2021 was a watershed year for the beauty industry. As consumer values and expectations changed, major cosmetics companies and startups were forced to adapt. “Waterless” beauty products and virtual makeup — these are the trends and technologies that will continue to transform the sector in 2022 and beyond.

Cosmetics sales fell 30% in the first half of the year, according to McKinsey. Even the big brands were hit: Coty (owner of CoverGirl and Rimmel) fell 52% in late March, while Ulta Beauty fell 29%, although both have since recovered as the U.S. beauty market is expected to recover and reach the pre-pandemic level in the second half of 2021.

Covid-19 sparked a further decline in interest in categories like makeup, which was already dropping off as consumers had fewer social contacts. Certain areas of beauty, such as skin care, have come into the spotlight as people have looked for ways to relieve stress.

As a result, sustainability and attention to environmental impact has become a driving force for major beauty players seeking to attract the attention of an increasingly informed shopper: some brands such as L’Oréal and Estée Lauder have announced targets to achieve carbon neutrality, while others have begun to innovate in more specific areas such as reusable as well as synthetic cosmetic ingredients.

In this long read, we are taking a look at the latest innovations in all areas of the cosmetics industry and highlight the main industry trends to look out for.

Product development and personalization

While product personalization is not a new trend, beauty brands continue to innovate and refine their techniques to create more personalized formulations for consumers — from matching lip colors to highly personalized hair care.

Many people tackle the personalization challenge with a variety of technologies and approaches, such as surveys that take customer preferences into account and customize products based on the results. Choice of answer is widespread in the growing D2C personalized hair care market, with companies from different regions such as the US (Function of Beauty), India (Bare Anatomy), Japan (Medulla) and others.

Custom-made products, in which companies formulate proposals specifically for each user. MAC Shanghai, for example, produces eyeshadow palettes for customers, while Shespoke has developed software to produce individually blended lipsticks on a large scale.

Home devices that can measure a user’s physiological data, such as the appearance of dark spots on a daily basis. The L’Oréal Perso device takes this data into account for your personalized make-up application every day.

DNA testing kits that enable companies to make product recommendations or create products based on user genes. Allel, for example, analyzes users with a DNA test to suggest skincare products.

Skin care brand Proven, for example, claims to upload consumer data to its AI platform, which contains information on over 100,000 products, over 8 million reviews, 4,000+ scientific publications in order to provide users with the most effective formulation. Atolla is also leveraging artificial intelligence to customize sera for consumers’ faces using data gathered through questionnaires and tests (measuring oil levels, moisture and pH), which are then processed by the company’s algorithm.

Last year, L’Oréal launched Perso, an artificial intelligence device designed to develop and distribute personalized skincare products, lipstick and foundation. The Perso app processes the user’s skin data from uploaded selfies, environmental conditions using location data, and user-entered skin care concerns to distribute custom formulas across the device.

Meanwhile, Johnson & Johnson has developed a variety of personalized skin care systems, from skin scanning devices like the Neutrogena Skin360 to 3D printed face masks using Neutrogena MaskiD technology.

Genomics also plays a big role in personalizing beauty advice.

Companies such as OmeSkin, Allél, Skinshift, and other OmeCare companies offer beauty-focused DNA testing kits that can be used to make product recommendations or create branded, personalized products based on the genomic characteristics of users’ skin.

The promise of personalization is appealing to customers looking to avoid decision fatigue, but the detailed information collected by many brands may raise some concerns — many of the privacy policies of these young consumer cosmetics brands allow them to sell such information to other companies at will.

But the benefits of personalization, including serving those not found in FMCG offerings, will push brands to strike a balance between privacy and innovation for new ideas. Make sure brands continue to develop hyper-personalized offerings to differentiate themselves from the competition and serve consumers more effectively.

NEW Associations Create HUGE Opportunities

Since the launch of Fenty Beauty in 2017, the term “inclusive beauty” has become fashionable in the industry, embracing new demographic markets that are increasingly important to the skin care industry.

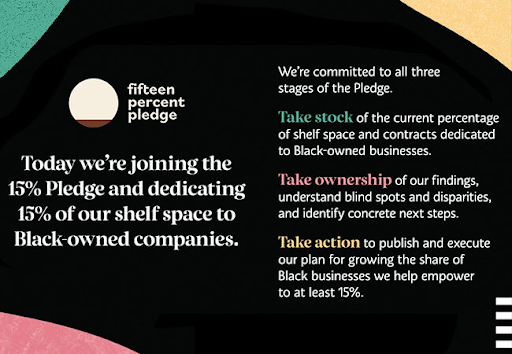

For example, large retailers such as Sephora, Macy’s, and Bluemercury have made a 15 percent commitment — a promise to give 15 percent of shelf space to black-owned businesses. Ulta Beauty also pledged to double the number of Black-owned brands sold by the retailer by the end of 2021, committing more than $25 million to pursue greater diversity.

As this trend continues to gain traction, understanding the difference between “niche” and “underserved” audiences remains critical as there are many demographic groups with untapped potential.

Below we outline some of these markets that are becoming integral to defining the future of inclusive beauty — and this should remain a high priority for brands looking to grow.

Personal Hygiene and Beauty Treatments for Men

Men’s grooming has expanded beyond cleansers, moisturizers and basic hygiene products over the past few decades to include eye creams, face masks, sunscreens, makeup and more.

Most modern brands like Stryx, Shakeup Cosmetics, and War Paint are using D2C distribution and updated packaging to appeal to a new generation of male consumers.

Since Unilever acquired Dollar Shave Club in 2016 for $1 billion, the number of mergers and acquisitions for men’s personal care brands has skyrocketed, including:

- in late 2018, P&G acquired Walker & Company Brands, the parent company of beauty and care brands focused on people of color;

- in September 2019, SC Johnson acquired the Oars + Alps menswear brand for $ 20 million;

- Edgwell has announced plans to buy men’s cosmetics brand Cremo for $235 million in August 2021.

In October 2020, it was reported that men’s care company Manscaped is looking into a sale that could cost the company up to $700 million.

D2C brands targeting men’s personal care products such as Bevel, Lumin, Huron, Scotch Porter, Stryx, Hawthorne and others reported growth in 2020, according to WWD. In January 2021, Hims & Hers, which launched as a holistic men’s wellness brand through the addition of hair and skin care products, has since expanded to a female audience. The cost of this company is $1.6 billion.

In Asia, skincare and makeup for men has been a growing trend for many years, and the US has only caught up with it relatively recently, which some attribute to «quarantine boldness».

South Korea is the trendsetter in this category: men in South Korea accounted for a fifth of global spending on men’s skin in 2018, a trend often associated with the rise in popularity of K-pop idols.

In addition, China is one of the fastest growing markets for men’s cosmetics and skin care products. According to Euromonitor, the country’s market for men’s skin care is already more than double that of South Korea and more than triple the size of the US market compared to last year.

Meanwhile, global brands have already presented lines of men’s cosmetics. Chanel launched Boy de Chanel in South Korea for the first time, while Shiseido said its line of men’s cosmetics had double-digit growth amid the pandemic, boosted by Japanese businessmen in their 40s.

Gender Neutral Beauty Products

Gender-neutral makeup lines are the next step towards inclusive beauty as the younger generation breaks down traditional gender norms and stigmas. More than half of Gen Z members believe that gender is non-binar and instead encompasses a whole spectrum.

As a result, brands are releasing beauty products that are not gender specific. Skincare brands from Aesop to Ursa Major and Non Gender Specific have ditched gender marketing in favor of packaging and selling unisex products that target specific skin concerns or conditions. Examples of makeup include Fenty and Milk Makeup, as well as indie startups like Fluide and Jecca Blac.

Skin Color

While there has been a lot of buzz about targeting people of different skin colors more effectively in the beauty industry, there is still a lot to be done.

Beyond Fenty, a number of inclusiveness-focused brands such as Mented Cosmetics, Urban Skin Rx and Live Tinted have partnered with larger retailers such as Ulta Beauty, Target and CVS to distribute their products nationally.

Existing corporations have focused on growing brands founded by people of color to bridge the gap in traditional beauty products. The purchasing power of black consumers is $ 1.3 trillion. The market for dark hair care products is estimated to be $ 2.5 billion.

To enter this huge market, among other things, grants and financial support for the founders of these products have appeared over the past year, including grants from Glossier and L’Oréal for black-owned businesses.

The lack of representation goes beyond basic shades and marketing. Black dermatologists make up only 3% of all specialists in the United States, which has a significant impact on the development of cosmetic products. Darker skin reacts differently to skin conditions such as acne, eczema, and keloids, and is more susceptible to hyperpigmentation due to more melanin. But many products are tested on lighter skin tones, completely ignoring their efficacy on other skin tones.

In November 2020, Unilever-owned Vaseline, together with actress Regina King and startup Hued, launched the Equitable Skincare for All program to offer complementary dermatologist courses and resources for people with different skin types and tones.

Ultimately, brands that can cater to this demographic without oversimplifying the nuanced dynamics of their communities are more likely to succeed in an increasingly saturated beauty market.

Beauty of Different Generations

There are great opportunities to meet the needs of a target group that goes beyond the segment of young people and adults (18-35 years old).

Several brands are working to serve older consumers such as Gen X or baby boomers. In particular, perimenopausal issues are gaining increasing attention in skin care, for example:

AbsoluteJOI is a skincare brand that makes products for women of color. Its founder, Anne Beale, said that its main customer base is women in their 40s and older, and that the skincare company boasts 30% of its loyal customers.

Pause Well-Aging specializes in menopausal skin care products that address perimenopausal issues such as hot flashes, night sweats and skin elasticity.

The State Of Arfa (now Chord) brand also offers products designed to address menopause issues, from cooling spray to hand and joint cream.

In September 2020, Ilia Beauty launched a marketing campaign with women of 20-70 years old.

Cosmetic brands are also expanding their group to babies and children:

Jessica Alba’s «Honest Company», which started out in the childcare industry, recently rose to prominence, raising over $412 million for its debut.

Launched in 2019, the Amyris Pipette brand expanded to Target in February 2021.

Childcare brand Mini Bloom was launched in December 2020.

Luxury skincare brands such as Pai Skincare, Dr. Barbara Sturm and others have expanded their range of baby and child skin care products.

Gen Z brands such as UK-based Plenaire and Bubble are also gaining traction. Meanwhile, existing brands like Chanel, YSL and others are rethinking their product launch and marketing strategies to appeal to younger shoppers.

Social media has become the main way for teenagers to find the trendiest products that suit their needs. TikTok in particular is a huge opportunity for brands to drive viral sales and change consumer preferences.

CeraVe, e.l.f. Cosmetics and The Ordinary have moved up the rankings to become some of the top teen skincare brands over the past year, thanks in large part to famous faces on the platform. For example, sales of Peace Out Skincare patches quadrupled in just 24 hours after they were approved by TikTok skinfluencer Hiram Yarbrough, while another teen’s viral video generated nearly $850,000 in sales for The Ordinary.

The famous tick-toker Hiram Yarbo is depicted against an orange background with a variety of skin care products.

Of course, to get into the hands of teenagers, parents also need to make sure that these products meet a real need and are safe for regular use.

Full ingredient descriptions and non-toxic additives will be critical to the sustainable growth of this category. According to DECA, 80% of teenage girls said they were willing to spend more on «pure» beauty.

Beauty Goes “Globally—local”

K-beauty hit the United States in 2011 when Sephora began selling Korean skincare brand Dr. Jart+. Since then, western buyers have increased their demand for Korean cosmetics: sheet masks and snail creams have become commonplace in beauty stores. Cosmetics exports from Korea grew 15% in 2020, according to the Korea Customs Service and the Korea Cosmetic Association, driven by growing demand from the United States and other Asian countries.

But the beauty boom is not limited to K-beauty; other markets draw attention to their own products, drawing on historical heritage.

This includes Asian beauty markets such as China, which is the boom in virtual beauty with its advanced mobile technologies.

“For example, they understand what is best for Asian skin. They are also quick to grasp current beauty trends that are attracting Chinese consumers and are quick to launch products that take advantage of those trends,” Nanyang University of Technology associate professor Alison Lim told Insider.

C-beauty brands have also used partnerships to expand beyond local markets. Perfect Diary ended its eyeshadow partnership with the Met in 2019 and chose Australian singer Troy Sivan as its ambassador. In November 2020, Perfect Diary debuted a $617 million IPO on the NYSE. Zeesea also launched eyeshadow palettes in collaboration with the British Museum, while Millet Pepper focused on global sales through Amazon.

Other major beauty markets include:

Home to the largest Muslim population in the world, Indonesia offers a booming halal beauty market. Cosmetics and skincare brands such as Base, Esqa and Rosé All Day are examples of Indonesian halal brands targeting this market.

The Indian company Nykaa has raised over $94 million and is reportedly planning to go public at a valuation of $3 billion. India’s beauty market is projected to surpass $20 billion by 2025, driven by a surge in consumer disposable income and increased use of makeup in general.

Major cosmetics companies are also trying to penetrate new markets, especially in South Asia and Africa. L’Oréal is doubling its share in the South Asia Pacific, Middle East and North Africa regions, which it believes will account for the bulk of L’Oréal’s new business over the next decade.

Ultimately, targeting new continents — or even specific country markets — requires hyper-localization, especially as global beauty markets continue to evolve and new trends inspired by heritage gain momentum.

Production and Distribution

SYNTHETIC BEAUTY

Biotechnology is increasingly affecting the production of cosmetic ingredients. Consumers continue to understand that not all synthetic additives are harmful.

In the business arena, the use of farm-created additives leads to potential supply chain instability given the number of suppliers, farms and fisheries that must be involved in the supply, while synthetic ingredients are produced in more controlled environments that can ensure consistency.

“Moreover, the additive manufacturing process in the laboratory reduces “the damaging impacts of agriculture, fisheries, mining, or the involvement of intermediaries that can increase the price and carbon footprint of raw materials extracted from the ground in long global supply chains,’ said the sustainable development consultant and All Earthlings founder Sara Jay in an interview with Coveteur.

Several brands are experimenting with biosynthetic supplements:

Ginkgo BioWorks, which recently announced a $17.5 billion SPAC deal, has created genetically engineered yeast fermentation to produce rose oil with new and unique flavors without using expensive rose petals.

Supplements-as-a-service biotech company Geltor is launching a vegan collagen formulated for use in skin care products.

Startup C16 Biosciences is using the brewing process to create a sustainable alternative to palm oil, rather than using traditional agricultural additives that have been extensively studied for their environmental damage and links to abuse in the world of work.

Vegan skincare brand Biossance creates its own eco-friendly squalene, an ingredient commonly sourced from shark liver.

Beauty conglomerates are also actively developing partnerships in the biotechnology field.

Johnson & Johnson, manufacturer of brands such as Neutrogena and Aveeno, is investing in new preservatives that can be used in products such as hair and body care. The company has invested in Curie Co, a startup that makes biomaterials to replace preservatives in JLABS daily cosmetics and personal care products. L’Oréal has signed an agreement with bacteria company Micreos.

Lab-made additives can become a brand identity in an expanding landscape of natural and sustainable products. In addition, biosynthetic ingredients could mean lower costs for companies in the future, including lower shipping costs, lower supply chain risk, and lower emissions.

The problem of increasing production remains. With plans for rapid growth and strong demand, companies should keep a close eye on quality — new factories can experience disruptions that could jeopardize the final product. As the planet’s resources are depleted, a switch to lab-created additives may arise as needed.

PART II