The global consulting and technology firm Capgemini has been tracking consumer shopping habits since 2002, surveying over 50,00 consumers worldwide, and gathering insights into the changing patterns of purchasing behaviour from originally predominantly traditional physical stores to now multichannel shopping.

The most recent research, Digital Shopper Relevancy Report 2014, surveyed more than 18,000 digital shoppers from 18 countries in order to understand how a range of channels and devices were used and valued as part of the shopping journey, segmentation of shoppers based on behaviour and preferences, and difference between developed and developing markets.

Social media should not be overestimated by retailers

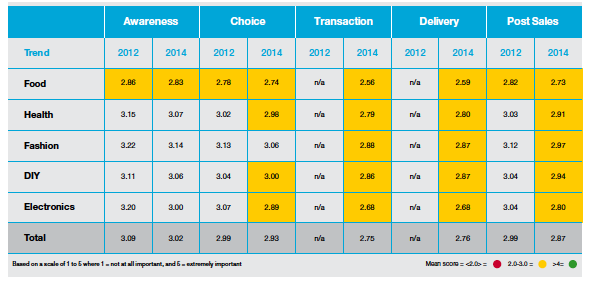

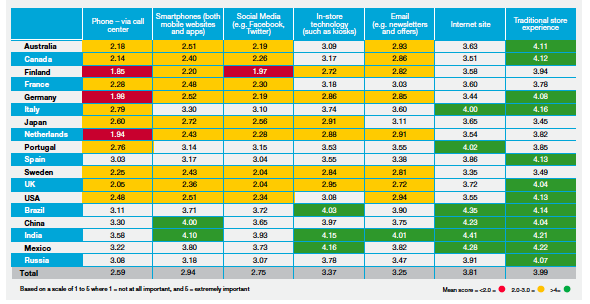

The research findings reveal that the value and role of social media experience in the shopping journey has declined since 2012. Respondents say they find social media less important than experience in retail stores, Internet, email, smartphone apps or use of technologies in-store. In 2014, fewer digital shoppers think social media could change the process of shopping (3.35 points again 3.30 in 2012). At the same time, only 29% don’t mind if retailers use their social-media data. So retailers should take a realistic view of the ROI in social media.

Kees Jacobs, Global Digital Proposition Lead, Capgemini Digital Customer Experience comments:

“Despite the surge in Facebook’s ad revenues and marketing innovations like Twitter’s new ‘Buy’ button, there is definitely a question mark over where and how ‘social’ fits into the shopper journey.

Social media is most relevant in the ‘awareness’ and ‘choice’ phases of shopping journeys (which is especially the case in fashion) but much less in ‘transaction, delivery and post-sales’.

Our report suggests that retailers still have work to do at every stage of the purchasing journey in order to make social media play a useful, valuable role in buying a product or service.”

Brick-and-mortar reigns

When asked about the value of physical stores in the shopping process, 75% of global shoppers identify the stores as important or very important, while Internet (web) is important or very important to 67%. However, 48% agree they use a physical store rather as a showroom than a purchasing destination.

Only 14% of respondents indicate that physical stores are less important to them. However, about 51% say they intend to spend more online in the future. 53% of shoppers anticipate an increase in ordering direct from a manufacturer via an app, or a 3rd party company’s app (50%).

Developing markets vs Developed

Shoppers from the developing markets show more interest and more frequent use of mobile sites and apps for shopping (4.0 and 4.1 respectively), and are more interested in personalized offers and recommendations (46% in India, 40% in Mexico, 38 % in Brazil) than shoppers from Western Europe (13%), in particular, UK (13%), France (15%), Germany (24%).

Seven types of digital shoppers

Drawing on the findings of the research, the Capgemini team defines seven types of digital shoppers differentiated by their behavioral patterns:

1. Reluctant digital shoppers (11% of the respondents from mature markets). This group is not comfortable with using technology and typically purchases from physical stores.

2. Value-conscious digital shoppers (29% of the respondents from mature markets). They prefer in-store shopping but are comfortable using Internet and email as part of their shopping journey.

3. Socially-engaged digital shoppers (41% of the respondents from mature markets). Heavy users of technology and social media for shopping decisions.

4. True Digital Shoppers (19% of the respondents from mature markets). This groups purchases online most frequently and is happy to sacrifise personal data to get customized deals.

5. Digitally-indifferent shoppers (23 % of the developing markets). They are uninterested in digital technology for shopping, but don’t mind sharing their personal data with retailers offline.

6. Interactive digital shoppers (50% of the developing markets). This group is regular online shoppers.

7. Technophile digital shoppers (27% of the developing markets). They are heavy adopter of digital shopping. Although they entrust retailers their personal information, they need an opportunity to switch possible notifications off.

The full report Digital Shopper Relevancy Report 2014 can be downloaded for free here.