Looking at the bread shelf in a store or a cafe, one would never say that the lion’s share of the presented “fresh bakery products” is formed from frozen products. The modern bakery business is studying world trends while we are figuring out what prospects of the industry in the near future are. Teaser: they’re huge.

Bread Realities

Frozen bakery products are becoming an integral part of the daily diet of consumers around the world, especially in Europe. At the moment the share of frozen bakery products reaches 80% of the total amount of manufactured products in Europe and the USA, which indicates the inevitable popularization of such products in the near future around the world.

The most radical forecasts generally suggest that traditional bakery products may soon disappear from the shelves.

And although the attitude of an ordinary consumer to freezing is far from unambiguous, neither manufacturers, nor retailers, nor catering establishments — no one particularly focuses on the fact that before the bakery products hit the shelf, they were frozen. The development of the technology has offered the bakery industry such solutions for the preservation of confectionery products that the finished products from frozen bakery products have the taste, color and aroma of the classic version.

This is not done to confuse customers. When consumers are looking for fresh bakery products with great taste and texture, they first check the expiration date on the product labels. A recent DSM survey, which surveyed 5,000 people in 10 countries, found out that for 73%, freshness is a key factor in consumer demand (DSM, The Future of Food Survey, January 2020). Long-term preservation of freshness is the first question that frozen baked products solves. But not just that.

With the development of freezing technologies, the world market is witnessing the rapid growth of the bread shelf, where the problems of the short shelf life of flour products are solved. In addition, this format provides for a reduction in the time spent on the production process and noticeably increases the shelf life. Frozen bakery products do not require immediate baking, so bakers, shops, cafes, restaurants, and consumers themselves prefer such products. Because the latter absolutely cannot tell the difference between frozen flour products or traditionally baked ones.

We will get back to the issue of high quality frozen bakery products in our review more than once.

Dynamics of the Cold

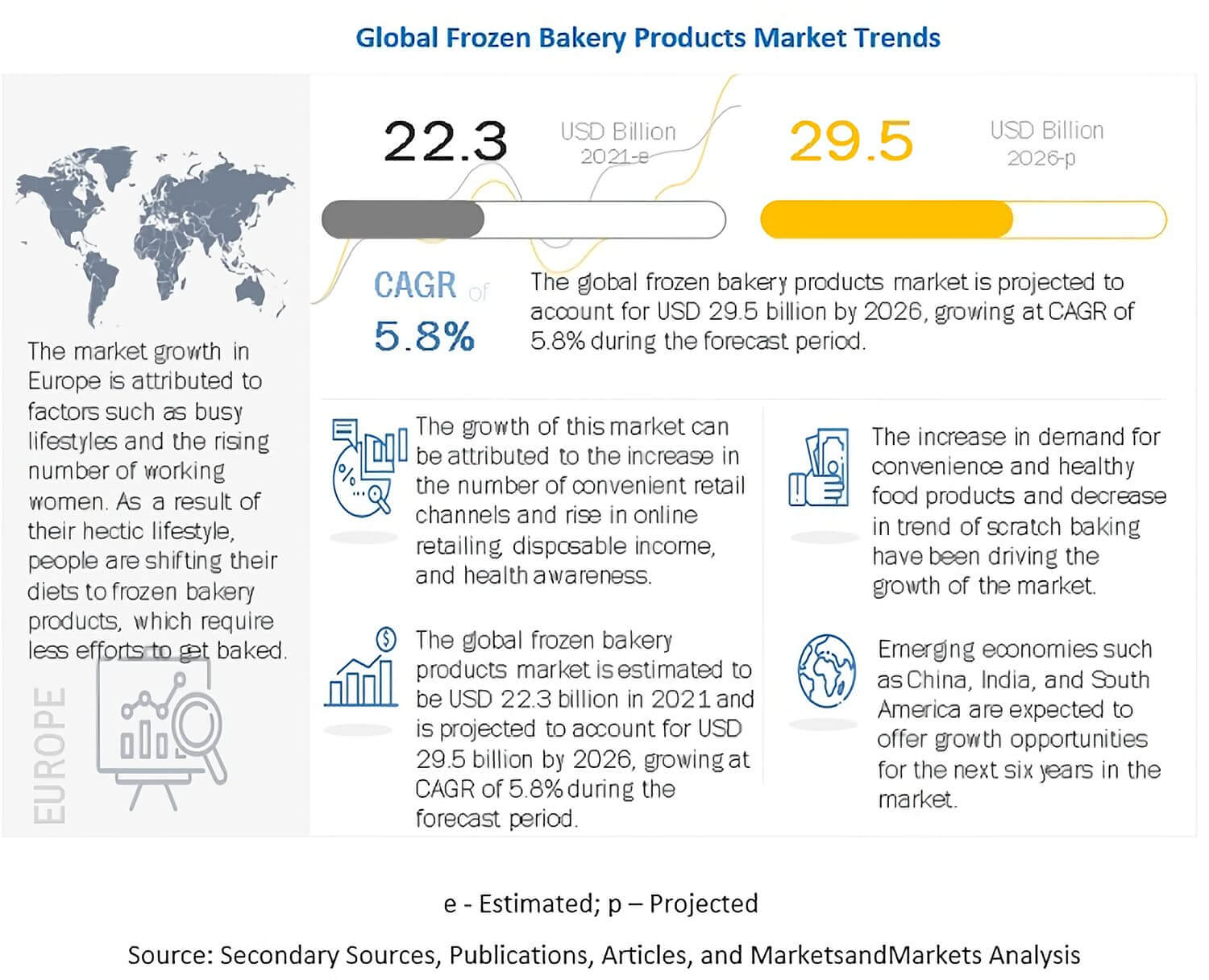

According to the forecast of Markets&Markets Research (USA), the total global frozen bakery market will grow from $22.3 billion in 2021 to $29.5 billion by 2026, at an average annual growth rate of 5.8%. The segment “overclocked” a decade ago — in 2012-2013 the average annual growth rate was over 7%. A downward adjustment has occurred in the last 2 years, which is directly related to the negative impact of the pandemic.

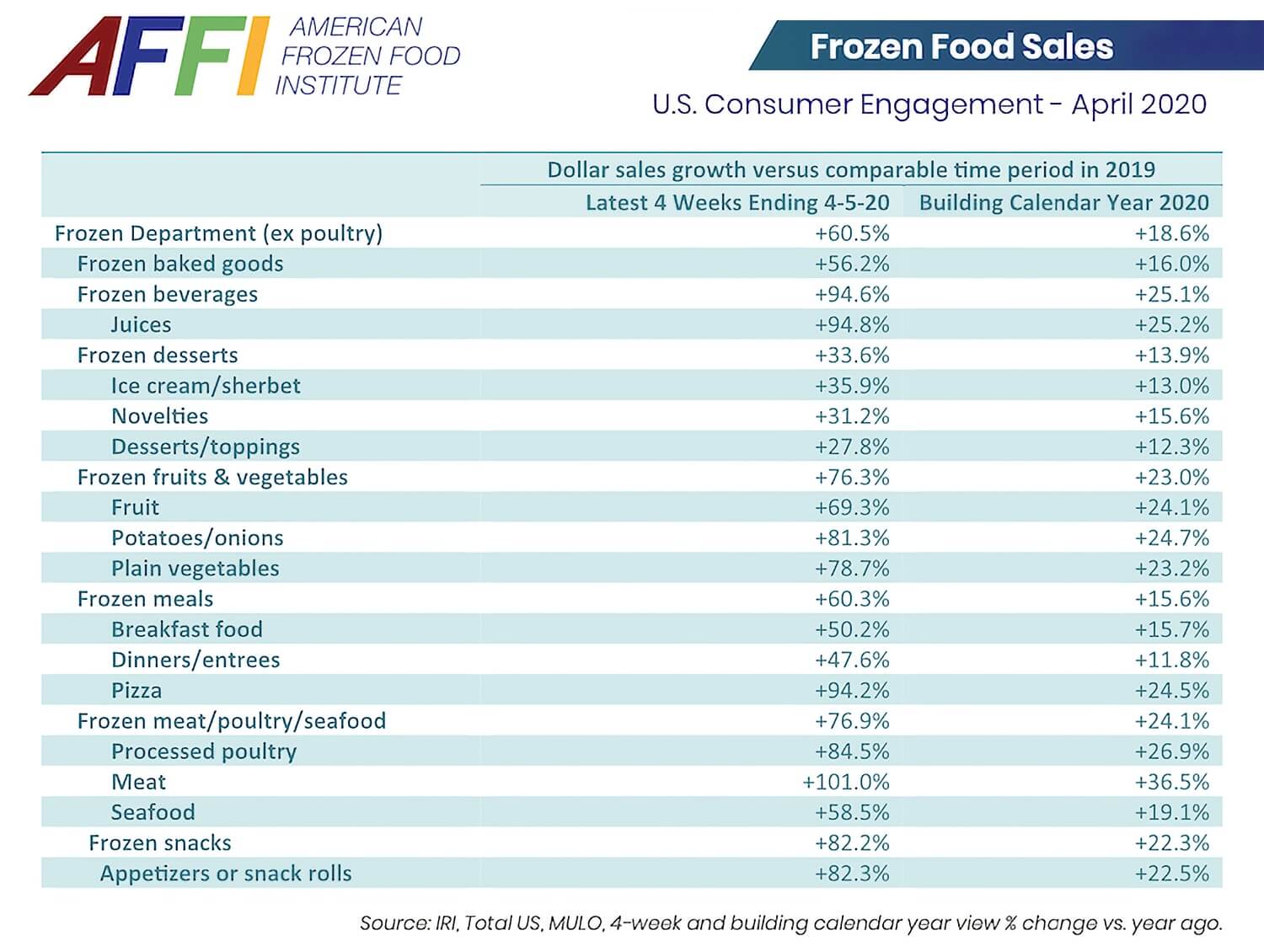

As a market driver, analysts indicate the growth in demand for semi-finished products, which indirectly stimulates the demand for frozen bakery products, since they require minimal effort for a person. For example, a consumer survey conducted by 210 Analytics for the American Frozen Food Institute (AFFI) shows that this category is increasingly attracting new and returning customers, demonstrating a high degree of customer satisfaction.

The vast majority of Americans buy frozen foods. 86% of all consumers bought frozen foods such as frozen pizza, bakery products, vegetables and ready meals. 50% of consumers who bought frozen said they are willing to buy much more (18%) or more (32%) similar products in the next few months, which makes the market’s medium and long term forecasts very optimistic.

The frozen food market is growing due to the increasing need for convenience. Rapid growth in frozen food production due to fast-growing urban households in developing countries is expected to spur demand for frozen bakery products.

«The study showed that frozen foods from the main consumer basket will remain a heavyweight category for many years to come,» said AFFI President and CEO Alison Bodor.

Rising per capita income and an increase in the number of snacks between meals were among the key factors driving the demand for frozen bakery products. The development of retail channels in the form of supermarkets, hypermarkets, convenience stores and specialty stores has also fueled market growth. In any well-known retail outlet in America or Europe, the frozen food department is perhaps the most extensive.

The frozen bakery products segment is growing the fastest. If we compare all the available data, then according to the assessment of the analytical company IndexBox, at the end of 2019 the situation in frozen bakery products looked like this:

— 55% of the market is covered by flour confectionery.

These include cakes, donuts, muffins, brownies, bagels, yoghurt-based muffins, and more. Sales monitoring data tracked by IRI reports that 2020 has been a remarkable year for the industry. For example, bagels grew by 20%, and their sales reached$ 1.2 billion. The English muffin category also brought more good news — sales rose 10.8% to $824.9 million.

— 20% of the market is for various types of bread, including French traditional and mini-baguettes, ciabatta, savory rolls and loaves.

The overall fresh bread and rolls category grew 6.1% to $15.0 billion in 2020. The hamburger and hot dog buns segment grew 10.9% to $ 2.6 billion (+ 5.6% in 2019), while the segment of other fresh buns and croissants jumped 12.0% to $2.4 billion (+ 8.5% in 2019) according to IRI data.

— Butter dough accounts for another 15% — cheesecakes, quick-cook pizza, various types of sandwiches, pies with toppings, etc. Frozen pizza is considered a daily food option in many Western countries such as France, Mexico, Spain and Germany. In addition, the dominance of this segment is explained by the consumption model in countries such as the USA, Italy, and Russia. Within the pastry category, frozen pizza accounts for up to 30% of the market in some regions.

— The remaining 10% are divided between puff pastry products, and the assortment is not much different from their rich counterparts, in addition to the difference in the very basis for cooking. (Source: bakery broducts sales data for 52 weeks ended April 18, 2021, IRI).

The demand for a particular product is determined by the sales markets. This is most clearly demonstrated by the preferences of companies in the HoReCa segment.

Public catering enterprises mainly prefer confectionery products, bakery products and bread as the most «popular» and demanded goods. As for mini-bakeries, their top priority is puff pastry and bread. If we talk about enterprises in the hospitality industry, then mini- bakery products are in the greatest demand there.

According to experts, the frozen food market has not yet reached maturity, and a number of factors will influence its further development. This is the development of new formats of trade and provision of services, and the emergence of mini-bakeries in shopping centers and shops, and the development of private bakeries and bread boutiques. The trend for homemade bakery products and the promotion of a healthy lifestyle will also play a role in expanding the range of bakery food freezing.

The key players in this market are Grupo Bimbo (Mexico), General Mills (USA), Aryzta Ag (Switzerland), Europastry SA (Spain), Conagra Brands (USA), Associated British Foods Plc (UK), Lantmannen Unibake International (Denmark) , Vandemoortele Nv (Belgium), Premier Foods Group (UK), Cargill (USA), Bridgford Foods Corporation (USA), Cole’s Quality Foods (USA) and Dawn Food Products (USA).

When it comes to frozen confectionery, all kinds of pizzas and a wide range of bakery products, the playing field is open to manufacturers of all sizes, but the bakery giants rather have advantages. This does not mean at all that local players are denied access to the segment. Just to compete in such a fast-growing sector, they have to focus on delivering truly innovative products.

So, moving into the frozen pizza category, Feel Good Foods launched the new Detroit-style Square Pan Pizza frozen keto pizza. The novelty differs from other gluten-free frozen pizzas on the market in that it has a thick crust and a square shape, which compares with more familiar to customers, round-shaped pizzas on a thin base.

Three SKUs are now available to customers: Margarita, Truffle Mushroom and Four Cheese, which can be purchased for a retail price of $10 at Whole Foods Market stores in all states of North America.

The Toronto-based frozen pizza maker The Bad Toss supplied its products exclusively to HoReCa until the lockdown. During the lockdown, like other representatives of the food industry, the owner and founder of the brand, Robert Fryer, had to change dramatically.

Feeling that in isolation, consumers lack a holiday, the company has reinvented the traditional frozen pizza, and uses unconventional combinations of ingredients for pizza-like products in its frozen, pie-like products.

Their product is described as bar-pie. Seven different options are available to customers through the company’s website, with the selection constantly rotating and the local fresh ingredients used depend on the season. In addition, bar pizza options change regularly based on the company’s founder travels around the world. In addition to the classic pepperoni or margarita, there are completely unconventional options that bring new spices and flavors to the pizza, such as corn dogs or doners.

Carnival Frozen Pizza Pie is a tasty reminder of holidays and festivals, garnished with favorite carnival specialties such as sliced corn dogs, jalapeno and cheddar sauce, mozzarella, diced pickles and a garnish of fried and jalapeno peppers.

The product is made interactive — several additional fillings are added to the package, which can be added to enhance the holiday experience «at home». It is a great option for frozen pizza that fits perfectly into the DIY trend, which we talked about separately in our special review.

Frost and Benefits

Prospects for the further development of the frozen bakery product sector are directly related to the active promotion of a healthy lifestyle. Demand has a lot to do with what customers are looking for in bakery and pastry departments. And manufacturers of frozen products, first of all, introduce and develop new types of products that are interesting for this category of consumers.

The demand for the following categories of frozen flour semi-finished products is growing:

— Gluten-free confectionery and bakery products

— Bread without added salt

— Low-calorie bakery products, especially breads with a minimum amount of calories

— Environmentally friendly organic «bio-bread», etc.

If a manufacturer cannot add value to their product, collaboration comes to the rescue. For example, Realgood Foods Co.’s grain-free nutritional pizza, co-developed with Beyond Meat, is a high-protein, plant-based sausage from one of the leaders in alternative meats.

Nutrient-rich pizza for plant-based or vegetarian consumers with macronutrient ratios that are difficult to find in the frozen food category. Realgood Foods’ protein pizza contains 8 g of carbohydrates per serving and 19 g of protein and traditional toppings such as mozzarella cheese and classic pizza sauce.

The new product is available at Kroger stores throughout the US and at realgoodfoods.com.

Players from adjacent segments are also striving to get into «useful baking». That only the efforts of the Green Giant brand are worth, which announced the release of breadsticks from … cauliflower. Available in Original and Garlic Flavors, the novelty is sold in the frozen bakery product sections of US supermarkets.

Green Giant breadsticks are freshly baked, gluten-free and available nationwide since September 2020. Each pack includes six sticks that can be baked in the oven in minutes. Cauliflower bread sticks contain no artificial colors, flavors or preservatives.

The manufacturer of Cali’flour, unique in its versatility, is expanding its useful assortment. The brand that has made so much noise in the ultra-healthy bakery products segment can be used as a low-carb replacement for classic tortillas, rolls, pita breads and even chips. The new taste of Cali’flour tortillas — sun-dried tomatoes with a fresh and pungent aroma and taste, became available when ordering online from July 2020, and hit the shelves of grocery stores in the country in the fall.

As with all Cali’flour Foods products, it is made entirely with simple ingredients, including fresh cauliflower, mozzarella, egg whites and sun-dried tomatoes. Each flatbread contains only 3 grams of net carbs, 60 calories and 5 grams of protein, so it contains only a fraction of the carbs and calories compared to classic cereal flatbreads. Cali’flour’s keto product is gluten and grain free, low glycemic and ideal for healthy lifestyle fans that are controlling their weight or blood sugar.

Tortillas made from «cali flour» are very confident in the $3.4 billion category, which grew by 13% in 2020, standing out for its noticeable «usefulness.» Alternative bakery products from cauliflower or spinach are ideal solutions for the health conscious consumer’s diet. We talked about this trend in a separate review on the keto trends in the bakery industry.

As for the basis for the production of useful flour semi-finished products, in the overwhelming majority of cases, premium wheat flour is used. Nevertheless, the active development of interests and preferences of millennials is forcing manufacturers to experiment, creating whole grains from rye, corn and even oatmeal.

The shelf with such offers is constantly expanding. Given the growing popularity of the healthy eating movement, such reforms look quite appropriate and allow you to reach a large audience of potential buyers.

As soon as the segment touches upon the topic of «clean» products, the question of the benefits and dangers of frozen bread becomes relevant. In order to avoid speculation, it should be noted that any kind of frozen bakery products is no different from traditional bakery products. Possible consequences depend solely on the composition and production technology.

It is worth dwelling on technologies in more detail. In the bakery segment, manufacturers today focus on the following frozen product formats:

- Part baked solutions — either partially baked (90%) semi-finished products, or generally raw molded dough (then its cost is 30% cheaper than ready-made bakery products), which are delivered to the point of sale frozen and prepared (baked) «on place «.

- Defrosting and Selling Solutions — Completely prepared and frozen foods that the retailer simply defrosts (defrosts) at room temperature before placing on the shelf.

Both of these approaches offer lower labor costs for retailers and also have an increased shelf life compared to classic baked options, which helps retailers and food service companies better manage inventory and manage illiquid assets.

Underbakery Products

Part bake or incomplete bake technology is what industry experts believe will soon replace traditional bakery products. Today it is one of the newest trends in the confectionery and bakery industry. It is extremely profitable for business, which is why there was such a stir around it.

Rhodes’ frozen lunch rolls are a prime example — ready-made frozen dough for rolls that can be baked at extraordinary speed.

In France, the homeland of frozen bread (as well as in Italy, Germany and the USA), the volume of the part bake market is the lion’s share (up to 90% in certain segments) of all bakery products. In Germany, which accounts for the largest share of frozen food in the European market — 23.5% (according to the German Institute for Frozen Food, almost 17,000 items are available in the category), the frozen bakery product industry has the most extensive infrastructure and a large consumer base with high purchasing power. This makes the German market the most attractive for both manufacturing companies and exporters.

The UK’s frozen food market has been driven by sales of pizzas and snacks, including frozen bread and savory pastries. The segment is growing by more than £100 million annually and, according to Kantar Worldpanel, these categories currently account for 16% of the total value of the frozen food market.

Experts believe that the production of «under-baked goods» is higher both in terms of profitability and quality than the production of traditional bread. After all, instead of opening a bakery with long dough keeping, kneading flour, equipping it with complex and expensive equipment, using all kinds of starter cultures, you can simply put on the oven, buy good frozen bread and open a baking point, heating ready-made semi-finished products.

The customer sees “hot, fresh bakery products” that smell exactly like the most ordinary bakery products and absolutely do not differ in taste from their usual classic rolls.

The main part of such freezing is small-piece bakery products and pastries: pies, buns for hamburgers, hot dogs, sandwiches and bagels, but not only. There is an obvious demand for such products, which is driving the growth of this frozen bakery products segment around the world.

Bakery manufacturer ARYZTA North America (owned by Aspire Bakeries), in an effort to stay in the wake of the new trend, has launched a new line of frozen bread at its bakery in Ancaster, Ontario, Canada. The modern bakery ARYZTA produces a variety of frozen bakery products and sweet pastries for catering and retail customers under the Oakrun Farm Bakery and Otis Spunkmeyer brands, as well as various bakery products for private labels.

Launched in November 2019, a new frozen bread line has expanded the range for retail grocers and food service establishments, where convenience foods are converted into freshly baked bread. Ancaster Bakery produces large loaves, as well as small buns for hamburgers and hot dogs, which are in particular demand at HoReCa.

Initially, the company served clients in Canada, but at the end of 2020, the production area increased to 22 thousand square meters. m., ARYZTA has expanded its supply to meet the needs of its US customers. The 10 production lines employ 48 people, allowing the manufacturer to expand the frozen bread category for foodservice, convenience stores and retail across North America.

La Brea Bakery in Los Angeles, USA used its classic fresh French baguette recipe to create a new take in the frozen bakery product segment — Take & Bake Frozen Demi Baguettes.

The product comes in a resealable, flap-type packaging that allows consumers to remove as many pieces as needed for baking.

MSRP $3.99 for a 4-pack of La Brea Take & Bake Frozen Demi Baguettes. The baking time is 10-12 minutes.

The September novelty of Pillsbury and General Mills Foodservice — frozen classic puff pastry croissants that can be baked in less than 30 minutes. Ready-to-bake croissants are the latest in Pillsbury’s long history of innovation that food service professionals rely on.

Pillsbury Freezer-to-Oven croissants do not require defrosting or proofing, which allows you to bake fresh croissants without preliminary preparation, whether in a mini-bakery or cafe. The 2 SKU European style croissants, made up of 48 puff layers, classic creamy and with chocolate, have a rich buttery flavor, delicate texture and a «flaky crust» thanks to a patented process validated by rigorous testing by General Mills culinary experts.

“Making fresh croissants is a challenge for many foodservice businesses, whether it’s baking from scratch or defrosting and proving frozen dough, so at Pillsbury Freezer-to-Oven we have improved the process,” says Sonia Ker, a member of the Chefs of the Mills — innovative a division of General Mills whose role includes product development and testing.

«Now it is as easy to make a real authentic croissant that employees of any skill level can achieve stable and flawless results,» the manufacturing company assures.

We started our story about the bread strategy of Grupo Bimbo in the article about keto trends in retail. But the leader of the US bakery industry is also known for its complete bakery products and confectionery solutions for food service businesses. Within the holding structure, this is handled by a separate division Bimbo Bakehouse, specializing in frozen and fresh bakery products for US restaurants and other catering establishments, as well as for its own bakery (ISB).

Although the Bimbo Bakehouse brand is new, the American subsidiary of Bimbo Bakeries USA has a rich b2b sourcing history. The frozen CBI plant was acquired by Grupo Bimbo from Wholesome Harvest Baking, Inc. in 2014 and is now part of the Bimbo Bakehouse. Wholesome Harvest remains a powerful frozen bakery products brand in the BBU portfolio.

With its flour products, Bimbo Bakehouse covers the widest possible range of bakery products for catering enterprises — from semi-finished products without artificial preservatives, colors and flavors to the preparation of traditional fresh bread, sandwich bread, various buns for hamburgers, hot dogs, bagels, English muffins and frozen handicraft bakery products (pretzels and croissants) to sweet pastries and pastries under the Goldminer and Wholesome Harvest Baking brands.

The BBU monitors health-related industry trends, and Bimbo Bakehouse continues to develop healthier HBU options, including for school catering. In 2021, the company launched new products specifically designed for the K12 segment, each of which meets grain requirements and is made from whole grain white wheat with healthy eating profiles.

As Dana Strain, marketing manager for frozen CBI for foodservice, notes: «BBU is the only commercial bakery serving all 50 US states.» And selected retail brands from the portfolio of the US bakery industry leader also retain significant market share and strength.

One of the iconic brands of the holding is Thomas. It is the best-selling brand of mini croissants and bagels in both retail and foodservice in the United States. Its sales, according to IRI, Chicago, for the 52 weeks ended April 18, 2021, rose 21.0% to $799.8 million.

Thomas mini-croissants arrive on the shelves in retail ready-to-eat (the recommended retail price is $ 4.49), and to catering establishments (among the clients of the holding are restaurants, coffee shops, hotels and school food factories) — in frozen form, which allows the holding to be actively develop a brand across different channels.

Thomas’s strength this year at BBU is seen through strong co-branding partnerships with leading national customers and a wide range of regional independent restaurants.

Bays English Muffins have recently released resealable packaging for their fans, much to the delight of their fans. In addition, the manufacturer has added English brioche-style muffins to its product line.

This «French style» English muffin gives bakery products that special buttery flavor of a traditional English muffin.

Throughout 2020, the manufacturer actively promoted its 4 SKUs of English muffin buns, which, according to the results of the past year, allowed the company to soar to the second line in the muffin category, leaving the Food for Life brand ahead — the undoubted leader of the segment.

Food for Life Baking made a huge breakthrough in the frozen buns category last year. Sales of its TOP product, Food for Life English Muffins, grew by 15.1% in 2020 to $19.1 million.

The concept of a vegan brand with almost 60 years of history (the company was founded in 1964) is to create truly healthy bakery products, specifically designed to help healthy people who want to live life to the fullest. The company manufactures more than 60 types of flour products — from bread to cereals to pasta, which do not contain yeast, gluten, are vegan certified and recommended for diabetics.