2021 has become a breakthrough year for the beauty industry. Major cosmetics companies and startups had to adapt cause of changes among consumer values and expectations.

From “waterless” beauty products to virtual makeup — here are the trends and technologies, that will continue to transform the beauty industry in 2022 and beyond.

NEO-Packing

The beauty and personal care industry produces about 120 billion packages each year, almost 91% of these bottles, wrappers and other plastic waste is unrecyclable, accumulating in the ocean and in landfills.

Consumers, especially millennials and Gen Zers, refuse to use single-use plastic. According to McKinsey, up to 70% of surveyed US consumers are going to pay more for green packaging.

The changes in this issue depend on government regulation in the EU and some US states, where consumer goods companies are pushed to adopt environmental sustainability.

The EU, for example, has a goal to become carbon neutral by 2050, and the EU Green Deal aims to move towards fully reusable or recyclable packaging by 2030.

Cosmetics conglomerates and indie-brands have embraced this trend equally: L’Oréal, Estée Lauder and Unilever undertake to reduce single-use packaging, while such brands as Pai Skincare and HiBar are reducing use of fresh raw material or abandon plastic completely.

The transition to Eco-friendly packaging generates new business models, because intention to reduce the volume of single-use plastic becomes essential.

Refill is used in various beauty fields. Myro and By Humankind allow consumers to renew the contents of deodorants, Kjaer Weis and Asa Beauty also allow to renew their cosmetics.

The Body Shop has launched own ‘service station’ around the world since March 2021, so consumers can renew supplies of shower gels, hand soaps, shampoos and conditioners.

Recycling is also adopted, for example, MAC Cosmetics and Lush give consumers the possibility to return empty containers for recycling free.

In April 2021, Lush launched «Bring It Back» program in the UK and Ireland, that allows customers to return any Lush plastic packaging for recycling and to get a small discount.

For example, Neutrogena produces compostable wipes. L’Oréal uses “Ecologic” bottles in its Seed Phytonutrients line of eco-friendly personal care products: shampoos are poured into waterproof paper bottles.

Some cosmetics brands are looking for more creative treatments by using such materials as mushrooms, wood pulp or agar.

«WATERLESS» BEAUTY AS THE NEXT BIG ECO TREND

A typical shampoo is 90% water, transporting water-based products leads to significant shipping costs, increased emissions and packaging volume. Removing water from products is a key challenge for modern companies.

New startups and corporations develop innovative materials for concentrating of active ingredients in shampoo, hand soap and other products. Consumers have a chance to use more environmentally friendly products without changing their daily routine, such as using shower gels or chewable toothpastes.

Susteau (formerly OWA Haircare) has signed a deal with Sephora to launch its waterless hair care products online and in retail stores. These concentrates are mixed with tap water. Susteau has applied for a patent for its powder-free shampoo.

Humankind claims about its achievement of carbon neutrality, this company has developed a wide range of water-efficient products, from toothpaste and mouthwash tablets to shampoo bars.

Meanwhile, L’Oréal in cooperation with Gjosa has developed a device called the Water Saver that reduces water in beauty salons during head cleaning. L’Oréal plans to introduce it to 10,000 salons in the coming years, this device can save up to 80% of the water used for shampooing. L’Oréal has also acquired a minority stake in Gjosa in March 2021.

Marketing & Merchandising.

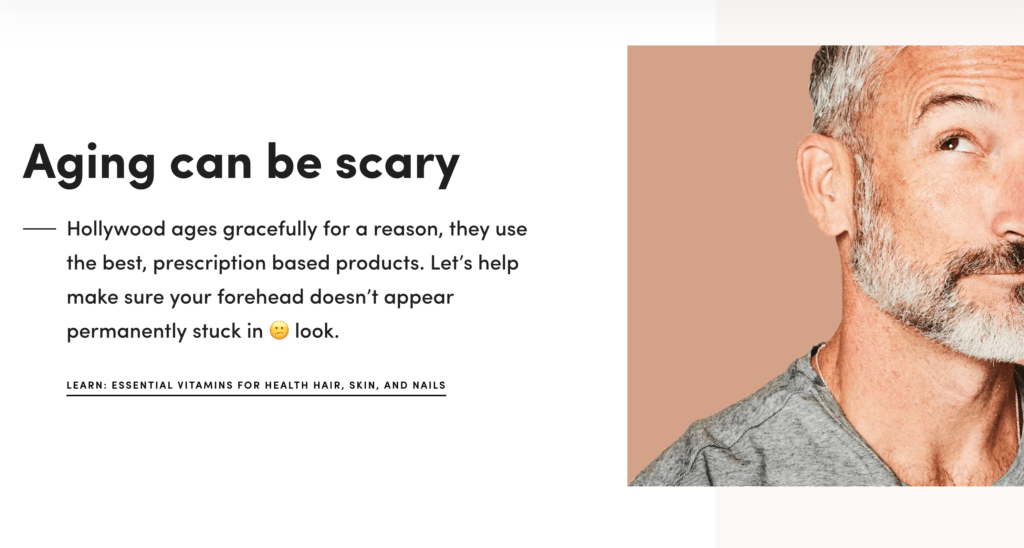

Beauty further integrates with the wellness economy

Internal skin care is one of the popular beauty trends today. Already popular Asian trend for specialty foods, nutritional supplements and beverages gathers pace, that promise beauty benefits.

This “inside” approach helps to prevent problems, while other cosmetic products can only hide them. Companies in this industry promote the idea «feel good — look good».

Although bio-supplements are not a new concept, more and more startups have a marketing strategy with products that promise such attractive benefits as weight loss, clearer skin and stronger hair.

Investors have supported beauty-sphere companies. One of them is Moon Juice, a vitamin supplier for HUM Nutrition and Nutrafol, which raised $ 36 million. It provides hair growth supplements.

The existing CPG players are also taking their first steps. For example, last year Nestlé agreed to acquire a majority stake in Vital Proteins. The company offers collagen-infused powders and snacks. Collagen is a protein, that helps skin cells to renew.

There are also new ‘edible beauty’ trends: Akiva provides collagen-infused drinks (SkinTe, Pop & Bottle) and even meal kits (Sakara Life, Urban Remedy).

More attention to the link between gut health and beauty is anticipated in the future, because the microbiome becomes an increasingly important health topic. Beauty Chef, a startup that raised

$ 6.8 million, already sells its products, linking beauty to the inner workings of the body.

Fragrances for Stress Relief and then some

Another new noteworthy beauty and health trend is «Functional Fragrances» — scents that are suspected to have a stress-reducing effect. They are already being offered by companies like Neom Organics and Aeroscena.

Leaping ahead, you should expect functional fragrances to be included in lots of beauty products, including such experiential beauty spheres such as spas and wellness hotels.

BIG TECH capitalizes on beauty

Technology play an increasingly essential role in the beauty industry.

Technology play an increasingly essential role in the beauty industry.

The broad range of tech companies, providing search data, smart home devices, artificial intelligence capabilities, e-commerce platforms and many other things, also offer compelling opportunities to make money in the beauty industry.

Amazon operates a specialty beauty store that sells salon products and equipment. The company has also even set up a hairdresser to show off its technology.

Google deals with brands by using its search data to study demand for cosmetic products.

Amazon has made major strides in expanding its beauty retail channel. It launched a private label beauty brand called Belei in 2019 and recently invested in India-based D2C beauty site MyGlamm.

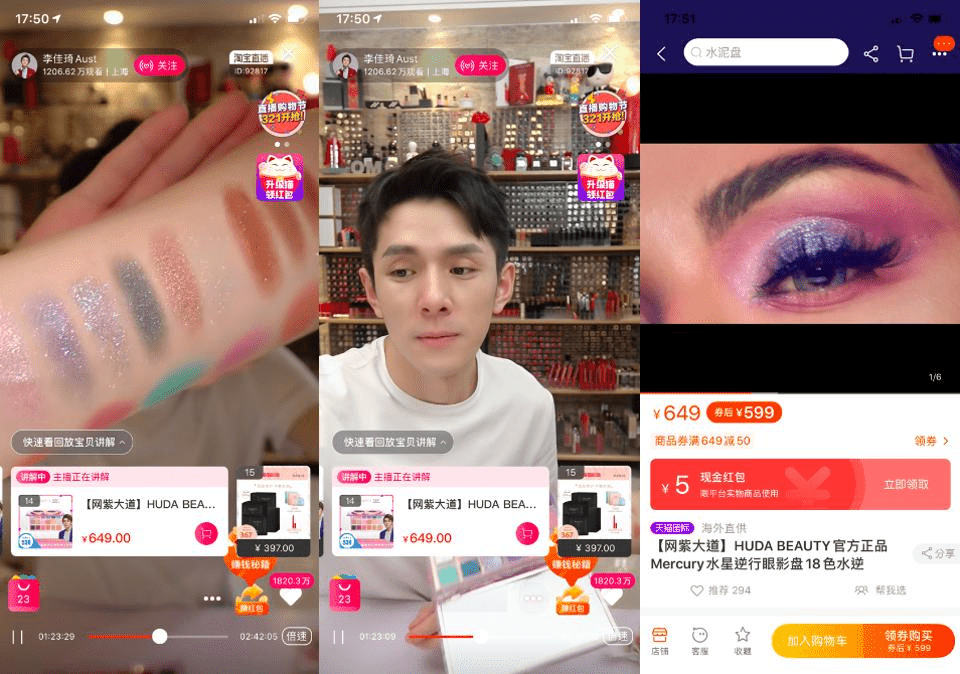

Instagram is not alone in using video for beauty products sales. The live stream includes a stores review. Viewers can buy presented goods online: it’s a new way to reach a younger audience and to increase sales.

Chinese tech giant Alibaba offers live streaming and augmented reality in retailing. These spheres have been used to attract luxury beauty brands to its e-commerce platform.

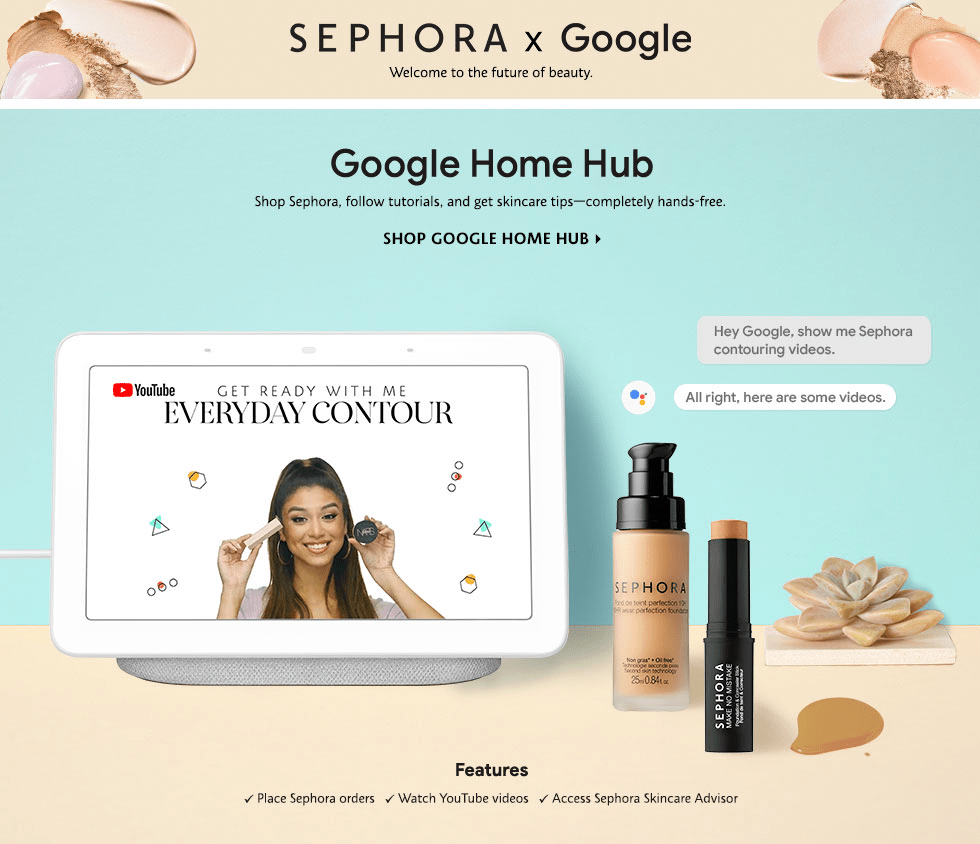

Voice assistants benefit beauty to a smart home

Amazon Alexa and Apple Siri Voice assistants open doors to partnerships in technology and beauty spheres.

Amazon, Apple and Google offer voice-activated smart speakers – they expect their virtual assistants to be deeply integrated into people’s home. At the same time, cosmetics companies are looking forward to embrace voice shopping to keep their brands in the spotlight on consumers.

For example, Sephora in cooperation with Google offers its Google Assistant app that allows users to order products, get skin care tips and watch Sephora’s YouTube videos.

For all seasons beauty has not been the central focus for big tech companies, but these giants will continue inevitably to expand their influence in this sector.

As the beauty industry becomes more technological, large companies get more opportunities to monetize their data, platforms and devices.