beta-caseins — both α1 and α2. That’s why some consumers who drink it experience discomfort, not because of lactose in it or the presence of milk allergy (both can be determined using diagnostics).

a2 Milk developed a genetic test to identify cows that only produce the beta-casein α2 protein, and then divided the herd into a separate group with a full cycle of strict control on a specially designed production line. This measure made it possible to guarantee the production of high-quality and more «intestinal-friendly» A2 milk — the company’s «trade secret».

While the majority of manufacturers were skeptical about the potential of a2 Milk, calling the α1 protein “only a theory”, consumers «tasted» the product of the New Zealanders. The company grew by 60% annually. And the post-pandemic hype for “stomach-friendly” A2 milk will only spur consumer demand for such products.

If A2 Milk has built its brand on the basis of «healthy for the belly» milk with α2-beta-casein proteins, then the Origin brand from Ohio takes a different approach — the company obtains A2 milk exclusively from Guernsey cows.

The manufacturer does not make any hard claims about A2 milk on the packaging, but instead focused on the fact that its milk comes from local sources, has an incredible taste and a special nutritional profile. Indeed, Origin A2 Guernsey has 5% more milk fat, 12% more protein, 15% more calcium and vitamins A and D than regular milk.

Origin A2 Guernsey milk has a specific yellow tint, which the manufacturer explains as a special high quality of fat content.

The company plans to create a network of farms and milk processors throughout the country to supply and process 100% certified A2 milk from Guernsey cows into dairy products under the Origin brand. Distribution is currently expanding to other markets including New York, Philadelphia and Washington DC through MOM’s Organic Market and The West Side Market, as well as elite HoReCa establishments.

Plant-Based Times

The market for herbal alternatives by 2020 has created serious competition for all major dairy categories. For example, in the sports nutrition sector, over 15% of products were made from plant sources.

Losing its market share, the dairy lobby in the form of the National Milk Producers Federation (NMPF) took the initiative to urge the FDA to enact a food standard for milk that would eliminate the mention of plant-based products.

Federal courts have banned the labeling of plant-based dairy products as milk because any reasonable consumer understands that dairy products do not contain dairy products. It is too early to say how this limitation will affect the segment’s growth.

In terms of plant-based beverage trends, nearly 30% of US consumers now consume plant-based milk on a daily basis. The Plant-Based Dairy International Association (PBFA) notes that despite the popularity of plant-based diets, there has been no significant increase in the percentage of vegans or vegetarians in the population (currently 15%). Consumers are trying plant-based foods and beverages in a flexible diet, which may help explain this shift in consumption in part.

We talked in detail about innovations in the vegetable milk segment in the article «Dairy-free Milk Innovations».

In addition to soy, rice, coconut and almonds, the category of plant-based alternative milk drinks has expanded with nut and bean-based products to include varieties made with cashews, hazelnuts, macadamia, peas, peanuts and pecans. In addition, non-dairy milk is made from bananas, barley, cassava, flax, hemp, oats, potatoes, and quinoa.

One recent discovery is the Chiamilk alternative dairy product from the Mamma Chia brand, naturally derived from chia seeds. This is a great demonstration of how you can differentiate yourself from competitors in a segment.

And from the moment the world’s largest milk producers began to take an interest in and invest in the vegetable sector. This category will only grow, say analysts at GIRA. In order for the dairy sector to maintain its market, it will need more innovative products.

Artificial Intelligence in the Dairy Industry

Let’s have a look at the story about technological innovations.

Santiago-based NotCo has received a first-of-its-kind US patent for artificial intelligence technology that management claims gives it a clear edge in molecularly re-creating next-generation dairy alternatives. The resulting patent is one of a set of patents filed by the company (the rest are pending).

The main product of the company is the NotMilk line, consisting of alternative milk and 2% skimmed plant milk, made on the basis of pea protein, fortified with vitamin B12 and vitamin D2. The nutritional value of the 2% new product (240 ml pack) is 4 g protein, 3 g fiber, 3 g sugar, and only 90 calories. (By comparison, a 240ml serving of Lucerne Farms 2% Dairy Milk contains 10g protein, 0g fiber, 14g sugar, and 140 calories.)

NotCo debuted in the United States with NotMilk in late 2020 at Whole Foods. Within two months — in a record short time — the company secured wide distribution throughout the country by penetrating Sprouts, Wegmans and entering into agreements with other national retailers. All of this should ensure that the brand has access to more than 5,000 U.S. households by the end of 2021.

NotCo currently has offices in New York (16 people) and San Francisco (where the development team is based). The owners hired top executives from Coca-Cola and Danone to support their expansion plans across the country and around the world — today NotCo employs more than 250 people around the world.

The company is not the only one to develop AI-powered food products, but is a leader in the dairy segment, focusing on the production of pea protein-based dairy alternatives. The formula used gives NotCo the ability to create herbal products faster and more “precisely” in flavor profile than anyone else in the space.