We returned to dairy trends more than once, analyzing dairy market trends in FMCG and, separately, in HoReCa from different angles. Today we’ll talk about the creamers. Perhaps even more complex, but no less interesting segment, open to bold experiments.

Milk rivers

The main difficulties in assessing global trends in the cream market are related to the fact that the product that we usually understand as “creamer” has completely different standards in different regions.

For example, in the United States, milk creamer is a dairy product with a milk content of at least 18%. While in Europe «creamer» refers to a product with a minimum milk content. And some large manufacturers in the cream segment, such as Nestle (Switzerland) and Saputo (Canada), offer their consumers various dairy creams, including the usual sour cream.

Dairy creamer is widely consumed in households, with Europe at the forefront of demand growth. Cream is consumed in several forms including heavy cream, double cream, whipped cream, and others. Dairy creamer production is a highly regulated process and is often sold as pasteurized and ultra-pasteurized.

In addition, flavored creamer is very popular at Christmas, especially in Western countries. Double cream is mixed with alcohol and sugar to make creams with brandy, cinnamon and calvados. They are widely used to make delicacies such as Christmas pudding, apple pie and others. As such, the flavored milk creamer market is expected to see revenue growth due to holidays and special events.

The global cream market is characterized by high dynamics. In this review, we have included the most interesting trends that we have discovered in this complex market, and in order not to confuse readers, we have attributed to them those novelties, primarily dairy cream, but not only, which the manufacturer himself refers to this category [even if, on at first glance, its product differs from the look we are used to], with the exception of the cream cheese category — we talked about cheese trends in a separate article.

As always, the goal of our review is to help readers generate actionable business ideas based on global market trends and the consumption of cream in completely different ways. The key trend in this segment is the increase in production driven by increased demand from key consumers, so to satisfy a broader consumer base, cream producers must take into account the special culinary, dietary and national requirements of consumers.

Creamy shores

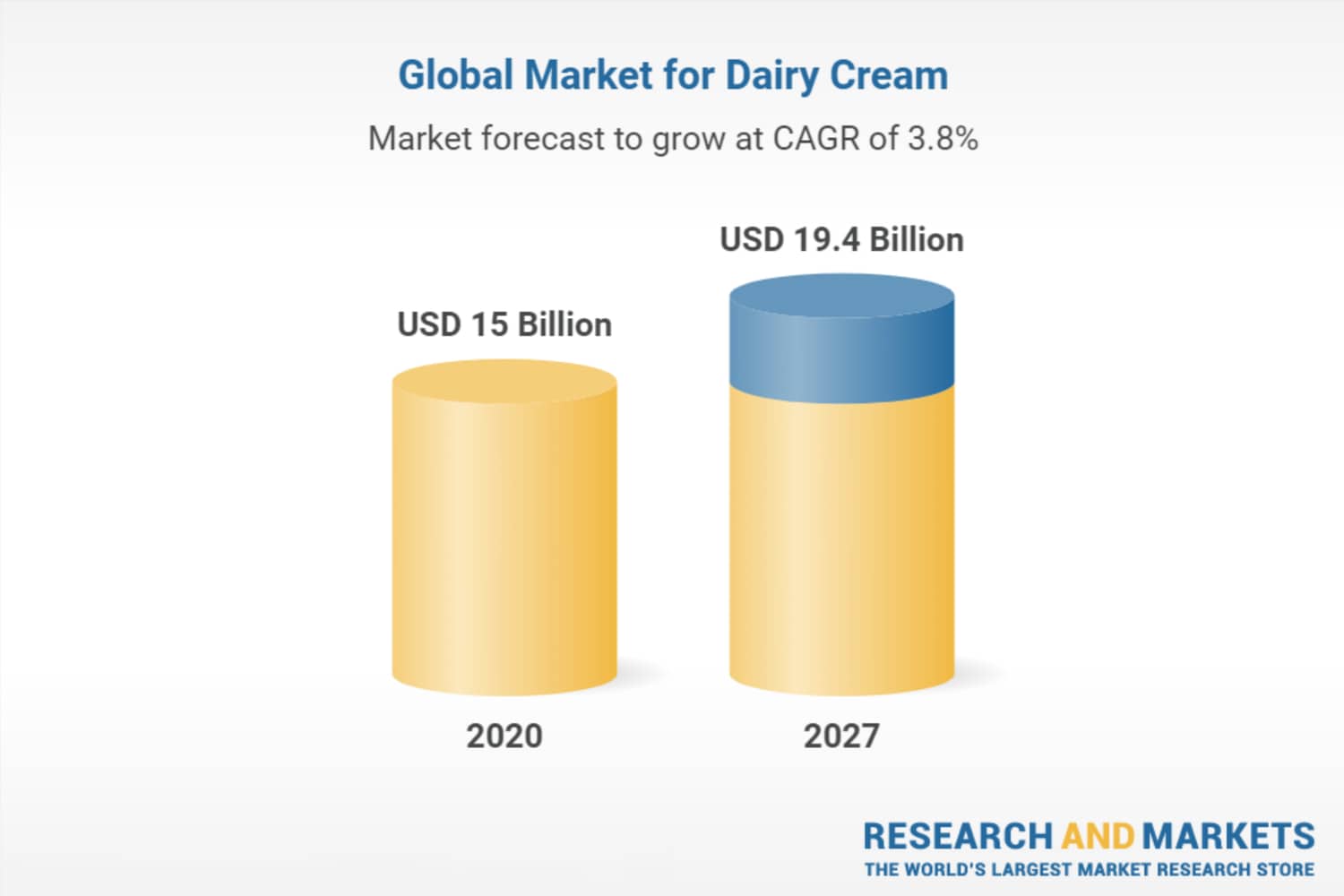

The cream market attracts producers primarily with its high profitability and consumption growth trends. Experts estimate that the global dairy cream market will reach $19.4 billion by 2027. Even in the context of the COVID-19 crisis, estimated at $15 billion in 2020, the global cream market has grown to $17.56 billion in 2021. Analysts expect that until 2028 it will grow by an average of 3.8%, which is a very positive forecast.

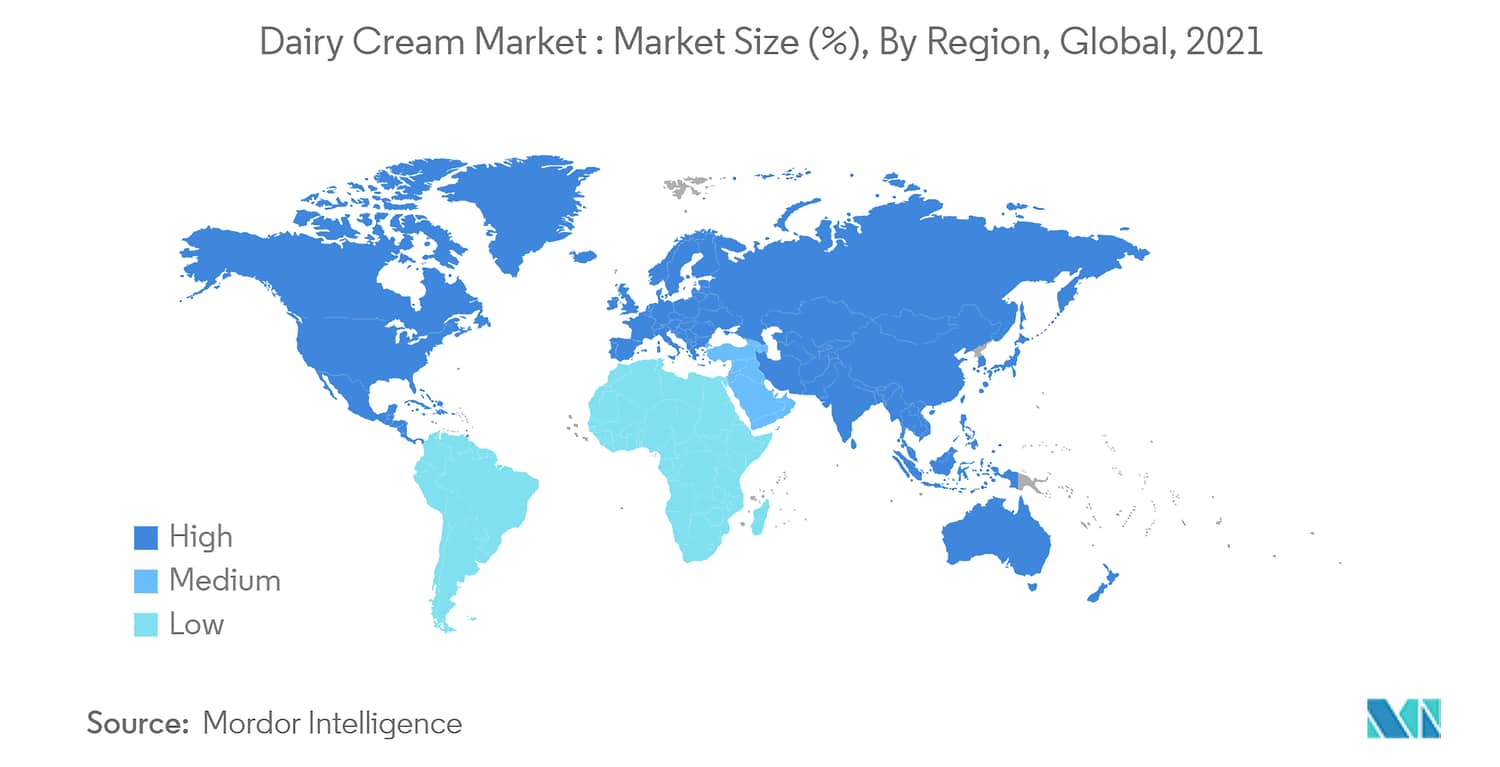

Despite being tested by the pandemic, the North American market will still retain its leading position in this segment. This is due to a well-established industry in the US and Canada.

Other noteworthy geographic markets include Japan and Canada. Until 2027, each of which, according to expert estimates, will grow by 2.2% and 3%, respectively.

Positive development is expected in the Asia-Pacific market, led by countries such as Australia, India and South Korea, as well as in Latin America, where growth in the segment has been observed over the past two years, where the average annual growth rate is expected at 3.3%. Although the region has shown slow growth until 2020, its vector will change dramatically once Latin America fully recovers from the effects of the 2015 recession.

In Western Europe, the cream market will grow at an average 2.8% CAGR. Germany remains the most attractive country for the regional dairy cream market with a market share of over 40%. Among other European countries, positive forecasts concern the Netherlands and Belgium, where the average annual growth rate will be even more than 3% in the next 5 years.

In addition, we are expected to see positive growth in the dairy creamer market in the Middle East, especially if producers are willing to accommodate special dietary and religious requirements. It is precisely these prerequisites that we observe when analyzing the successful “creamy cases” of recent years.

How to cream

The main attention of the manufacturers of creamy novelties is given to the aspect of nutrition. Most of the major producers in the cream market offer their consumers pasteurized milk and cream, especially from skimmed milk. This is in line with growing consumer demand for dairy products rich in milk proteins and vitamins.

The rise in dieting consumers has led to an increase in household consumption of skimmed milk, as it eliminates much of the saturated fat and cholesterol.

Finally, like its “big brother” milk, the cream market is actively experimenting with plant-based non-dairy alternatives. Today it is one of the main drivers of segment development. According to analysts from Allied Market Research (Portland, Oregon), the global market for alternative creamers will reach $2.38 billion by 2027 ($1.7 billion in 2019).

Vegetable creamers are actively filling the portfolios of both new wave companies, such as Mooala or Elmhurst, which have concentrated exclusively on dairy-free drinks made from nuts, oats, coconut or banana milk, and quite classic dairy brands, including such well-known manufacturing brands as Arla Foods, DMK, Nestle, Danone and other dairy giants.

Mooala has created a plant-based sugar-free creamer that is certified organic. The manufacturer has included vanilla beans, oat cream and banana nuts in its zero-sugar plant-based coffee creamer.

Vanilla Bean includes a simple combination of almonds and coconut cream, Oats ‘N’ Creme includes oats, almonds and coconut cream, and Banana Nut combines nourishing ingredients such as almonds, coconut cream and banana puree.

While many dairy-free coffee creamers have been presented in nut-based creamy formulas, the Banana Nut variety stands out in particular, as consumers have already noted.

The 90-year-old dairy brand Elmhurst, which switched to the production of exclusively dairy alternatives in 2017, introduced the world’s first cream based on hemp milk to the cream market in the same year.

According to the company’s core values, the products it produces are made with six or fewer ingredients, and the creamers used contain 4-5 ingredients, depending on taste.

Elmhurst’s portfolio already had 4 SKUs of alternative creamers made from peanuts, walnuts, hazelnuts, cashews, oats and almonds. Hemp creamer is made not only from real hemp seeds, but also from real hemp cream, which are just two simple ingredients used in the manufacture of the product. The company has succeeded in creating hemp-based vegetable creamers for coffee or tea that do not curdle.

Elmhurst Vegan Hemp Coffee Creamer is free of added sugars, gums, oils and stabilizers, rich in nutritious omega-3 and omega-6 fatty acids and has a creamy texture to enhance the quality of hot coffee drinks.

Elmhurst Barista Hemp Cream will be available exclusively at HoReCa. However, Elmhurst marketing director Heba Mahmood mentioned in an interview that customers can expect this cream to appear on store shelves as well.

As many consumers experiment with plant-based milk alternatives, brands are seizing the opportunity to get people interested in dairy-free products that are more suitable for you and fit certain drinking rituals.

Danone-owned vegan brand Silk has expanded its Oat Yeah line of oat dairy products with the launch of the new Oat Yeah Oatmilk Creamer. The new creamer ($4.29 a pack), made with gluten-free oats, comes in two flavors: natural sweet creamy vanilla and The Oatmeal Cookie One, inspired by the classic cinnamon-tinged cookie treat.

The oat milk segment continues to dominate the traditional dairy sector, so it makes sense that oat cream will now delight latte lovers both at their favorite cafes and at home. Oat Yeah Oatmilk Creamers are available at grocery stores nationwide, including Target, Walmart, and Sprouts.

Silk recently pleased its fans with four more creamy novelties. They go well with coffee or tea, as well as in classic alcoholic cocktails with the addition of cream.

Seasonal Silk Maple Brown Sugar Oat Milk Creamer — Flavored Additive with Maple Brown Sugar and Oat Milk and Silk Almond with Mint and Dark Chocolate, a blend of dark chocolate notes with minty aftertaste and almonds.

Another 2 SKUs are Silk Pumpkin Spice and Silk Unsweet Pumpkin Spice Almond Creamer with zero sugar content. Limited editions are available nationwide during the season for a suggested retail price of $4.59 per pack.

Compared to other manufacturers, Honest to Goodness is relatively young. The manufacturer started as a specialist creamer brand offering a line of plant-based coffee creamers created with ingredients from around the world. Honest to Goodness is based on a mission to support local communities where ingredients are produced for brands of creamy alternatives.

The initial product line of the new brand includes three flavors — Madagascar vanilla beans, unsweetened Madagascar vanilla beans and Himalayan salted caramel.

Honest to Goodness, part of the B Corp movement, aims to make a lasting and tangible positive impact on the communities where its ingredients are grown.

3 SKUs of Honest to Goodness Coffee Creamer in 473 ml (16 fl oz) packs are available through Amazon Fresh and Fresh Direct for a retail price of $3.99 each. You can also buy Global Variety Packs on Amazon.com for $12.

Half & half

Plant-based alternatives open up room for experimentation.

For example, the brand’s all-natural dairy and non-dairy creamer line, made with only milk and cream (or dairy alternatives), sugar and natural flavoring, has recently been expanded with two new varieties. Non-dairy coffee creamers that are made with coconut or almond base have been on the market for quite some time. New from Natural Bliss is a cream with a mixture of half almond milk and half coconut cream.

The company believes that this creamer will appeal to those with certain dietary restrictions or preferences, as well as those looking for an alternative way to add richness to their drinks.

An obvious, but not as simple step as it might seem. Almond and coconut milk behave differently in hot drinks. Of particular difficulty is the need to create a balanced creamy taste, in which almonds and coconut of different taste would complement each other and not harm coffee lovers to enjoy the taste of a coffee drink with cream.

The company coped with the task. Two brand new plant-based Half&Half Natural Bliss SKUs are available in either sugar-free or vanilla-flavoured versions in both HoReCa and classic retail.

Picking up the trend is Forager Project, a brand known for its cashew gurt product, an alternative dairy-free cashew yogurt.

The company recently hit the market with its Half&Half version ($4.99 for a 473 ml/16 fl oz bottle). This time, the organic coffee creamer is made with a mixture of water and cashew milk, along with coconut cream, dates, and a few other simple flavor ingredients.

Technologists have done their best. The product turned out to be «exceptionally creamy» and not only because of the added coconut cream. Per serving (2 tablespoons) 1.5g fat, 1g carbs, 0g sugar and 20 calories — that’s cashew! At the same time, this is a good option for fans of coffee creamer with low sugar content — a stable trend in itself, which is worth talking about separately.

And without sugar

With the simultaneous expansion of coffee culture and a plant-based diet, consumers are looking for inventive new ways to enjoy a cup of coffee with cream without harming their figure. In addition to sweeteners, consumers – especially millennial women – are now looking for options that they find flavorful yet healthy creamy additives.

The popularity of low-calorie, sugar-free cream products continues to grow around the world, along with the global consumer drive to avoid sweets. For this reason, the latter are regularly looking for offers with zero sugar content. As we can see, all of the brands mentioned above have their own variant of «sugar-free» cream. While this is unlikely to be a benchmark for the segment, each product that contributes an additional 5 calories to the daily diet will be subject to «prejudiced evaluation» by consumers who monitor the calorie content of the products they buy.

The cream market is no exception. Especially realizing that cream is an important ingredient not only as an additional ingredient in coffee consumption, but also as an ingredient in baking and desserts. And those brands that manage to gain a foothold in this sub-segment will receive additional benefits.

Among them is Nutpods, an American plant-based creamer. The company introduced its first natural flavored coffee creamer with zero sugar per serving.

Sprouts Farmers Markets and Wegmans are now offering Sweet Crème, French Vanilla and Cookie Butter in refrigerated 762 ml (25.4 fl oz) formats. Online the same products are available in 336 ml (11.2 fl oz) format.

The Nutpods brand prioritizes minimizing its impact on the environment, which is why it chooses Plant-Pack cartons made from 95% plant-based materials to package its products.

Against this background, even the Milkadamia brand has attended to the release of a sugar-free version. While many of the creams on the market are plant-based with almond, coconut or soy milk, Milkadamia makes its creams based on macadamia milk and full-fat coconut cream.

The Milkadamia brand also made it into our review because of its bold «Free-Ranging Trees» advertising campaign. The marketers of the manufacturer tried to transform the version of “free-range cows”, familiar, and in some places even beaten, for the classic dairy segment. The manufacturer insisted that the macadamia nuts grown in eastern Australia were «watered only by rain» and not by artificial irrigation, thus supporting the ecology in the region.

Such an idea [although, of course, served on the verge of absurdity] touched upon complex issues related to food production and sustainability, did not find support from the USDA. According to the USDA, the trees cannot be classified as «free-range». Having been subjected to quite active trolling in the network, the advertisement was curtailed.

The gluten-free, sugar-free version of Unsweetened Vanilla Creamer Milkadamia with 10 calories per serving remained on the market. What is important, the manufacturer managed to preserve the non-standard and bright taste of the product, which has long found its fans.

Challenge for technologists

All the trends that we mentioned in the review are long-term. They will set the tone in the segment in the next 5-8 years. Especially, plant-based alternatives.

If we compare the state of the cream segment with the development of dairy alternatives, the scenarios for the development of the cream segment are more than positive.

For example, pre-pandemic forecasts by research firm Technavio (Toronto) stated that the global market for dairy alternatives will grow at a compound annual growth rate of 9.8% until 2025; growth (CAGR) of 7.3% by 2027, which is a very optimistic picture.

In the everyday vegetable non-cream category, almonds and oats are currently the standard. At the same time, consumers can try walnut, macadamia, banana or flaxseed cream, which can also bring a combination of balanced taste and natural texture to the consumer experience. In addition, there are great prospects on the market for products from lupine, lentils, corn, millet, hemp — the list is far from complete!

So the Upfield brand announced last year the start of sales of vegetable cream-cream Flora Plant Professional with a fat content of 31%. A distinctive feature of the novelty is a unique formula based on lentil protein. It is lentils that provide a neutral creamy taste of the product and an appetizing creamy shade.

Flora Plant Professional is lactose and gluten free and is therefore suitable for vegetarian, vegan, children’s and diet menus. The product from Upfield has certificates of kosher and halal and is recommended for the production of specific dishes of national cuisines, as well as for special in-flight catering menus.

Vegetable Flora Plant Professional are stable when heated, do not cut off when interacting with acids, quickly whip into a dense and strong foam and tolerate shock freezing without loss of quality — a versatile product that is equally suitable for preparing hot dishes (soups, sauces and pastas) and confectionery , as well as decorating coffee drinks and cocktails with airy creamy foam.

Due to its neutral creamy taste, Flora Plant Professional can be used on a par with natural milk cream and even instead of them. Thus, there is no need for establishments to purchase two items (milk cream for main menu dishes and vegetable cream for vegan items) — all this is solved by one SKU.

Inspired by the success of Flora Plant Professional 31% fat, the brand recently announced a lower 15% fat product in the professional line. The novelty will appear immediately in several European markets, including Germany and Russia.

In addition, the market should expect really bold innovations. In our opinion, this segment presents a real challenge for the technology departments of players striving for leadership in their areas, which opens up great opportunities for R&D.

For example, the Korean company hy Co, formerly known as Korea Yakult, is seriously diversifying its lines of yogurt and milk-based drinks, enriching them with probiotic cultures Lactobacillus curvatus HY7601 and Lactobacillus plantarum KY1032. Last year, the company branched out into probiotic ingredients, creating the brand name Fatslim for weight management, which consists of a blend of the two probiotics.

Having successfully sold its innovation in the South Korean market, the company changed its name to hy Co and is now actively promoting the idea of producing various functional milk-cream and sour-milk products enriched with probiotics. This sub-segment deserves a separate review of functional drinks, but why not even more differentiate in such a highly competitive market?

We continue to monitor the players of the segment, we expect really unexpected creamy discoveries.