Plant-based milk is the largest category of alternative dairy products. Its sales reached $ 2.5 billion in 2020, according to SPINS data, up 20% from 2019. We devoted a whole section to the trends in plant-based milk in FMCG in the material “Non-dairy Dairy Innovations”. Today let’s talk about the trends of vegetable and dairy alternatives in the horeca segment.

Milk Life

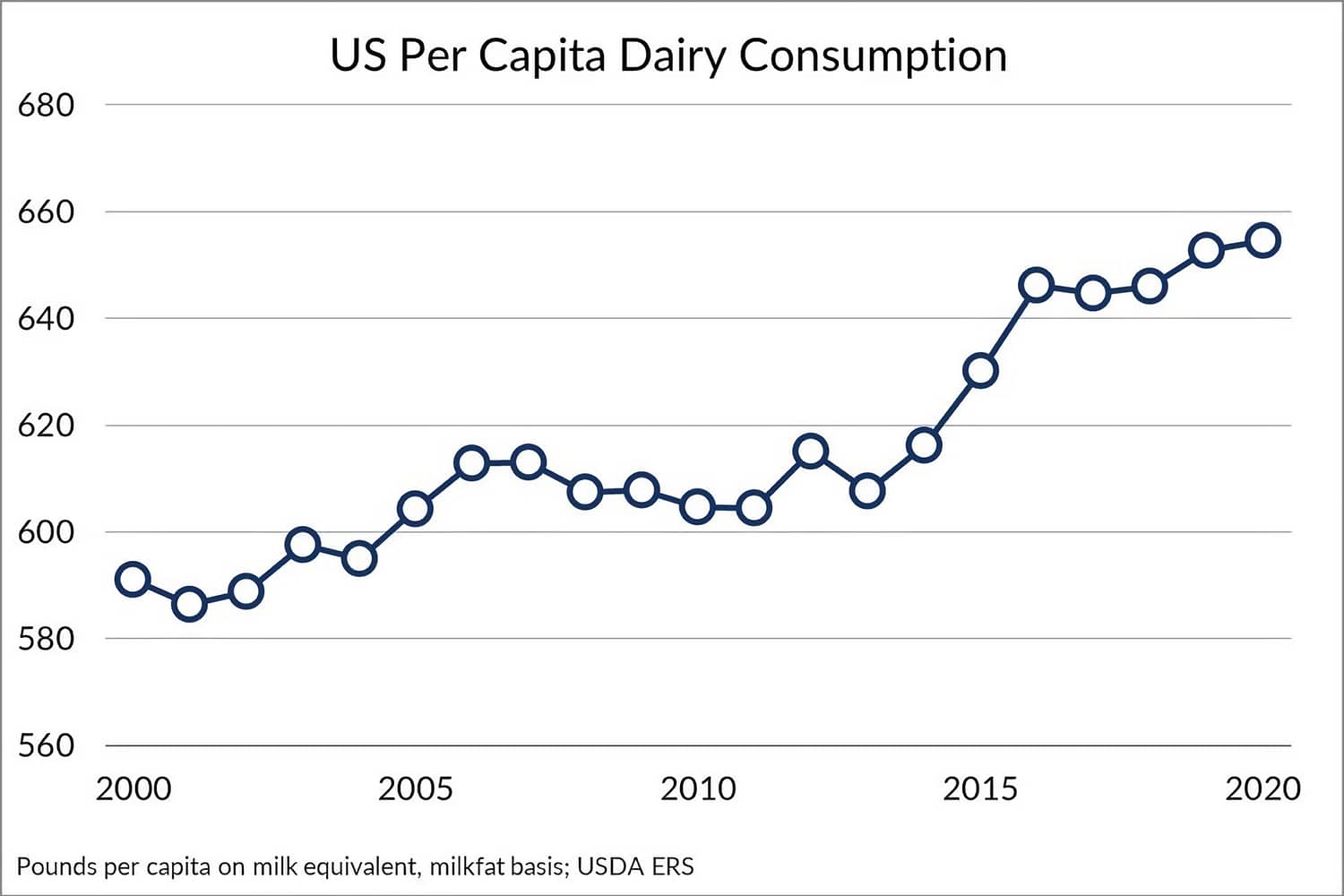

In early October, the United States Department of Agriculture (USDA) released annual data on per capita dairy consumption in America. It turned out that despite the severe turmoil caused by the COVID-19 pandemic, Americans are opting for dairy products again.

Together with information from the USDA’s Economic Research Service (ERS) tracking milk consumption since 1975, the demand picture is clear. Until the 2000s, the average citizen consumed about 237 l/245 kg (539 lb) dairy products annually. In recent years, the category has stagnated, and the consumption of cow’s milk has been decreasing. The sector was supported by growing consumption of cheese, yoghurt and ice cream, as well as other dairy derivatives.

Living in a pandemic has left many people wondering what the term «health» means to them. And to find the answers, they went to grocery stores, making rational choices in favor of healthier foods and drinks. First of all, this is reflected in milk — it is returning to consumer baskets, due to the growing beliefs about its benefits for immunity — the new mantra of the post-pandemic era.

Last year the average American consumed 288 l/297 kg of dairy products (+ 21.5%), and in the first half of 2021 consumption again increased by 1.3 liters per person compared to the same period in 2020, which also reflected the positive shifts in demand for the dairy industry.

“Americans have always treated milk as a nutritious staple in their diet. They also value the versatility of dairy in new, delicious and more affordable products, ”says Michael Dykes, President and CEO of the International Dairy Association (IDFA), Washington.“ But the range of products most sought after by consumers is changing. These days, US residents eat more dairy products than they drink. In addition, they include dairy products in their meals, and they also use them for fitness nutrition, recovery and a healthy lifestyle. »

According to the 52-week sales data released in April 2021 by SPINS for the Good Nutrition Institute (GFI) and the Plant Food Association (PBFA), the largest and most mature segment in the plant-based category is plant-based milk. Its sales reached $ 2.5 billion in 2020.

Today, the penetration of non-dairy milk into permanent US consumption is 39%, up 20% from last year and accounting for 15% of all liquid milk sales (retail sales rose for the first time in years).

The consumer shift towards plant-based alternatives is a major shift affecting the entire dairy sector. “2020 was a breakthrough year for plant-based milk,” said Kyle Gahan, an analyst at the Institute for Good Nutrition. «In 2020, 57% of American families bought plant-based foods, up from 53% in 2019, and plant-based milk is on shelves in nearly 40% of American refrigerators.»

By observing the innovations taking place in the plant milk market and changes in consumer behavior, one can imagine how the dairy industry will develop in the future.

Plant-based Perspectives

Consumers who choose diets without animal meat or cow’s milk open up new opportunities for vegetable producers almost every year. The choice of plants that are used today as the basis for non-dairy alternatives is quite wide. In addition to the already classics of soy milk, oat milk and almond milk, which is the fastest growing newcomer, the segment also includes alternative milk from rice, hazelnut, cashew, pea, flax, hemp and others.

Some analysts include coconut milk on this list, although it is more of a cooking aid than a ready-to-drink beverage. Nevertheless, coconut milk, which attracted consumers, is annually included in the TOP-5 of the popular plant-based milk rating.

Most consumers today are aware of soy milk, which, in fact, was the pioneer in this category. And this is the only segment that has shown negative dynamics in recent years (-0.9% in 2020). Although sales of soy milk increased 2.1% in the last 12 weeks of 2021, bringing the category back to growth for the first time in a decade.

Oat milk is a relative newcomer to the plant-based milk segment in the US. Until recently, oat alternatives were barely recorded in sales data. Nowadays, oat products have become a history of unbridled success in the category: sales are growing by hundreds of percent (according to the results of 2020, the growth was 219.3%), which brought it to second place.

In addition, oats are the best option because they have an advantage over soy and almonds: they are not among the eight allergens listed by the US Food and Drug Administration.

Oat milk that was rare a decade ago has become practically the standard for baristas today and is ubiquitous even in local coffee shops. Oat milk is one of the fastest growing foods in the plant-based milk category.

According to a recent study by Future Market Insights, the global oat milk market is set to grow at a CAGR of 8.2% between 2018 and 2027, underlining consumer demand and close attention to oat milk substitutes from retailers, restaurants and cafes in a wide variety of formats.

Starbucks coffee chain is one of the apologists for plant-based milk in public catering. The world leader in the coffee market introduced soy milk to its North American division back in 1997. Since the 2000s, Starbucks has expanded its offerings of dairy alternatives to its locations around the world, with soy milk on the Starbucks China menu since 2007. In 2015 coconut milk was added to the chain’s assortment, in 2016 — nut and almond milk.

Since 2020, oat milk has become a constant supply for coffee in several regions at once, thanks to a global partnership with the world leader in the market for oat alternatives, Oatly from Sweden. The food service giant claims that up to 20% of consumers in its establishments in the US and almost 49% in China choose plant-based alternatives over their usual milk for coffee.

Data from the US National Institutes of Health (NIH) suggests that about 65% of the world’s population has a reduced ability to digest lactose. When you consider that lactose intolerance in adulthood is most common among people of East Asian descent (according to some estimates, it affects 70% to 100% of people in some communities), the findings of a study by Arizton Advisory & Intelligence, which in a recently published global market survey of dairy alternatives from 2019-2024, highlighted China, Japan, India and Indonesia as the largest markets in the Asia-Pacific region, maximizing the growth of the global quasi-dairy market.

The coffee-optimized version of Oatly Barista, designed for serving hot drinks, is available in over 200 coffee shops in New York City. Not only in early adopters like Starbucks or Intelligentsia — Oatly is found in local chains such as Café Grumpy, Joe Coffee Company and Ninth Street Espresso, and hundreds more with less presence like Sey Coffee, Kaffe 1668, Everyman Espresso, Little Skips and Cafe Integral and others, one level below.

The product has repeatedly been included in various national ratings of coffee lovers. For example, Oatly iKaffe (localized for the Swedish market Oatly Barista Edition) in 2020 in Sweden was named “the best creamy product for coffee”, in comparison with the oat version of Valio Oddlygood Barista from the Finnish manufacturer and the novelty of the Coop Oat segment from the Swedish company Trensums Food AB.

Doug Palace, the CEO of Intelligentsia’s Kilogram Tea, claims that Oatly «brings out the flavor of tea even better than caffeine,» thereby making a default recommendation for adding Oatly Barista to tea drinks.

But most importantly, serious financial support has come to the oat milk category. So Blackstone Growth and other investors like Howard Schultz, the former CEO of Starbucks, and Oprah Winfrey last year invested $200 million in Swedish manufacturer Oatly, thereby stimulating the development of new plant-based products. We can say that today’s producers of oat products are setting the tone for the entire segment of dairy substitutes.

This popularity among consumers is due to the richer creamy taste of oat milk compared to the almond and soy varieties, as well as the soft texture. This makes it a more versatile option as a supplement to drinks — the flavor of the product is still a powerful driver. Its positive sustainable production is also an important factor.

Manufacturers of alternative oat milk for catering today know a lot about modern oat processing technologies in order to successfully solve the problems of «light taste» in their products, bringing the oat taste as close as possible to the authentic profile of classic milk. And, in fact, today’s oat milk has a pleasant sweet taste, and even if there is a small residual oat character, there is no objection from consumers.

Today, soy and oat-based dairy alternatives face intense competition from grain, nut and legume milk made from almonds, cashews, macadamias, rice, peas and hemp — all together and singly competing for the love of consumers.

This opens up excellent opportunities to try various pseudo-dairy products for the latter. Primarily almond-based milk alternatives. Almond has been the fastest growing segment of the vegetable milk market in recent years.

Horeca Sector Replies

As consumer demand for non-dairy milk rises, there has been a marked increase in the supply of plant-based alternatives on the menu. While vegan cafes traditionally offered drinks like soy latte or oat milk, other food service establishments, following leaders like Starbucks, turned the niche market into a trend.

Whereas in the past manufacturers of alternative dairy products were eager to get on the shelves of Costco, Kroger or Target, today for non-dairy milk companies such food chains as Starbucks are welcome partners. Affiliate packaging for cafes and restaurants, increased volumes, assortment and balanced flavor for coffee are the main drivers for meeting the demand of restaurant chains of various sizes, seeking to satisfy the increased interest in plant-based alternatives to coffee. And it is like that all over the world.

The category is growing amid the convergence of two broad general trends: healthier eating (for example, according to an Ipsos survey, more than half of Americans (51%) made the decision to eat healthy on New Year’s Eve 2020), as well as avoiding animal products and a desire to stick to full or part-vegan lifestyle (the vegan community has stated that the number of vegans worldwide has grown by more than 360% over the past decade), in part due to sustainability concerns.

A large group of alternative milk consumers use plant-based alternatives due to lactose intolerance. Some consumers are concerned about the possible use of antibiotics and growth hormones.

Recent data from the NPD Group’s Coffee Consumption Survey shows that in one of the world’s largest coffee markets, the United States, coffee shops (both independent and chain) have been some of the most efficient coffee consumption channels in North America for a long time. After the lifting of the pandemic restrictions, coffee lovers consume almost 1/5 of the servings of coffee in public catering (19%) and 81% drink at home.

The pre-pandemic structure of coffee consumption was even rosier — 27% of coffee portions were consumed from public catering and 73% of portions from home. Although the locks and restrictions have had a significant impact on the structure of coffee demand, for example, Americans have reduced visits to their favorite coffee shops by 6%, analysts believe that it will recover within 1.5 years.

But the demand for plant-based milk alternatives has caused some stir among the classic milk players. For example, Mintel research shows that nearly a quarter of Britons (23%) have preferred plant-based dairy alternatives in the past 12 months. Despite the fact that the UK in the EU is only in third place in terms of milk consumption, behind Germany and France.

But the fact that interest in cowmilk from a cow, first of all, is lost by young consumers 16-24 years old (37% of this age group said that they have reduced their consumption of standard milk in favor of plant-based alternatives), and another 24% of “non-users”, are ready to try alternative milk because of its usefulness, and most importantly — 40% (!) of respondents can pay more for the functionality of the product for the body — a similar situation is observed in all EU countries, which forces the dairy industry mastodons to actively adjust their product strategies.

In turn, catering companies are expanding their “plant-based menus” by targeting these “actively positive” and, most importantly, highly solvent young consumers. And as café and restaurant guests are constantly looking for new ways to personalize their drinks, so are the demands on suppliers for the nuances of flavor expected at horeca from plant-based milk paired with espresso, hot or cold coffee drinks.

The growing segment of non-dairy products in horeca can be roughly divided into two categories: milk, which mixes easily with prepared drinks, and milk, which is more noticeable in coffee.

We have prepared an overview of new product launches in the segment, where possible, trying to accompany each product with a brief summary of its «behavior» in coffee, based on the assessment of monitoring consumer publications in Business Insider, Forbes Livestrong, Shape, and regional magazines, including Sprudge and South China Morning Post.

Our analytics in no way claim to be any plant milk ratings for horeca. We have only selected the most interesting products and, according to the reviews of professionals, the most delicious.

Alternatives Exist

The overwhelming popularity of oat milk has even led to its scarcity in many places around the world, as well as to skyrocketing prices. Luckily for those looking to try this product, there is a wide selection of this product.

Oatly is an undoubted oatmeal leader. The company is closely associated with the oat dairy product category. Catering-oriented Oat Drink Barista Edition has helped make the Swedish brand a consistent favorite with American consumers and beyond.

For those who don’t know, the Swedish brand Oatly has been around for quite some time. The company was founded in Sweden in 1990 and now sells its products in more than 30 countries in North America, Europe and Asia.

In 2019, the company planned to open a plant in the United States in Cumberland County, New Jersey, but the pandemic has adjusted plans. Production is now slated to go online in mid-2022. First of all, the new facilities are intended for the production of drinks with an extended shelf life (ESL). Investments in the American manufacturing division amounted to $45 million.

The producer’s oat assortment is quite wide, and the ability of the “coffee version” to foam, providing the viscosity necessary for making lattes and other milk drinks, made it very convenient to use when directly added to coffee or tea, which, incidentally, contrasts with many types of almond milk that curdle on contact with hot drinks.

You can buy an authentic version of the Oatly Barista online (a pack of six 946 ml cartons sold online for a retail price of $32), but any version of Oatly from your local supermarket will work for a homemade vegan latte.

The Silk brand is actively pumping the «oat segment», expanding the already quite wide range of non-dairy alternatives produced by a new line of oat milk called Oat Yeah.

The all-new lineup includes three products, The Plain One, The Vanilla One and The Chocolate One, all of which are touted as being great on their own and to be added to coffee. Oatmeal novelties have a smooth, creamy texture inspired by classic milk, while meeting the nutritional needs and environmental values of the modern consumer.

Silk is owned by the French dairy giant Danone SA, which already has plant-based So Delicious Wondermilk and Alpro Not Milk in its portfolio. However, according to Shane Grant, co-CEO of Danone SA and CEO of Danone in North America, Silk that was developed for the US market «has different challenges.» Silk Oat Yeah’s products target the 60% of consumers in key plant-based markets such as the United States who are “not buying plant-based milk yet”.

The company considers this a challenge and, developing the line, launches a completely new dairy technology Silk NextMilk, based on analogs of ingredients: almonds, oats, soybeans.

While sales in the main dairy segment Danone in the first half of 2020 fell 2.9% to 6.41 billion euros from 6.60 billion euros, sales of plant products increased in double-digit percent for the sixth consecutive quarter. This allowed the manufacturer to generate an operating profit of £584 million. Although this is 2.7% less than a year earlier (£598 million), it is the “plant-based brands” that have made Danone resilient in the US to gain new market share in a growing segment.

The company has high hopes for the oat version under the Silk Oat Yeah brand. In addition, Danone, with its Silk NextMilk platform, plans to excel in other plant-based alternative segments.

Oat milk is also popular in Canada. Another novelty from Earth’s Own Oat M*lk Barista Edition. Made from oats grown exclusively in Canada.

Earth’s Own is gluten-free and 100% vegan and plant-based. The product gets foamy easily, which is appreciated by baristas, and has a delicious taste when added to coffee, which is already appreciated by residents of the country, which is the second promising market for plant-based milk after the United States.

Mushroom Oat milk from Barista Blend line from Califia Farms, USA contains plant-based adapagens from mushrooms. We have repeatedly mentioned mushroom trends in drinks in our reviews, for example, talking about innovations in the coffee market.

Mushroom Oat is developed by professional baristas, it foams perfectly and is logically joined to Califia’s Barista Blend range, which have already had 3 SKUs: Oat Barista Blend, Almond Barista Blend and Unsweetened Almond Barista Blend.

Another novelty from the company, expanding the line — hemp milk Hemp Barista Blend with a mild nutty taste. It’s a source of calcium, contains Omega-3 fatty acids ALA and no added sugar.

Mushroom Oat Barista Blend is the only ready-to-drink alternative to oat milk made with certified organic mushroom extracts, contains 3,000 mg of whole cordyceps, 2,400 mg of lion’s mane mushroom and has a soft, earthy and rich flavor that fans of latte and cappuccino have already appreciated.

Califia Farms’ Mushroom Oat Barista Blend and Hemp Barista Blend are available at national retail stores throughout the US, including Whole Foods, for a suggested retail price of $5.99.

We’re finishing the story about oat “dairy” products with a non-standard novelty. The American company JOI has launched the first waste-free dairy product on the market — dry oat milk.

It is made with a single ingredient — organic, gluten-free and organic oats. Also JOI is packaged in compostable packaging. Reducing the negative impact on the planet is at the heart of JOI’s mission, and the new product marks an important milestone in achieving that goal. “We strive to provide consumers with alternative dairy products that have a minimal impact on the environment,” says Hector Gutierrez, CEO of JOI.

When mixed or whisked with water, the powder becomes regular oat milk. From a 340 g bag, you can make 3.8 liters of oat milk. Consumers can add as much dry product as they prefer for the consistency of their choice, and can also «customize» their own favorite flavors by adding sweeteners and spices.

This approach of the manufacturer easily makes it possible to classify JOI oat milk powder as a DIY product – is another powerful trend that we talked about in our large review.