Shock Freeze Crunch

There is also a need in the market for fully prepared, rather than partially baked, frozen bakery products. Such products do not need to be baked at the point of sale; it is enough to defrost (thaw) them for several hours at normal room temperature.

The production of high quality frozen ready-made bakery products is associated with the development of a technology known as the IQF method. IQF is a shock freezing method that prevents large ice crystals from forming in food. Blast chilling allows you to keep the freshness and appearance of bakery products for a long time. It is produced in a special chamber where all layers of bakery products are quickly frozen.

The main feature of the method is that it does not affect the nutritional value of flour bakery products, the integrity of the protein structure and biochemical composition. The freezing speed leaves no chance for bacteria, the environment for their reproduction simply does not have time to develop.

With traditional freezing, the resulting ice crystals are much larger than with shock freezing, which is why the structure of the flour product is destroyed, after which it loses its appearance and taste. Damage to the crystalline fibers causes food to dry out.

The shock freezing method is widely used and is an indispensable attribute of confectionery and catering enterprises in America, Germany, England, France, etc.

For example, all donuts in Dunkin are made using this technology. True, the freshness period of these products rarely exceeded 24-30 hours, which imposed on retail outlets the need for more careful planning of inventory.

In North America, however, donuts have long ceased to be seen as just a breakfast supplement. For the last 2-3 years, the beigne trend — French-style donuts made with high-protein bread flours have made donuts fit into consumer lifestyles, making them the fastest growing breakfast category on the U.S. food service menu.

IQF blast freezer can be considered a step forward for the entire confectionery and bakery market. It allows you to preserve freshness and naturalness, as well as the aesthetic value of the finished product (confectionery is glazed and decorated after the base is frozen, which allows you to achieve ideal visual aesthetics).

Frozen confectionery is a different story in the portfolios of major players. For example, BBU has a dedicated premium confectionery line under the Tenderflake brand. The brand is exclusive to Canadian retailers in the frozen confectionery sector.

The 70-year history of the confectionery brand (dating back to 1943) began with the sale of melted pork fat, which local housewives used exclusively for baking. Until the 1980s, when margarine and spreads began to spread, Canadian consumers believed that the only delicious confectionery product was bakery products made with only lard. Storytelling actively supported sales.

Tenderflake is one of the most popular brands of puff pastry in Canada today. A funny paradox: despite its popularity in Canada, Tenderflake is completely unknown in the US. Fans of the brand have to bring it back from their trip. The product is not shipped to United States stores, and the product is available on Amazon for a monstrously high price of $12.78 per box, while it retails for $3 on Canadian shelves.

Chilled Benefits

The obvious advantages of frozen bakery products and confectionery products are in logistics. Frozen flour semi-finished products can be transported even to the other end of the country. In addition, at a point selling perishable bakery products, there is no need to write off illiquid assets — you can bake products as needed. In addition, a fashion has now become established — to bake bread in supermarkets (or rather, to reheat bread — now we already understand this) to attract visitors with the smell of “fresh bakery products”.

This approach can increase the average check by 20%! The main thing is to «lure» the buyer to a fragrant bakery shelf. This approach provides excellent opportunities for innovative flour products.

For example, Pizza Cupcake is a savory cupcake-shaped snack found in the frozen pizza section of over 100 Wegmans grocery stores on the East Coast. Currently, only the signature flavor of pepperoni can be found in stores, while the classic flavor of Margarita can be ordered online.

Pizza Cupcake «reimagined the classic pizza» by turning it into an appetizer with authentic Italian ingredients. Great for a party or a light snack for kids.

Since its debut in 2018, The Pizza Cupcake has relied solely on online sales. But as soon as the company appeared on the Shark Tank TV cooking show, it received a $125,000 investment from American TV host, innovator and entrepreneur from Laurie Greiner, and went on retail for $9.99 for a box of six.

To enjoy the muffin pizza, it must be baked in the oven for 10-12 minutes.

Just before lockdown-2020, there was an offer for catering and hospitality industries that are interested in actively developing this segment of frozen snacks.

Non-frozen Catering

The key driver for the development of the frozen bakery product market is HoReCa and bakeries and confectioneries. These enterprises are actively developing, «mimicking» handicraft bakery, including bakeries in retail chains. Freezing is growing most actively in such a segment as b2b2c, when frozen products are bought by a business not for sale, but for the manufacture of other products for the end customer.

The modern market is saturated with bakeries not only in megacities. Now, not only in the periphery, but even at a distant gas station, you can buy (and eat) a freshly baked croissant, a bun or a sandwich — frozen bakery products, along with coffee, are the main drivers of the development of the gas station food segment.

The American food service industry consumes a huge amount of bakery products every year. Catering is a key component of America’s national economy. In 2019, according to the Economic Research Service of the United States Department of Agriculture (USDA-ERS), the share of food eaten at home was 45.2% and outside the home was 54.8%. Foodservice revenue in the United States is approaching $1 trillion over a typical year, reaching $969.4 billion in 2019.

Until March 2020, the frozen bakery products market for HoReCa was developing especially actively. The main drivers of demand were both ready-to-use deep-frozen products required by fast foods and coffee shops, and special ingredients that chain bakeries with their own production, catering companies, kitchen factories, and “dark kitchen”, a new actively purchased retail trend.

The pandemic literally nullified the achievements of 2019 and forced the food service industry players to hastily optimize their already heavily optimized resources and business processes. And it was the frozen bakery products that allowed the industry to survive the most difficult times of lockdown.

According to the preliminary forecast of Euromonitor International, in 2020 the increase in the sales of frozen confectionery products in HoReCa amounted to at least 1.3%, the increase in frozen bakery products and bakery products — 1.9%. By the way, these are the only product groups that can show positive growth (in 2019, growth was 31.9%). In the rest of the groups, analysts predict negative results. It will take years for the market to recover, and even then, provided that all coronavirus restrictions are lifted.

Daily Bread

Industry analysts assure that consumption of frozen bakery products will increase rapidly over the next decade. However, despite the fact that frozen bakery products is gaining popularity among consumers of different ages, its rapid growth is constrained by several fundamental restrictions.

Oddly enough, consumer bias remains one of these obstacles to development. The growing youth population prefers ready-to-eat frozen food, which leads to stimulating market growth. However, older customers, especially the older generation, prefer regular freshly bakery products. In their opinion, foods processed a year or more before consumption cannot be nutritious.

This is due to the realization that the nutritional value deteriorates during the refrigeration process, which greatly inhibits the growth of the market. The need to maintain a constant temperature of frozen food is sometimes made difficult by the ineffective provision of low temperatures during transport and storage in some developing and underdeveloped countries. Presumably, this can become one of the main constraints to market growth.

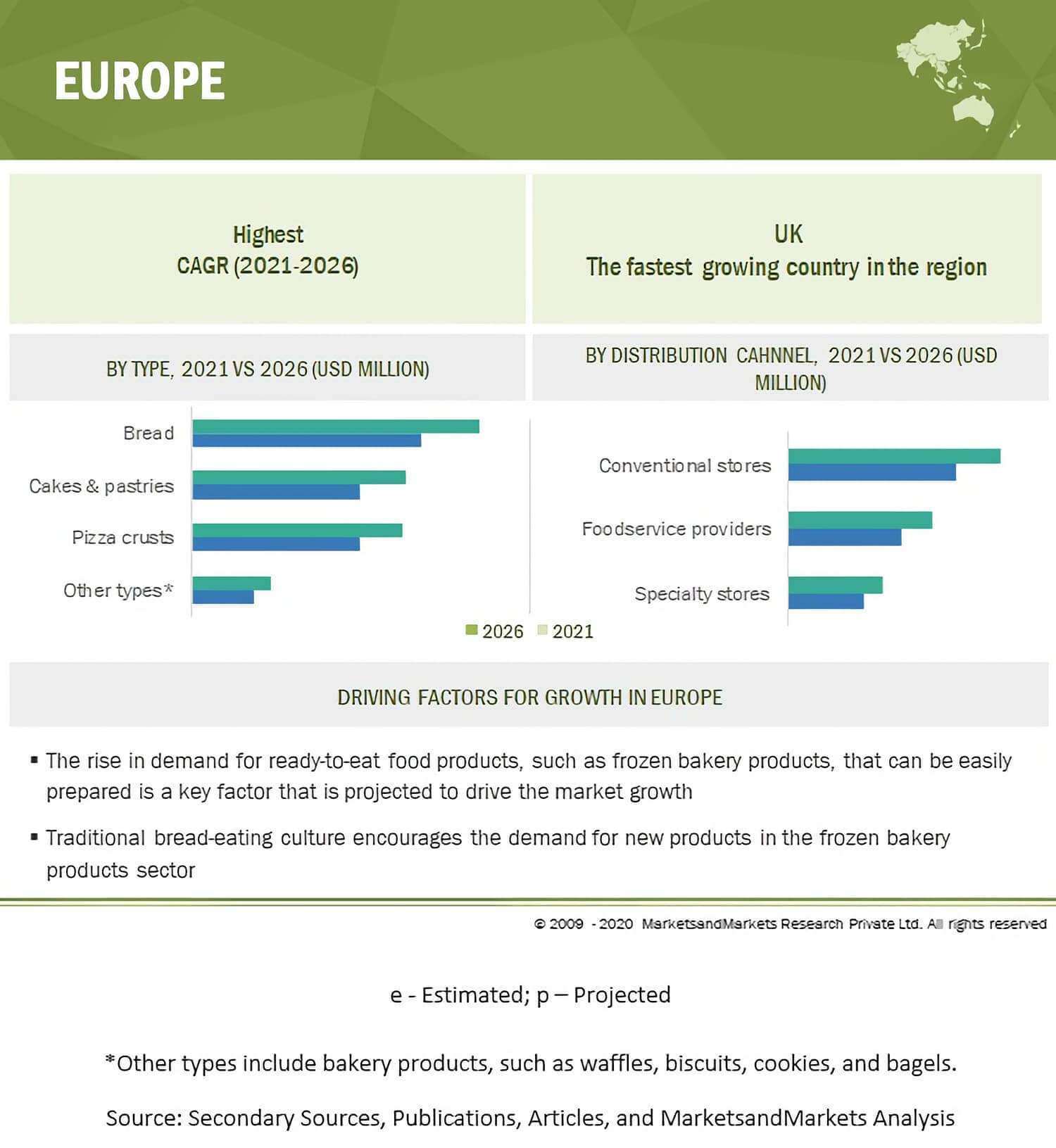

Consumption of frozen foods is common in Europe and will also increase in other countries and regions. The European frozen food market will become the largest between 2021 and 2026, while the Asia-Pacific market is projected to grow at its highest CAGR.

Europe in 2020 is the largest market with 56.5% share. As many EU member states actively encourage manufacturers to produce frozen bakery products, the market is forecast to grow significantly in the future. Market growth in Europe is largely driven by the established French bakery market.

The Old World is followed by North America and the Asia-Pacific region. In general, experts associate the increase in consumption of frozen bakery products in these regions with a change in consumer preferences as an alternative to “unhealthy bakery products”.

Economic development in both emerging and advanced economies has resulted in a very dynamic bakery market scenario. Growing consumer interest in their health has given specialty bakery product manufacturers the opportunity to introduce fortified, gluten-free, organic, low-calorie and sugar-free foods and develop a broad consumer base. These factors have led to an increase in the number of specialized pastry shops around the world, and freezing technologies have made wholesome bakery products the driver of their assortment.

The key factors in the popularity of freezing in the bakery products market are ease of use, consumer demand for taste, and the development of retail channels. However, the lack of freezers in some retail stores, especially in small towns and rural areas, may constrain growth in the bakery products segment.

But in such channels as retail chains and HoReCa, where storage issues have been resolved, there are huge prerequisites for the growth of frozen bakery products and confectionery products.