Almond “Magic”

Almond milk claims a new standard for coffee drinks. Demand for almond milk in the US market exceeded demand for soybeans for the first time in 2018. It took the segment 3 years to become the undisputed leader.

Retail sales of almond milk in the United States, which now account for two-thirds of sales by category, grew 16.9% last year on SPINS-measured channels in 52-week sales to $ 1.59 billion. Almond Breeze brand said the growth of retail sales in the US retail market by 17%. Consumers love the texture and perfectly balanced light creamy taste, so it’s no surprise that Almond Breeze almond milk has quickly become the most popular in all key US markets.

The market leader is owned by Blue Diamond Growers and is currently sold in 100 countries from Mexico and Brazil to Thailand. 2 SKUs with original and savory flavors in 2020 brought the company $800 million in annual retail sales.

While oat milk is most strongly associated with coffee and gained popularity in coffee shops before hitting US retail stores, the exact opposite story happened with almond milk. Consumers first tried this variety as a standalone drink, and only then got to hot drinks.

Almond milk contains less protein than regular milk and most other plant-based milk, with the exception of coconut milk (Almond Breeze contains 1 g of protein per 240 ml serving, compared to 3 g for Oatly oat milk, 8 g for Silk soy milk and 0 g for So Delicious coconut milk), manufacturer does not add additional protein to the product in the US market (it has some protein-enriched offerings for other markets such as South Korea and Australia). But it enriches its line in the USA with key micronutrients that consumers are looking for, including calcium, the content of which is higher in almond milk compared to regular milk, as well as vitamins D, A, E.

When it comes to calories, almond milk outperforms any other plant-based milk (Almond Breeze Original has 60 calories per 240 ml serving versus 120 calories for Oatly oat milk, 110 calories for Silk soy milk and 70 calories for So Delicious). In addition, it has an attractive flavor profile that has helped make the brand the largest player in the segment.

There are also almond varieties from other manufacturers. For example, the premium Barista Almond Milk, made from Australian almonds grown in the Murray-Darling region, from Alternative Dairy Co.

The product is created by coffee enthusiasts with over thirty years of experience working with non-dairy alternatives in collaboration with professional baristas. To achieve the perfect taste, the manufacturer removes the skin from the almonds so that the product does not contain bitterness and does not roast the almonds, ensuring that the almond flavor does not prevail over the coffee taste in the resulting drink.

Barista Almond Milk is a vegan, lactose-free, low-sugar, gluten-free ready-to-eat product. The product is rich in potassium, calcium and phosphorus and, like all plant foods, has a lower environmental impact.

According to the company, this is «not milk», from which baristas literally go crazy. Available to order through specialized platforms for professionals in the coffee industry, not sold in retail.

Barista Almond Drink organic almond milk from Rude Health from the Netherlands is made with toasted organic Italian almonds and spring water. Available for sale in London, Amsterdam and New York, as well as planetorganic.com for £2.99.

According to the company, the thin creamy drink from Rude Health is a version of the product that «was enjoyed by the ancient Persians, thousands of years before it was adapted to be added to coffee.»

On such a romantic note, we got to pea milk — another relative newcomer. Its sales rose 15.8% last year, while long-standing coconut milk boosted sales by 25.9%, thanks to a longer shelf life.

Pea Milk

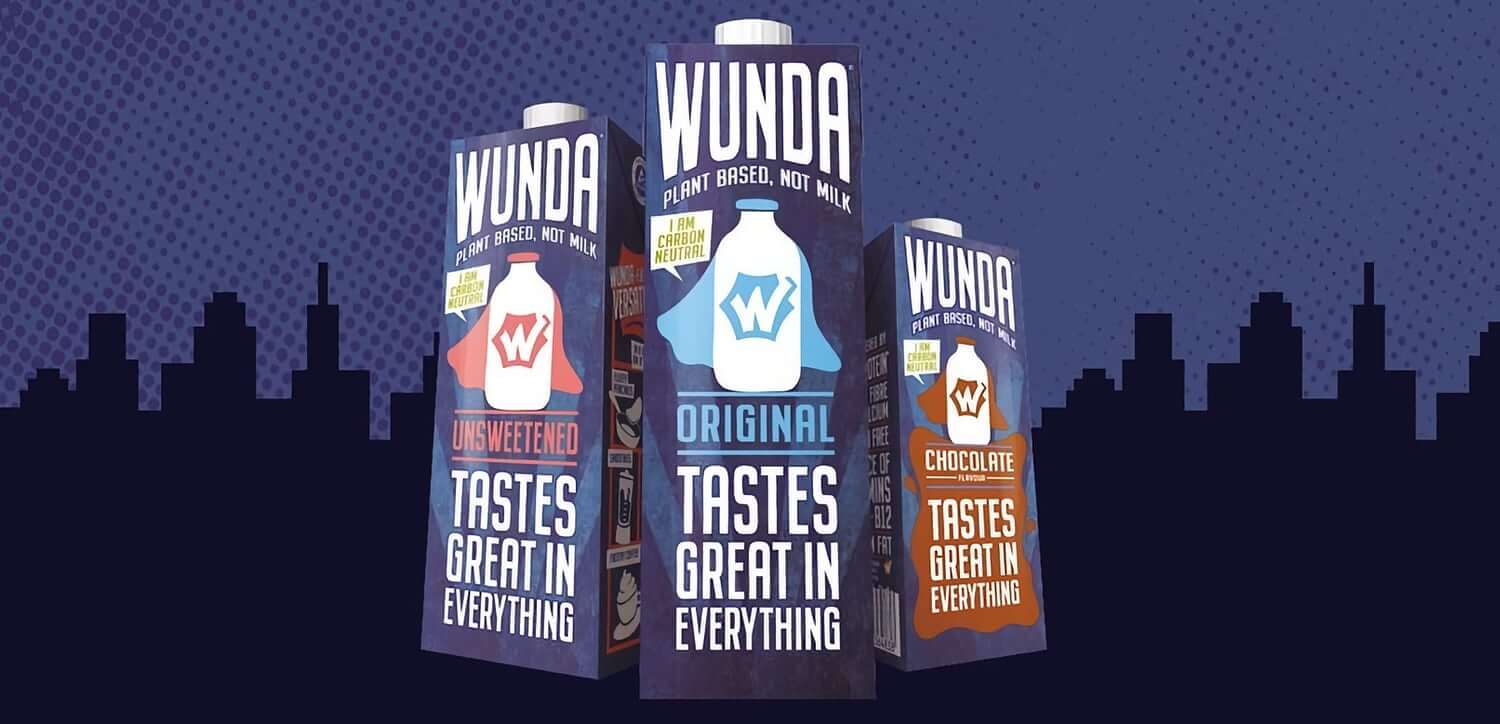

Nestlé‘s May Launch is a new Wunda pea drink designed for any application that uses milk.

A versatile source of protein and fiber, it has a great neutral taste, which makes it possible to use for various purposes, and the fact that the new product is still carbon-neutral (certified by the Carbon Trust) makes it an ideal alternative to milk for responsible consumers.

The young intrapreneurs of the global food industry leader created Wunda based on consumer needs, drawing on a long history of plant-based dairy production through the Nestlé R&D Accelerator in just six months.

The Wunda range is made with protein-rich french and belgian yellow peas. Drinks that are high in fiber, low in sugar and fat, are fortified with calcium and are a source of vitamins D, B2 and B12. In addition to the original version, the Wunda range includes savory and chocolate options, which have received a Nutri-Score A in Europe.

First, Wunda will be launched in France, the Netherlands and Portugal, followed by expansion into other European markets.

Dutch plant-based producer Fooditive Group has released its GoPeasy pea-based dairy drink, available to consumers in 2021.

“The product includes innovative Fooditive ingredients,” says Moayad Abushohedim, food scientist and founder of Fooditive. GoPeasy is sweetened with Fooditive natural sweetener, which is made from third grade apples and pears and fruit residues in a circular economy model incorporated into the Fooditive manufacturing process.

The protein-rich lactose-free non-dairy drink GoPeasy with no added sugar and low fat content has a naturally balanced classic milk taste, with a rich mouthfeel.

The coffee-friendly original variant has been extended with two more SKUs: lemon-strawberry with refreshing notes and cherry-chocolate for a pleasant sensation, only to attract new consumers.

Rice Milk Alternatives

Rice milk with its various versions has been around longer than other dairy alternatives. The key to such a long survival is most likely its ability to «not offend coffee» — when added to hot coffee drinks, rice alternatives give an unusual result: even after pouring in quite a lot of rice milk, it practically does not affect the taste of coffee, which allows you to make rich dairy drinks such as flat white.

And of course, it has become one of the convenient foods for baristas, although it is still far from the popularity of its oat or almond brothers.

Rice Milk from Pacific Foods Barista Series is a great non-dairy milk option for nut allergic customers. The creamy consistency provides a texture similar to whole milk, but without the heavy milky flavor, making it attractive for latte art or decadent baked goods.

A 12-pack (946 ml) package of PARVE certified gluten-free kosher milk with a great flavor profile when ordered online will cost $42.50.

A curious variety is the exotic version of Elmhurst’s Milked Brown Rice plant-based milk made from brown rice from a manufacturer with a history.

Americans have known Elmhurst from New York since 1925, when milk was delivered to Queens and Brooklyn on a truck filled with ice. The new — already completely non-dairy story — of the renewed «dairy farm without cows» began in 2017. And when in the USA they remember about some exotic vegetable milk, Elmhurst is remembered first. A wide range of various milk substitutes is produced under this brand. The company, in collaboration with nutritional scientist Dr. Sherrill Mitchell, uses the revolutionary HydroRelease process to produce premium non-dairy products from natural ingredients with a smooth creamy taste, high nutritional value and no added emulsifiers.

Milked Brown Rice is a product with an absolutely watery structure and the taste of cold rice pudding, only more liquid, which reveals its potential in coffee, creating a warm rice drink, close to the coffee version of genmaichi (Japanese green tea of the bunchy variety fried with rice) with a bright smoky-sweet profile. For real coffee aesthetes!

Sustainable Plant-Based Development

The rate of increase in consumption of alternative milk from nuts and plants will depend on how quickly these products taste as good as regular milk and how quickly they cost the same or less than a classic farm drink. Today, the value of products sold based on plant-based alternative proteins is roughly double that of conventional plant-based proteins.

In a recently released report from the Boston Consulting Group, plant-based milk may soon equal to cow’s milk in taste, texture and price. According to the BCS baseline scenario, parity will be reached as early as 2023, if not sooner.

The development scenarios for the segment are more than positive. For example, Toronto-based research firm Technavio predicts that the global alternative dairy market will have a CAGR of nearly 10% between 2020 and 2024.

North America and Europe are the most developed markets for dairy alternative proteins, according to a BCS report. Opportunities exist in the Asia-Pacific region, which will account for two-thirds of the world’s plant-based milk consumption by 2035. Therefore, analysts are already adding China and India to the most capacious and promising markets of the USA, Canada, and the EU.

Laïta Nutrition, the nutrition arm of the French dairy cooperative Laïta, estimates that global demand for plant-based milk will increase by 40% by 2030.

The target consumer of plant-based foods has changed over the past few years. Vegans and vegetarians make up a very small percentage of the population in the United States — about 5%. Instead of targeting just this group, manufacturers should focus their marketing efforts on a significantly larger group of omnivorous consumers concerned with their own health and ethical behavior towards animals (32% of respondents, according to the Matson survey conducted in June 2020, said that they trying to cut back on plant-based products).

The Health Nutrition Institute’s (GFI) State of the Industry 2021 report, with the encouraging title “Plant-based Meat, Eggs and Dairy,” argues that plant-based milk is becoming mainstream as it is enjoyed by an increasing number of consumers.

Gallup polls confirm this. 2020 saw a significant increase in the number of consumers who ate, drank, or are aware of plant-based milk alternatives. 25% of shoppers believe the plant-based diet is a fundamental shift that will last forever.

“Coffee” Conclusion

When it comes to coffee history in horeca, the plant-based trend poses a major challenge to both dairy alternative producers and food service providers. They need to reinvent themselves, innovate and offer their consumers new and exciting alternatives to classic milk.

In the everyday non-dairy category, almonds are now the standard, although soybeans are still alive and well and oats are gaining traction. But if consumers suddenly want to abandon almond and oat milk or they need to do it for objective reasons, there are great prospects on the market for products made from lupine, lentils, corn, millet, hemp. And this list is far from complete!

If hazelnut, walnut, macadamia, banana or flaxseed milk brings consumers a combination of balanced flavor and natural texture, they can easily create the next new champion.