Consumers choose snacks based on just four characteristics: taste, ingredients, packaging, and price. But the preferences of representatives of different generations vary greatly. Collected data from the latest purchase reports of young consumers.

Snacks: who is who

In modern life, snacks accompany us throughout the day. The range of offers for a snack is constantly expanding. Today, snack products include not only traditional chips, crackers, croutons and popcorn, but also snacks made from meat, fish, seafood, fruits, vegetables, cheese, and other ingredients that make the segment healthy in the eyes of modern consumers who are building a healthy lifestyle into a cult.

We have repeatedly talked about the popular trends in the snacking market. But if you study this sector from a broader angle, you can note its other features. For example, in the preferences of the choice of categories by consumers from different generations, which came into our field of vision this time. And there is something to talk about.

When we start talking about the prospects of a particular consumer group, every time we focus on the potential of the «Generation Z». But you always have to make a reservation — this is in the future, at present, millennials are setting the tone on the market. But it is important for manufacturers to understand the differences in expectations and preferences of these two adjacent generational groups now – in the future, these groups will have the maximum influence on the coordinates in which the snack market will develop.

Our material includes data from the report «Gen Z vs. Millennials Youth Snacking Trends Report» by Austin, Texas-based research company Knit and the U.S. Snack Index, by Frito-Lay North America Brands (a division of PepsiCo), two authoritative sources that have established differences in snacking trends between two generations. It is unlikely that anyone will question the analytics of these resources.

Our review contains valuable and relevant insights regarding the needs and expectations of the two consumer groups with the strongest market potential. With which of them you want to communicate the most in the medium term, you choose.

«Avocado Bruschetta Generation»

Starting with the «Greeks» (Knit researchers estimate that millennials were born between 1981 and 1996, which is consistent with the popular Strauss-Hau theory of generational cycles), consumers have become accustomed to spending time in cafes and restaurants. Just for no reason, because some of them, working as freelancers, choose this location as their office. Not only because it is convenient to meet someone there – for them, leisure is more valuable than buying a new [and not always necessary] thing.

Millennials have become regulars at various coffee shops where you can drink coffee and grab some interesting snacks, such as avocado bruschetta, at a price higher than a full-fledged business lunch.

They don’t brew Turkish coffee in the morning like X’s or in a coffee machine like Baby Boomers. For a glass of coffee, they prefer to go to a coffee shop of at least the fourth wave. And not at all because of the love of the drink – coffee has become an attribute of obligation for them.

Millennials are called the «thumb generation». Under them, information technology began to develop rapidly, and the Internet finally penetrated into mobile phones. It is as a result of such digital transformations that representatives of this generation have developed an excellent ability to write canvases of text with the finger of one hand.

Global mobilization has brought us into the age of digital Darwinism, dramatically changing the way consumers now connect with each other, open up and choose to interact with brands.

Although it has only just begun with the millennials. Finally, universal consumer digitalization has taken root among those who were born after 1997. Representatives of this era became members of the most curious consumer group of «socio-environmental idealists», called «Generation Z». In the long term, they are able to create a total estimated purchasing power of $150 billion, which hardly gives brands a reason to relax, realizing that understanding the consumer characteristics of millennials and zetas gives manufacturers an excellent backlog in strategic, and even not long-term, if you look at the calendar, planning.

Let’s look at the specifics of snacking in these two age groups. The differences were found to be quite significant.

Sweet versus salty

The strongest differences were noted in the frequency of snacking. So, out of the total number of respondents, 76.2% said that they had a snack two or three times a day. At the same time, millennials tend to snack more (18.2% of respondents prefer snacks 4-5 times a day versus 7.1% of the total number of Generation Z). In addition, 27.9% of Centennials (Gen Z) have only one snack a day (19.9% of Millennials).

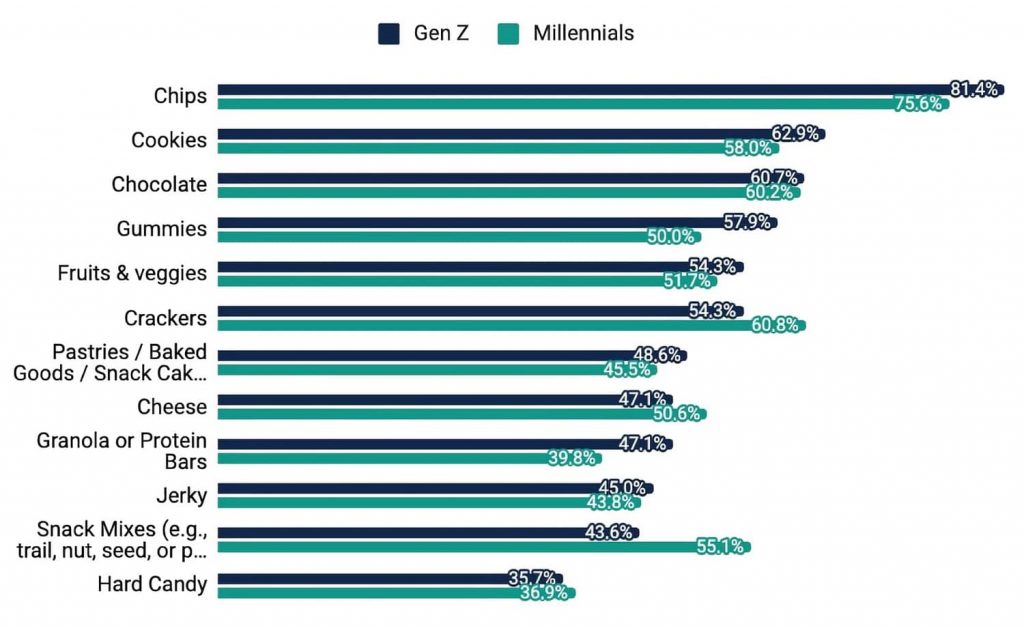

No less important differences were found in the categories of products that respondents prefer. The survey showed that while Gen Z prefers sweets, millennials are more inclined towards salty snacks. At the same time, Gen Z showed a slightly higher preference for savory and spicy snacks – 57.1% and 47.9%, respectively (for millennials, 47.7% and 42%, respectively).

When the questions got down to preferred categories, chips were the most preferred snack option for both age groups. The next most popular categories for Gen Z were cookies, chocolate, and then gummies. Millennials, on the other hand, preferred crackers and salty snacks, the two categories that were most popular among this generation.

For both Z’s and Y’s, snacking most often occurs during passive activities – when they’re watching TV or have nothing to do at home. More than 56% of Millennials and 50% of Generation Z snack while watching TV.

Characteristic snacks depending on consumption scenario

For Gen Z:

- Time spent at home alone: crackers and cheese

- Time spent with friends: gummies

- Watching TV: gummies, chips and cookies

- Post workout: protein bars and fruit

For millennials:

- Time spent at home alone: cookies and crackers

- Time spent with friends: chips, cookies and cheese

- For a snack «on the go»: muesli bars and snacks

- Watching TV: chips and chocolate

- Post workout: protein bars

Brand and benefits

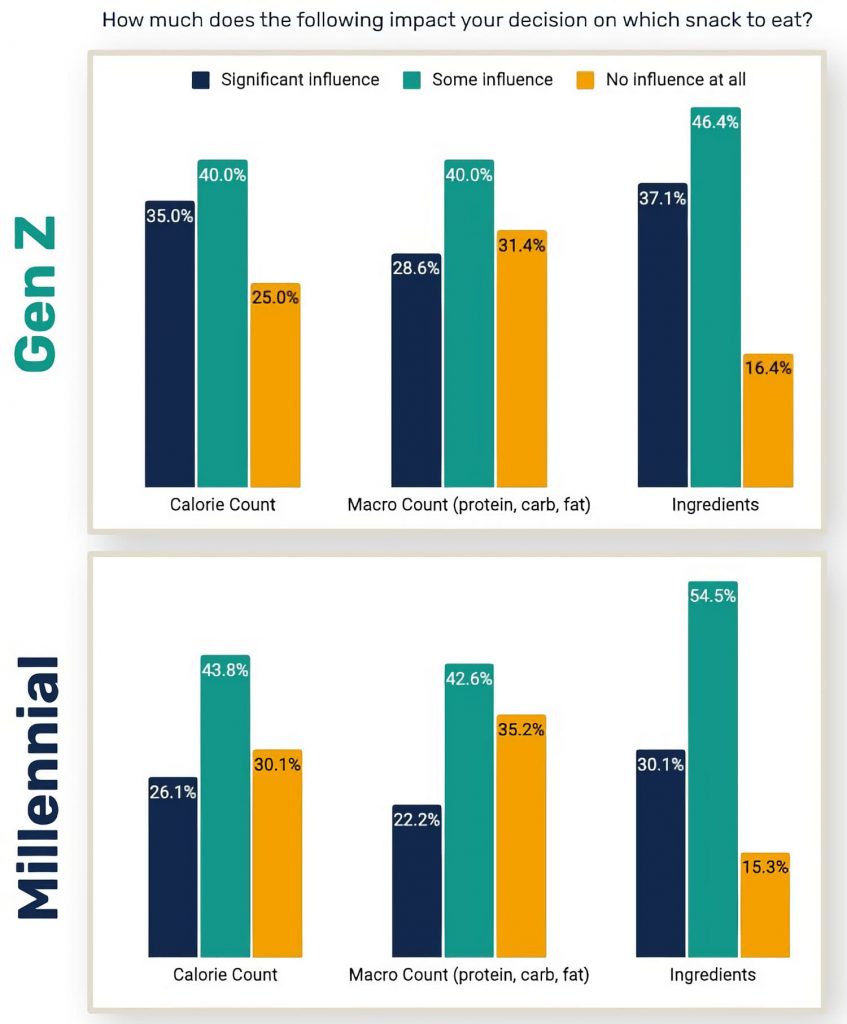

The growing interest in their own health has forced both older millennials and their «Z kids» to turn their attention to gluten-free and plant-based foods. This has led to a rise in demand for ever healthier snacks among both generations, Knit notes in its report.

For both Gen Z and Millennials, ingredients seem to have the biggest impact when it comes to which snack to choose. Information on the number of calories and the composition also affects, these parameters are not far behind.

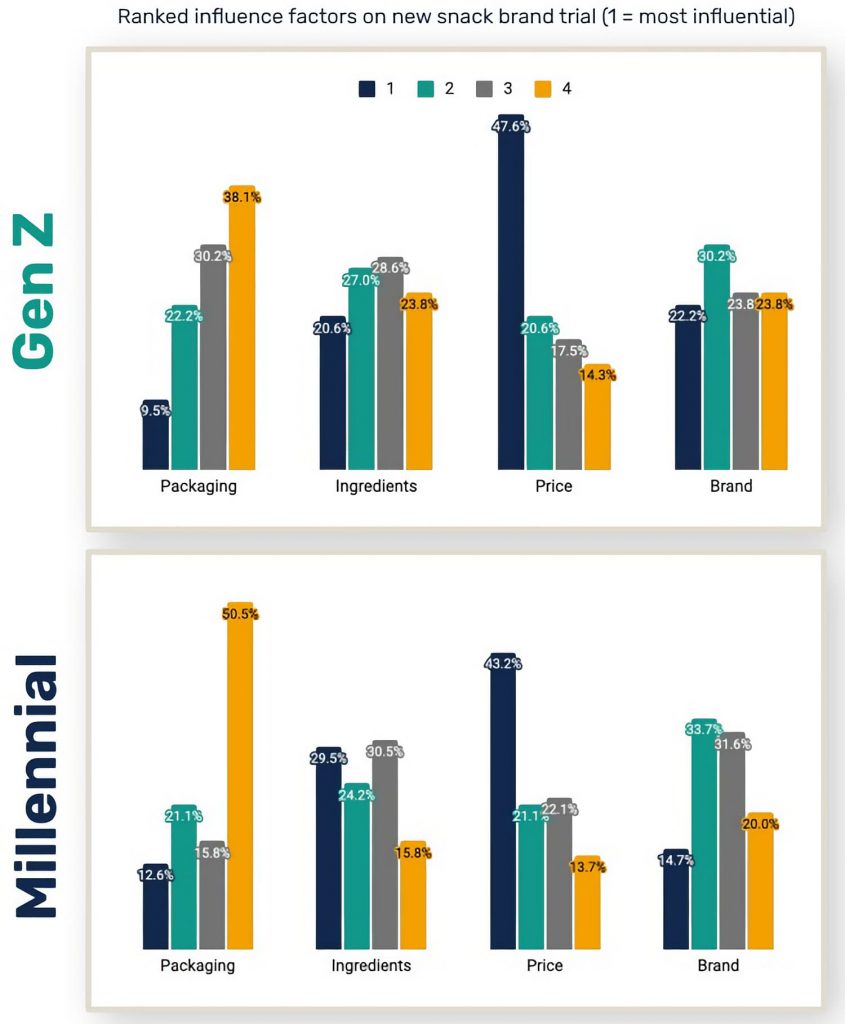

One of the important drivers for choosing snacks is the price. For both millennials and Gen Z, it is a major factor influencing choice. Especially with the first purchase.

Before shelling out a portion of their weekly spending on snacks, Knit says consumers of both generations want to make sure they have the resources for essential groceries after such purchases. After price preferences, brand recognition is important for the Zetas. It has the strongest influence on the choice of new products: 52.4% of Generation Z rank a brand first or second, compared to 48.4% of millennials.

Finally, another difference is in relation to new products and ways to choose them.

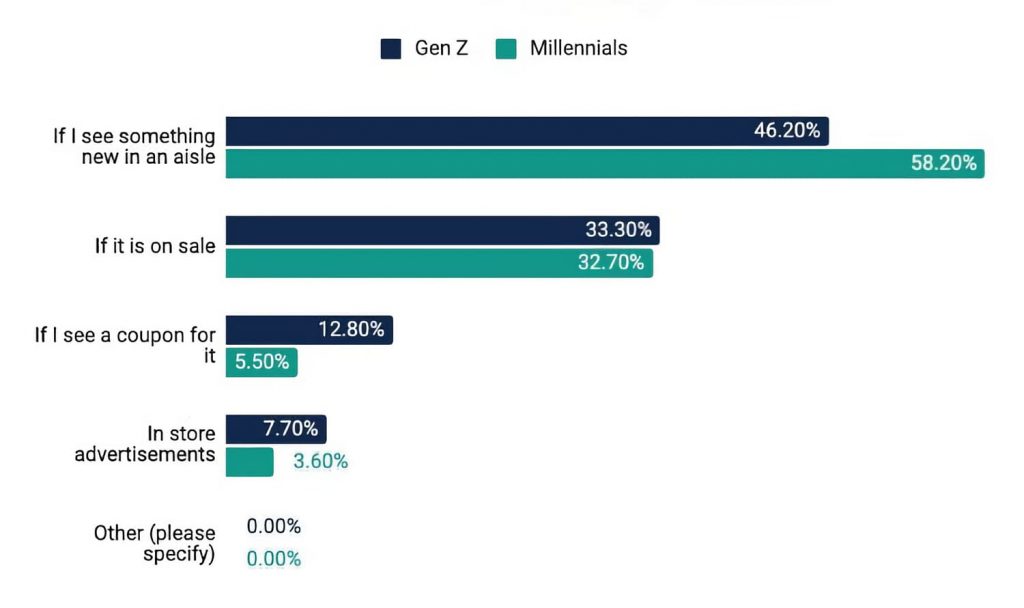

The best method of discovering new products for both Gen Z and millennials is to encounter something new on the store shelf (46.2% and 58.2% respectively), but for Gen Z, price still remains the dominant factor.

Centennials are more likely to try a new product if a discounted coupon is offered for it – 12.8% of young consumers will take advantage of this. For millennials, this factor is less important. Among them, 5.5% of players are ready to purchase novelties using coupons.

Point-of-sale advertising has a little more impact on Gen Z. They are 7.7% likely to try a new product if they see information about it on the trading floor, compared to 3.6% for millennials.

The perfect «crunch index»

According to the U.S. index Snack Index, for more than 70% of consumers in 2022, «crunchy snacks» remained the ideal snack. Therefore, it is not surprising that the choice of chips as a preferred snack option is found in representatives of both generations.

It is important that this picture will continue in the current year. Although experts are unanimous in their opinion: the structure of the chips market is changing. We also drew attention to this in a specialized report, presenting a picture of diverse scenarios, the development of this segment of snacks and predicting a «chipsocalypse».

The Snack Index established several other important differences in «generational style» consumption.

Nearly half of all respondents of all ages said that when they think of the perfect snack, they imagine it as a product «reminiscent of a specific moment in time in the past». This was noted by 49% of all respondents. The «nostalgic touches» of brands play a strong role for people of all ages. The only thing that product managers should pay special attention to are the cultural differences that are characteristic of the younger generation Z.

50% of respondents arrange snacks after dark. However, compared to older adults, young people are twice as likely to order snacks at night through delivery services, while millennials claim to «satisfy their late-night snacks» by visiting 24-hour grocery stores.

65% of older millennials crave snacks the most when they want to treat themselves, while 61% of those surveyed say no to snacking when they feel down.

Finally, snacks are an unusual sensory experience for consumers: 55% of millennials surveyed indicate they crave snacks the most when they smell good, while 52% of Generation Z prefer to choose snacks when they see them.

This once again shows that packaging has a much stronger influence on the choice of the younger generation than it previously worked for their parents.