The potato chips market is experiencing global shifts today. Producers of the hit snack are masterfully capturing the growing healthy lifestyle inclinations of consumers. Introducing unusual innovations, they dramatically affect the structure of the global chips market. We studied the category of unsweetened snacks and collected the most current trends in the material.

Crispy Trends

Deep fried or baked crispy potato slices are a popular snack for people of all ages around the world. Delicious salty snack is available in numerous varieties and flavors in millions of retail outlets around the world.

This is how we have observed the market for chips for almost 70 years — it is believed that the date of birth of potato chips was 1953, when the chef of the Moon’s Lake Lodge hotel restaurant in Saratoga Lake, New York, George Crum, came up with the original recipe for «chips Saratoga, which gave life to the popular potato snack.

In recent years, the segment has shown massive growth. According to MRFR reports, the global potato chip market will reach over $44.2 billion by the end of 2027. That being said, it will thrive with a healthy CAGR of over 4.4% throughout the forecast period. The trend is impressive, especially considering that back in 2005 the global market for potato chips was estimated at $16.5 billion.

The share of consumption of potato chips is about 10.4% of the total volume of the global snack market, which was estimated at $427 billion in 2020. The segment of potato chips is still the most impressive, although it has “experienced” better times – a decade ago, this figure accounted for up to a third of the market. Potato chips have unofficially secured the title of a kind of snack standard.

By now, the term «snack» is no longer limited to just potato chips or crackers. In the last 10 years, the range of preferred snack foods has expanded significantly and continues to grow.

The demand for protein and the desire to eat on the go have opened up huge opportunities for meat snacks. They are positioned as a healthier snack and have broken out of a niche segment into the mainstream in five years. Loved by millions of consumers in many countries, «meat chips», naturally pushed the position of potato chips. For example, in the US, meat appetizers are the third largest snack category and the fastest growing sub-segment of the entire snack market. We took a closer look at this dynamic innovation sector in a dedicated report.

However, despite the fact that at present chips do not show impressive dynamics in their classic markets in the USA and Europe, the segment as a whole feels relatively cheerful. And in the context of current trends in the global snack market — even positively — the average annual growth of the global snack market in 2021-2027 will be 3.37% CAGR.

Potato preferences

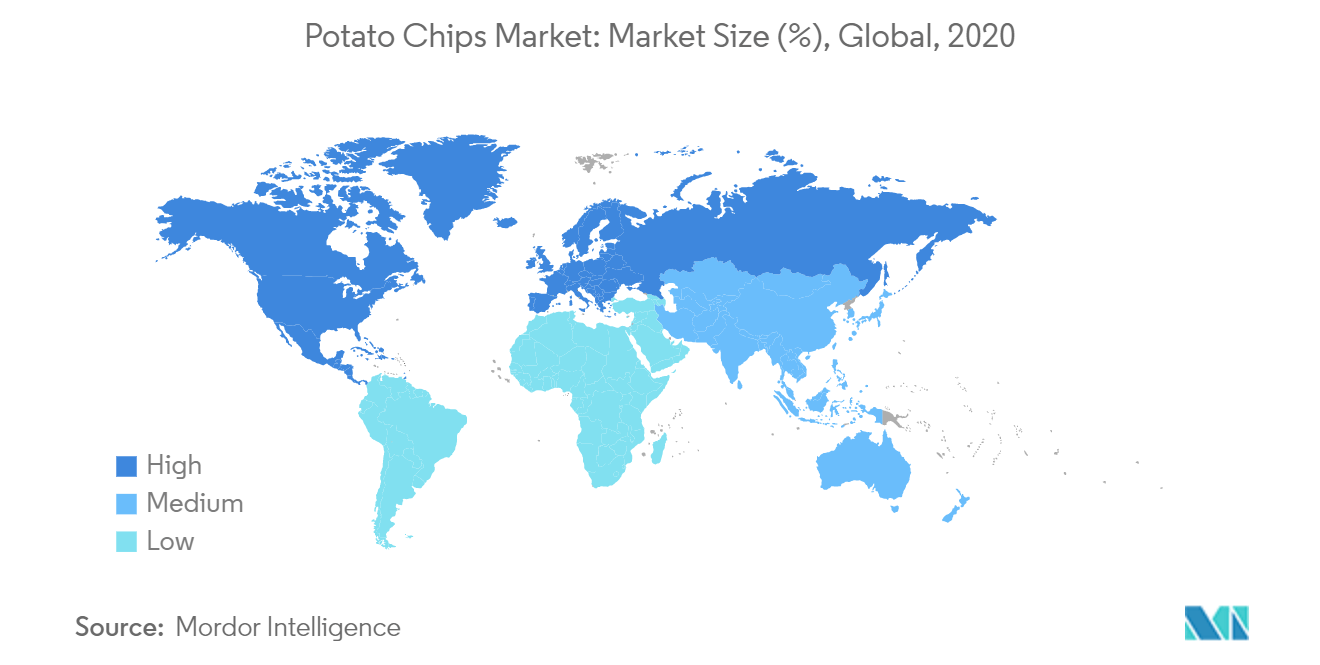

Levels of consumption of potato chips vary greatly in different regions of the world, but in each of them there is a huge scale in the category of salty snacks. North America and Europe are traditionally the countries with the highest consumption of potato chips in terms of value. At the same time, the volume of the EU market has remained stable for a long time and amounts to $4.5 billion.

The countries with the highest consumption of potato chips per capita are the Netherlands (11 kg per person), Sweden (7 kg per person) and Germany (6 kg per person). The potato chip market is one of the markets less affected by the pandemic. Some of the decline that affected the potato chips market in covid 2019 is attributed by experts more to a disruption in the potato supply chain than to demand. Consumption shows resilience due to the stability of consumer demand for chips.

The chips market in Europe is expected to remain robust over the medium term. Experts predict that until 2030 the European market will increase, although it will show a rather mediocre growth — the expected average annual growth rate will be +0.6%.

In the US, the potato chip market is showing signs of slowing. By 2030, its volume will approach $12.0 billion, but the average annual growth rate in the coming years is unlikely to exceed 1% (+0.7% in the US versus +0.6% in the EU). Which, frankly, is weak for the homeland of the popular snack.

The last time high growth (+3.4%) in North America was observed in 2019. Then the market increased for the third year in a row after a two-year decline in 2014-2015. However, for developed countries with a high concentration of snack brands serving a limited population, this is quite natural.

But consumers in North America have a new love. New World accounts for 33.3% of the world market for vegetable and fruit chips. This is the largest share of the volume, which was estimated at $11.4 billion in 2021. Demand for natural and organic fast foods is growing in the US and Canada, which has forced manufacturers to expand their offerings of vegetable chips with natural flavors. The proliferation of supermarket chains has also been a major factor leading to the dominance of the region.

But the fastest growing markets today are the Asia-Pacific region, the Middle East and Latin America. In Asia and Oceania, not only the classic potato chips will feel positive — the average annual growth rate of vegetable and fruit alternatives is expected at 9.2% until 2030.

First of all, stable demand remains from the rapidly developing India and China. It supports the rapid growth of modern distribution channels such as supermarkets and hypermarkets. Another important aspect driving continued growth is the launch of new and unusual flavors.

Convenience, functionality, interesting tastes and attractive design will remain the basic characteristics in the segment of savory snacks. Among the factors that impose restrictions on the growth of the chips market in the coming years, experts identify:

— Constantly changing consumer preferences

— Strong competition from other snacks

— Changing behavior patterns of snack consumers

The global challenge for the snack industry in the medium term is consumer orientation towards “healthy snacking” in line with global healthy lifestyle trends. The growing popularity of on-the-go foods driven by the accelerating pace of life is rapidly moving snacks into the category of complete meals.

What helps the producers of the chips segment to capture regional and world markets now? How do brands reflect their values in new product ideas in the chips market?

Pleasure and benefit

The market for chips today is not just growing. The evolution of the segment reflects all global changes in the style of consumption. This is noted in their analytical reviews by NielsenIQ, Mintel, Mordor Intelligence and other research companies.

The global shift in the chips market is doing much more than just satisfying basic human needs. Experts have long noticed that an integral part of a snack, in addition to satisfying hunger, has become pleasure and benefit. 85% of consumers worldwide admit to eating at least one snack a day to satisfy their hunger and one snack a day to enjoy themselves.

And if we add to this the post-COVID desire of consumers to maintain their own health with the general attraction of the latter to more healthy foods and drinks, this is reflected instantly in the snack market.

According to research published in Sosland Publishing Company in January 2022, approximately 80% of U.S. potato chip consumers are willing to try different versions of this snack to improve their physical well-being. In May 2022, roughly 51% of millennials and 45% of Gen Xers are looking for healthier options in food and snacks (data from Renolon). This affects the active growth of the market for alternative snacks for a snack.

The appearance of the crispy snack changes slightly. However, the refocusing on finding delicious, nutritious and sustainable foods to fuel a healthy lifestyle on the go is changing the very concept of chips.

The ingredients undergo powerful transformations — there is little left of the “potato” in them. Positioned as healthier, vegetable and fruit chips are increasingly encouraging consumers to prefer them over potato chips.

In 2021, the global market for healthy fruit and vegetable chips was valued at $11.4 billion. The compound annual growth rate is expected to be 8.1% CAGR between 2022 and 2030, according to Grand View Research. The prospects for the sector are clear.

Innovations in the production of alternatives in the market for chips, open up unlimited scope for creativity in the direction of R&D. Visitors to such specialized exhibitions as Sweets & Snacks Expo will not let you lie. Looking at the winners of the 2020-2021 Most Innovative New Product Awards, «chip discoveries» can be found in several categories.

Let’s start with the vegetable chips segment. In 2021, this segment occupied the largest share of the young, but actively emerging market.

Cauliflower Chips

Veggiecraft Farms — real cauliflower snacks. The company makes a variety of cauliflower pasta and has now introduced a new line of plant-based snacks made from cruciferous vegetables. Cauliflower Chips are made from real cauliflower and come in flavors like Honey BBQ and Black Pepper & Sea Salt.

Consumers have long turned to snacks to satisfy their healthy snacking cravings. And cauliflower-based products (we mentioned other segments in our keto trends review) continue to capture the interest of people who are looking for better versions of familiar snacks with a much more pronounced healthy component.

A new product from Veggiecraft Farms was introduced at this year’s National Association of Convenience Stores show.

Released his «potato chips» from cauliflower Real Food. From the Ground Up’s 3 healthy quick bite SKUs, flavored with sea salt, sour cream and onion, salt and vinegar without artificial flavors, colors or preservatives, briefly topped the manufacturer’s hit parade.

Chips from Real Food are vegan, gluten free and GMO free. The suggested retail price for the pack is $3.99 for a 100 g (3.5 oz) bag.

Pumpkin chips

The Beginnings brand presented its future of chips. His version of pumpkin chips with porcini mushrooms is a 100% natural snack enriched with only natural ingredients: honey, olive oil, garlic, sea salt and dried porcini mushrooms.

Because pumpkin chips are cooked at a low temperature, The Beginnings says they retain all of their natural nutrients found in vegetables and mushrooms. Add to that the low salt content and plenty of fiber, and here you go, you have healthy vegetable chips made with no added preservatives, colors, or flavors.

The manufacturer positions its own version as a direct replacement for «potato chips for health-conscious consumers» who are constantly looking for healthy plant-based chips made from anything from spinach and beets to cabbage.

Exploiting the theme, The Beginnings notes that its pumpkin-mushroom variant is that «colorful, nutritious and healthy alternative to oily, high-sodium potato chips that appeal to young and old crunchy snackers alike.»

Beet chips

Okanagan Rawesome introduced beetroot chips with onion and herbs to the market. Grain-free, vegan, keto-friendly and gluten-free snacks made with non-GMO organic ingredients. The low carb snack consists of sprouted grains and is suitable for low carb and low calorie snackers, as well as suitable for people with gluten intolerance.

Sauerkraut chips

Farmhouse Culture’s unique Kraut Krisps sauerkraut chips are back on the market. The brand has always emphasized that sauerkraut is the first ingredient in their recipe. Each bag of chips contains five ounces of sauerkraut, according to the manufacturer. True, the improved new product Kraut Krisps now has three ounces of sauerkraut, but the amazing taste is completely preserved.

Usually snacks are prepared with the addition of laboratory probiotics. The same novelty is preferred by «lovers of salty snacks with the benefits of naturally fermented products» — in full accordance with the mission of Farmhouse Culture. Eating Kraut Krisps with dill pickle, as Farmhouse Culture describes, is like «biting off dill pickle.»

For now, Farmhouse Culture offers SKUs of Sea Salt and Dill Pickle Flavored Kraut Chips, but promises to introduce a chili-lime variety to the market soon.

Mushroom chips

As uninteresting as mushrooms may have seemed to consumers in previous years, the rise of adaptogens has inspired consumers to consider medicinal mushrooms such as cordyceps, reishi, and shiitake as more than just mushrooms. Mushrooms can now be found in a wide range of bottled drinks, plant-based jerky, superfood powders, and even granola bars.

Over the past few years, mushrooms have found their place as a healthy ingredient in fruit and vegetable snacks. Now the benefits of mycotherapy have appeared in the chips market.

The MudLrk brand offers original shiitake mushroom chips, fried in palm oil at a low temperature and seasoned with herbs, spices and dried vegetables. As a result, 4 SKUs of familiar flavors are presented to the market in a “new version”: original ones with salt, pepper, ranch-type mustard and hot buffalo sauce.

Mushroom chips are free of gluten and preservatives; in addition, they are an excellent source of natural fiber. Shiitake mushrooms have been consumed by people around the world for centuries, now MudLrk offers them in a convenient snack format, and even in fully compostable packaging.

Continuing the theme of mushroom chips made from 100% natural shiitake brand Yuguo Farms

At the Winter Fancy Food Show 2020, Yuguo Farms unveiled its range of 100% natural non-GMO shiitake mushroom chips to the world in three flavors: original, spicy and wasabi.

Vegetable snacks with a hearty crunch are not the only love of the market. Fruit chips are another popular retail segment responding to the growth of consumer and trade demand for healthy lifestyle products. The fruit chips segment is forecast to post even faster growth with a CAGR of 10.2% from 2022 to 2030.

Fruit chips

In an effort to meet growing demand from their “conscious snacking” customers, healthy snack wholesaler Epicurium, vegan store Faire and www.ankorstore.com have launched Purely plantain chips.

Plantain is the cousin of the banana. The savory fruit has a larger fruit with a green or gray-greenish peel, in contrast to the yellow peel of a banana we are used to. The flesh of the plantain is more starchy, tough and unsweetened.

Plantains have more carbs from starches, while bananas have more carbs from sugars. Plantains and bananas contain the same amount of calories, about 90-120 calories per 100-gram serving. Other than that, plantains are not a significant source of fat or protein.

Nutrient-packed plantain is a good source of complex carbohydrates and several vital nutrients. They are high in potassium, which is essential for controlling heart rate and blood pressure, thereby reducing the risk of heart disease. As well as magnesium, vitamin C, fiber and anti-inflammatory antioxidants. Because of their high fiber content, plantain products aid digestion by helping lower cholesterol, which also promotes good heart function.

Plantain is considered a staple food in Africa, Southeast Asia, and Central and South America, where «fried plantains» are a well-established versatile street food snack and a stand-alone dish in restaurants as a side dish, «chifles» (Spanish: chifles) — shavings or thin slices of vegetable bananas fried in oil and seasoned with salt.

Plantain is now becoming more popular in the US and UK as its health benefits become more known. For example, Prime Planet is heavily investing in its Tostones brand, seeing it as the preferred alternative to plantain chips for US consumers.

And natural and free of gluten, sugar, palm oil and trans fats, Purely Plantain, from Ecuadorian-grown plantains, is available on the shelves of chain supermarkets and independent retailers across the UK. Purely Plantain 28g is available at Ocado and select Co-op stores for a retail price of £1. A 75g package will cost £1.99.

The Barnana brand is another well-known manufacturer of banana-based snacks. The company launched its organic chips from plantains grown on small farms in Ecuador and natural coconut oil.

The manufacturer has chosen the date for the online launch of two of its new products with sea salt and garlic flavors on August 27 — National Banana Lovers Day. By mid-September (less than a month), the novelty was already available in chain retail stores such as Whole Foods.

Avocado chips

We also got into our fruit rating the chips from an unsweetened «fruit» originally from Mexico — avocados. Avocados are highly valued by fans of a healthy diet and have long been firmly established on the shelves of supermarkets around the world. It could be assumed that someday there will be such chips.

This variety pleases the Temole brand. Their novelty is avocado chips with nacho cheese flavor. Made with fresh avocados, whole grains, high fiber brown rice, onions, tomatoes, limes, sea salt and cheese. All this in order to mimic the flavor profile of nachos.

Temole Avocado Chips are oven-baked, gluten-free, and a source of fiber and protein. Thanks to avocado’s monounsaturated fatty acids, this snack is a great option for those looking for ways to improve their heart health.

40g packs of Temole Avocado Chips are available from online retailers, select c-stores and gas stations.

Fish chips

Fish skin chips are a popular snack food in various parts of Asia. The raw materials for such products are practically «food waste», usually subject to disposal. The upcycled foods movement, which is gaining momentum around the world, has become a new “blue ocean” for European and American manufacturers.

In a dedicated review on the concept of upcycled foods, we detailed the various scenarios for this innovative trend, which creates hundreds of simple, delicious, high-value foods that are increasingly gaining the attention of responsible consumers around the world.

Now the circular economy has reached the chips market. By modernizing simple traditional snacks, brands are giving old products new twists. And the demand for healthier alternatives is driving consumers to experiment with fish skin products, which also offer many health benefits.

Hou Sek, a brand that offers consumers a wide range of gourmet snacks, has introduced a new product — chips made from fish skin with the addition of salted egg in the best traditions of local Malaysian flavors.

Expanding the line of fish skin chips, the new salted egg was born thanks to long experiments. The company expects to actively expand its market share. Since the original rich textured fish skin SKU was first launched on the market in January 2018 (the year Hou Sek itself was founded), the company has sold more than 10,000 snack packs in its first year of operation.

Salmon Skin Chips by Sea Chips is the first product of its kind to come from the UK. The manufacturer makes the most of «salmon’s nutrient-dense, often wasted skin» by launching gluten-free, all-natural fish skin chips on the market.

There are 3 SKUs available on the market — Lightly Salted, Vinegar Salt and Chili Lime — with a portion of the sales proceeds donated by the brand to charities that help keep the oceans and seas healthy and clean.

The brand Abakus Foods sees in its products not only an alternative to potato chips. The manufacturer set the goal of releasing a snack with a richer nutritional profile and launched seaweed chips on the market.

Three flavors are currently available: salt and vinegar, lightly salted, and cheese flavored. Each piece is coated with tapioca to make the chips crunchier.

The company is seriously considering expanding its nutritious algae range, as since the launch of Seaweed Chips, the repurchase rate has been high and the response online and social media has been amazing. People repeatedly come back for a healthy, tasty and nutritious supplement that nature itself provides. And the marketing department of the company is closely studying the possibilities of seaweed in other market segments.

Actively collaborating with the 1% for the Planet program, the company donates 1% of its sales to environmental causes, gathering around its brand a community of enthusiasts to «pay back to nature».

Oh flour

When talking about innovations in the chips/crisp segment, it is impossible to miss flour snacks. Versatile and protein-rich chickpeas and other legumes and pulses are confidently taking their place in the category as they become plant bases free of “wrong additives”, including a wide range of products in the food industry, from rice substitutes to one-piece pasta.

In the snack segment, for example, these are gluten-free chips from the 34 Degrees brand. The novelty has a vegetable formula consisting of only six ingredients: steamed chickpea flour, rice flour, potato starch, coconut oil, salt and sunflower lecithin.

Non-GMO Dairy-Free Crackers are loaded with protein and provide the taste and texture that consumers expect from conventional saltine crackers. As 34 Degrees President and Founder Craig Lieberman describes, “We have carefully selected ingredients and tested hundreds of recipes to achieve just the right taste and texture.”

There is no way back

The recovery in the chips segment, which began in 2020, can be explained by the desire of consumers to “eat” stress. Finding themselves in an unusual situation for humanity, locked at home with a limited arsenal of pleasures and constant fear for the life, health and well-being of their families, many began to consider snacking as a way to relieve stress or simply as an affordable entertainment.

The pandemic has redefined life priorities. What was previously given insufficient attention, suddenly became the main thing. We clearly understood that life is a fragile thing. On the one hand, there should be fewer factors that could reduce it, and on the other hand, you should not deny yourself small weaknesses, joys and pleasures, because tomorrow may not come. And the more diverse these pleasures are, the more positive emotions we will get.

This immediately affected the structure of demand in the snack market. First of all, consumers made a choice in favor of healthy snacks, giving preference to brands that support health and improve the quality of life with their products. Manufacturers in the segment of salty snacks immediately reacted to this. We have seen above what innovations claim to reshape this sector.

Experts unanimously argue that consumer behavior in snacking has completely transformed. A return to old eating habits is already unlikely. Therefore, while the consumption of snack foods is growing around the world, we have collected the main trends in their consumption for reference, which it would not be out of place to recall. This will help manufacturers more accurately transform their product marketing strategies.

Consumption trends in the snack market:

— People understand the importance of fractional nutrition, replacing the main meals with snacks.

— Consumers want to enjoy and benefit from snacking at the same time.

— Consumers have become impatient and want to get the product quickly.

— The possibility of a healthy snack is wanted by those who follow the diet.

— Consumers want to try the product recommended by social networks.

— Consumption awareness is growing, people are paying attention to the company’s sustainable development policy.

Whereas earlier demand in this sector was stimulated by the development of infrastructure such as subway stations, cinema halls, airports and other places of impulsive demand, further growth in demand will increasingly be noted for snacks for home consumption. And besides this, the growing demand in developing countries and the growing demand among the young population for obvious exoticism, both in tastes and compositions.

Experts agree that in the classic potato chips segment, the main driver for the coming years will be the development of new flavors; In the motley segment of non-potato chip innovations, consumers crave novelties that meet their taste preferences, in perfect harmony with the global trend for healthy snacking.

Non-potato chips are now actively trying to transform a conservative segment that has developed over the years. And this vector is not so much the desire of manufacturers to respond to current challenges — in the era of chipsocalypse, their survival depends on it.